Is Micron a Buy After Massive Earnings Topper?

It's easy to overlook the components that make our day-to-day technology function. For instance, I am writing this article on a program that isn't stored locally on my computer; it's in the cloud. The vast majority of software I use is like that. Online banking, payment processing, software, data storage, and a bushel of other functions run through the cloud, and the cloud runs through data centers. Artificial intelligence (AI) and machine learning (ML) exponentially increase processing and memory needs.

Hyperscalers, like Meta Platforms, Alphabet, Microsoft, and Elon Musk's xAI, are building massive data centers that each house at least 5,000 cloud servers, all running 24/7. The recent explosion in the number of these larger centers is detailed below.

Image source: Statista.

The center total passed 1,000 in 2024, and research suggests more than 120 will come online annually for several years. Suppliers like Micron Technology (NASDAQ: MU) will benefit tremendously.

Massive opportunity

When discussing Micron, the talk focuses on memory -- specifically, DRAM (Dynamic Random Access Memory) and NAND (flash memory). At a basic level, DRAM functions as temporary storage while a device is in use, and NAND stores data permanently. Your smartphone and computers use both, and so do data centers. Data centers specifically require high-bandwidth memory (HBM), a high-performance DRAM type. Micron expects the demand for its HBM products to grow from $4 billion in 2023 to $25 billion in 2025. This is a massive opportunity for the company, but not the only one.

Data centers also need a type of NAND memory called SSDs (solid-state drives). Micron hit a milestone last quarter with over $1 billion in revenue from its SSDs, tripling sales from the prior year. Micron is investing heavily in new plants to keep up with the sizzling demand.

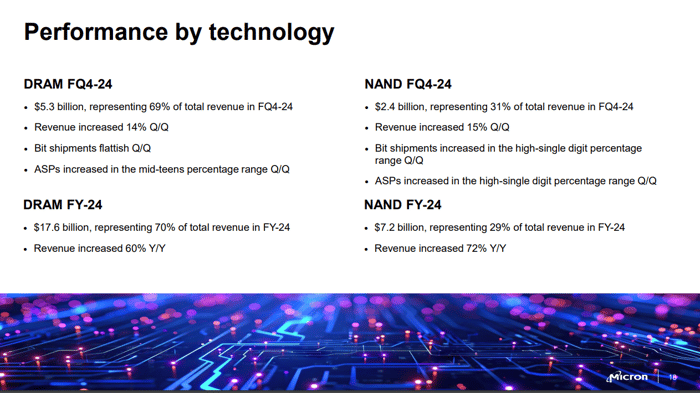

Micron's last quarter, fiscal Q4, was spectacular. The slide below is an excellent visual of the results.

Image source: Micron.

Growth soared in each quadrant, with fiscal year 2024 growth in DRAM of 60% and NAND of 72% being particularly impressive. Micron's results tend to be cyclical. It relies on consumer electronics (smartphones, etc.), businesses spending on computers, automotive demand, and data centers. Given the data center upcycle and the Federal Reserve's recent rate cut with hints of further cuts (which tend to spur economic growth and spending), Micron has significant tailwinds now.

Is Micron stock a buy?

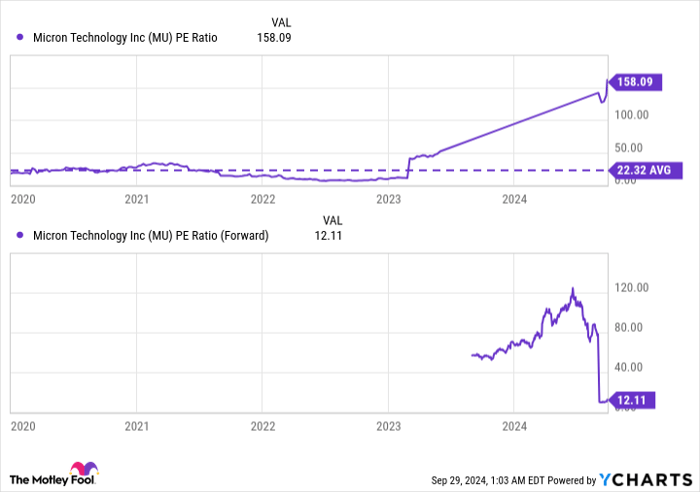

Micron stock pulled back after a long run that began in early 2023 and it now trades 30% off its recent highs. Its current price-to-earnings ratio is sky-high; however, the ratio drops to just 12 on a forward basis, as shown below.

MU PE Ratio data by YCharts

The average price-to-earnings ratio from the beginning of 2019 through the end of 2020 was 18, suggesting that the stock has room to climb, given the growth expectations and headwinds detailed above. The cyclical nature of the stock and a major slowdown in the economy are the largest risks. Analysts are also bullish. The average price target is $156, 45% higher than the current price, and a forward P/E all the way up to 28 of 29 rates it as a buy or strong buy. Last quarter's results confirmed the enthusiasm and next year looks even better.

Micron has the makings to be a terrific investment.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $744,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Bradley Guichard has positions in Micron Technology. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, and Microsoft. The Motley Fool has a disclosure policy.