GBP/USD pulls back from the brink of a fresh bull run

- GBP/USD snapped a two-day win streak on Tuesday.

- Markets are geared for a fresh swing following Wednesday's delayed NFP print.

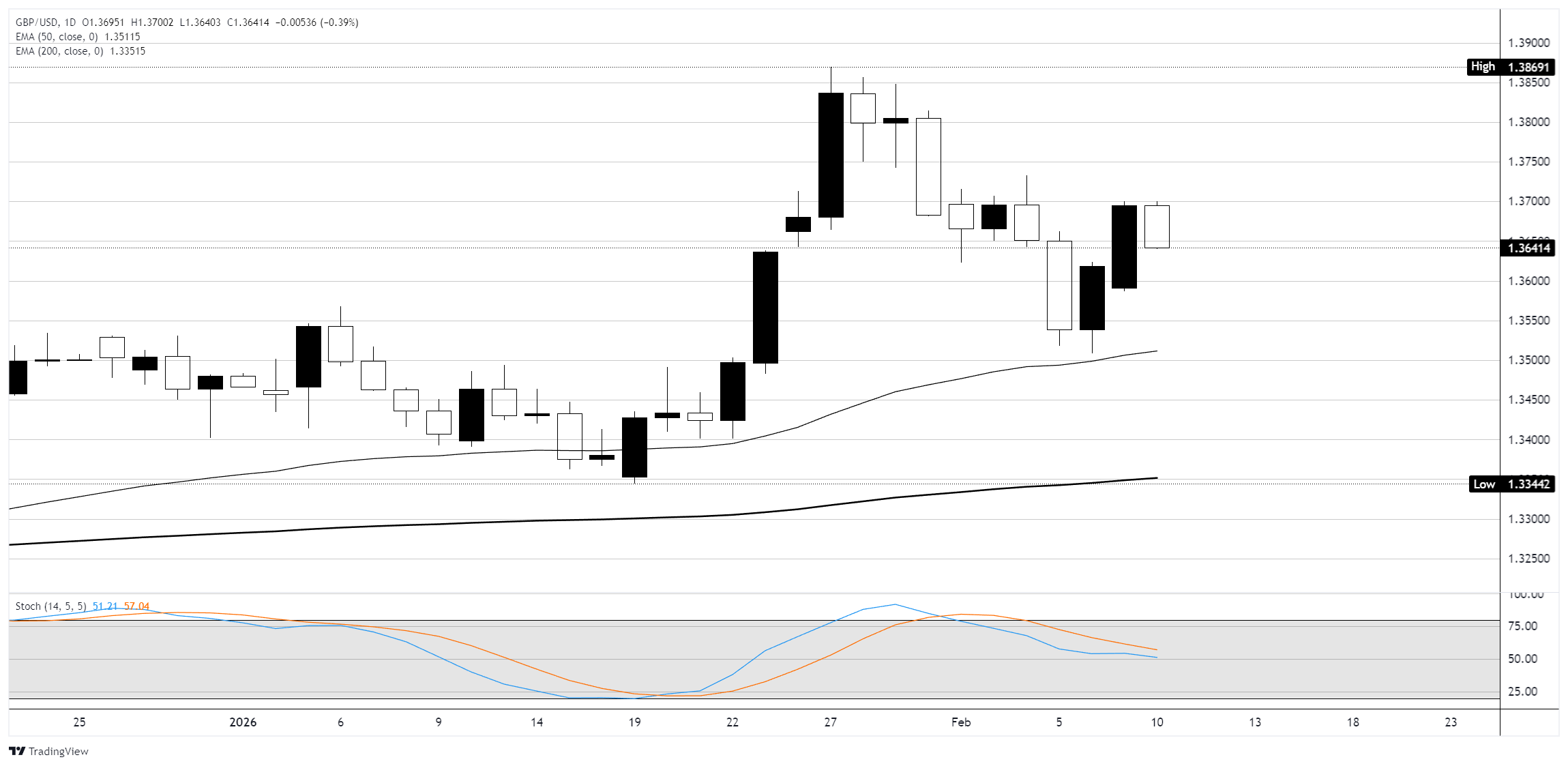

GBP/USD pulled back on Tuesday after Monday's strong bounce from the 1.3510 low, closing at 1.3641, down 0.39% on the session. The daily chart shows the pair gave back gains from a high of 1.3700, printing a bearish candle that suggests the recovery from Friday's two-week low is losing steam near the 50% Fibonacci retracement of the 1.3869 to 1.3510 decline (around 1.3690). The broader structure is still bullish, with price holding well above the 50 Exponential Moving Average (EMA) at 1.3512 and the 200 EMA at 1.3352, but the sharp selloff from the late-January high of 1.3869 has carved out a lower high pattern that threatens the uptrend. Bank of England (BoE) dovishness following last week's 5-4 split hold at 3.75%, combined with growing UK political uncertainty around Prime Minister Starmer's leadership, continue to weigh on Pound Sterling. The Stochastic Oscillator (14, 5, 5) reads 51.21/57.04, with %K crossing below %D in neutral territory, pointing to weakening momentum heading into Wednesday's session.

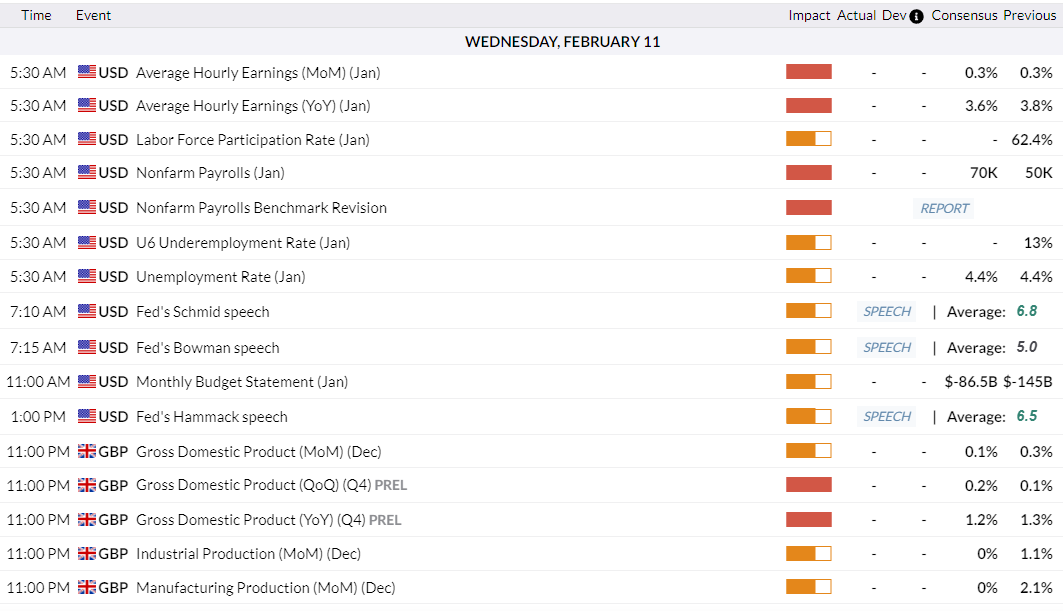

Wednesday brings a double-barreled event risk for this pair with both sides of the Atlantic releasing high-impact data. The delayed January Non-Farm Payrolls (NFP) report from the Bureau of Labor Statistics (BLS) is due at 5:30 AM, with consensus expecting a 70K gain versus December's 50K, alongside the annual benchmark revision, unemployment rate (consensus 4.4%), and average hourly earnings (consensus 0.3% MoM, 3.6% YoY). Later at 11:00 PM, the UK releases preliminary Q4 Gross Domestic Product (GDP) data (consensus 0.2% QoQ versus 0.1% prior), December monthly GDP (consensus 0.1% MoM), and December industrial and manufacturing production figures (both consensus 0% MoM). The NFP release is likely to set the tone early; a soft print below 70K would pressure the US Dollar and could drive GBP/USD back toward the 1.3700 to 1.3727 resistance zone (the 61.8% Fibonacci retracement), while a stronger number risks pushing the pair back toward 1.3510 support and the 50 EMA. The UK GDP data later in the session then becomes the second catalyst; a miss on the 0.2% QoQ consensus would reinforce BoE rate cut expectations for March and could cap any GBP gains. Three Federal Reserve (Fed) speakers (Schmid, Bowman, Hammack) are also on the calendar Wednesday, adding further potential for sharp intraday swings between the 1.3510 floor and the 1.3700 ceiling.

Economic calendar on Wednesday:

GBP/USD daily chart

Pound Sterling FAQs

What is the Pound Sterling?

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

How do the decisions of the Bank of England impact on the Pound Sterling?

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

How does economic data influence the value of the Pound?

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

How does the Trade Balance impact the Pound?

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.