AUD/USD takes a breather as midweek NFP looms

- AUD/USD has paused on the high end of a rally peak.

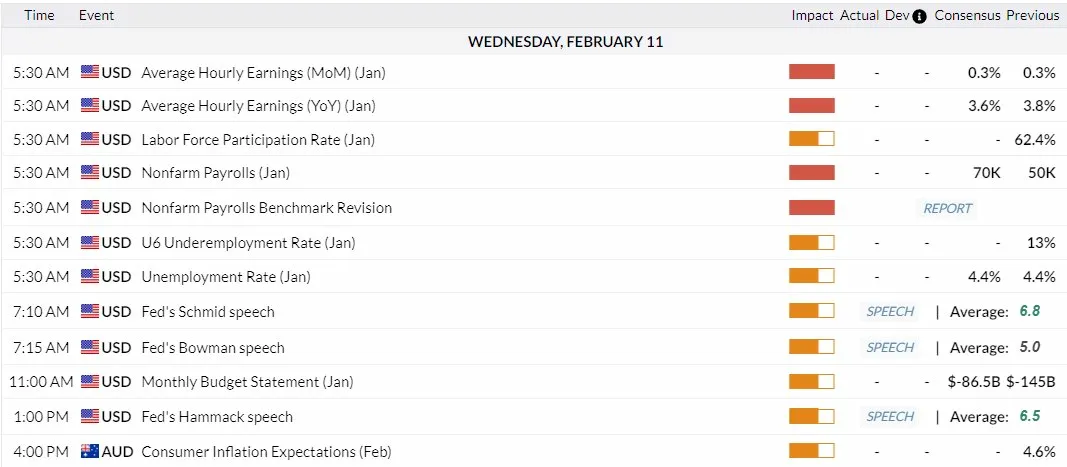

- Key US data will hang over markets heading through Wednesday.

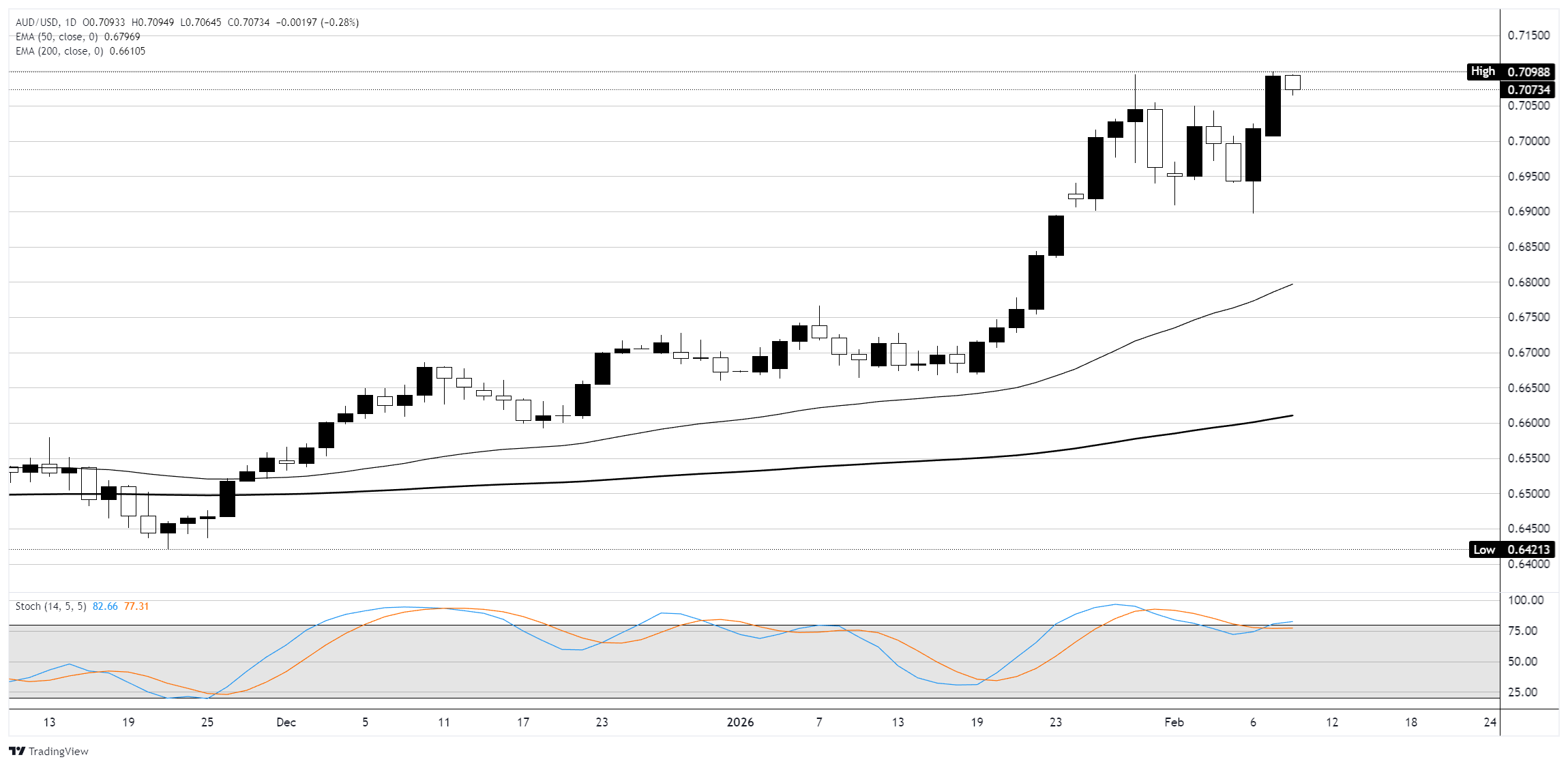

The Australian Dollar is holding a strong uptrend on the daily chart, with price trading well above both the 50 Exponential Moving Average (EMA) at 0.6797 and the 200 EMA at 0.6611, confirming a firmly bullish structure of higher highs and higher lows since the late November swing low near 0.6421. Monday's session saw AUD/USD push to fresh three-year highs at 0.7099, testing the psychologically significant 0.7100 handle before pulling back to close around 0.7072. The rally from December's base near 0.6500 has been steep and largely uninterrupted, with the pair clearing the 0.7000 level for the first time since February 2023. The gap between price and the 50 EMA continues to widen, suggesting the move is becoming overextended, while the Reserve Bank of Australia's (RBA) recent 25 basis point hike to 3.85% and the Federal Reserve's (Fed) dovish rate path are providing a fundamental tailwind through policy divergence.

The Stochastic Oscillator (14, 5, 5) on the daily chart is churning on the high end and testing overbought territory, signaling fading upside momentum and raising the probability of a near-term pullback or consolidation phase. Immediate resistance sits at the session high of 0.7099, with the next upside target at the 2023 high near 0.7157 if buyers can force a clean break above 0.7100. On the downside, support lies at the 0.7000 psychological level, followed by the cluster of recent consolidation lows around 0.6950 and 0.6896. The key event risk for this pair arrives on Wednesday with the delayed release of January Non-Farm Payrolls (NFP) data, originally scheduled for February 6 but postponed to February 11 due to the partial government shutdown. Consensus expects a 70K gain versus December's 50K, alongside the annual benchmark revision and unemployment rate data. A softer-than-expected NFP print would likely reinforce US Dollar weakness and fuel another leg higher toward 0.7160, while a strong report could trigger a sharper corrective pullback given the already stretched positioning. Multiple Fed speakers (Schmid, Bowman, Hammack) are also scheduled for Wednesday, adding further volatility potential around the data release.

AUD/USD chart

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.