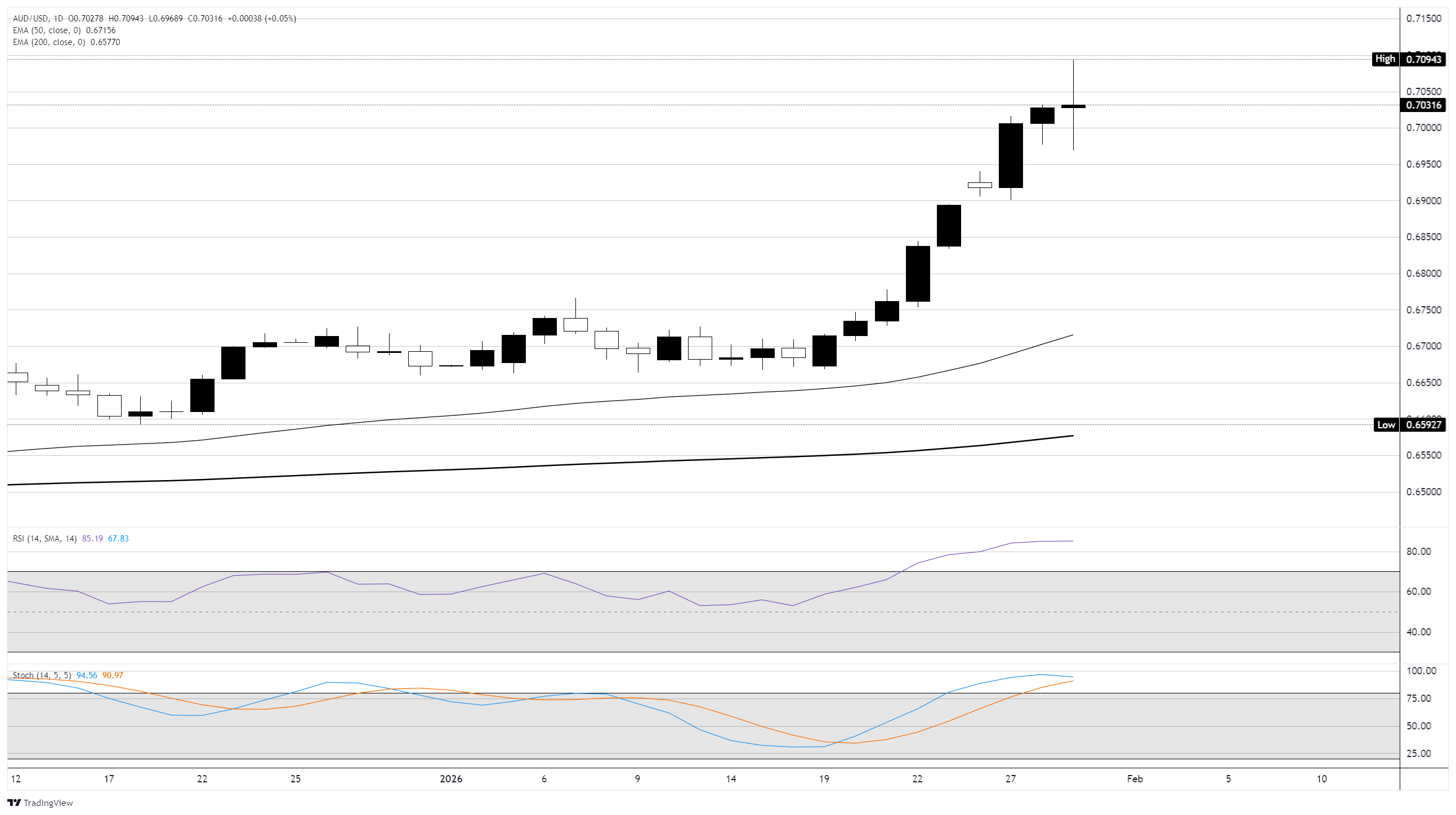

AUD/USD recoils after setting fresh three-year high

- AUD/USD sputtered on Thursday, backsliding from multi-year highs.

- The Aussie has been on a tear, but fresh sentiment jitters hit AUD markets hard.

- Despite a lopsided Thursday session, the Aussie is still up 1.3% for the week.

AUD/USD hit a slippery slow patch on Thursday as volatility worsens across the board. The Australian Dollar (AUD) hit a three-year high against the US Dollar (USD), before falling back into the low side for the day as broad-market sentiment flows sour.

The metals-sensitive Aussie is taking a correlated hit as both Silver and Gold prices suffer a volatility shock across global markets. Despite knocking into accelerated record highs this week, investor sentiment is turning wary in the face of an increasingly questionable AI rally and a looming US government shutdown.

Spot Gold prices came within inches of poking through a new all-time high of $5,600 per ounce on Thursday before a sharp rebuke sent XAU/USD bids back below $5,100. Intraday Gold prices have since stabilized around where the day started near $5,350 per ounce, but the knock-on volatility damage has been dealt, paring away what would have been a 0.9% gain in the AUD/USD pair.

The US government has once again failed to clear a critical budgetary hurdle, and is barreling towards another government shutdown. The Trump administration has been at the helm during two of the US’s longest-running government shutdowns, and investors fear a third record-setting federal government closure could kick off another period of limited or no official data with which to gauge the American economic engine.

AUD/USD daily chart

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.