What the July Jobs Report Reveals: Record Downward Revisions Stoke Recession Fears

TradingKey - The release of the U.S. July nonfarm payrolls report on Friday, August 1 has shattered the narrative of a resilient labor market — so severely that President Donald Trump fired the head of the Bureau of Labor Statistics (BLS) within hours. With payroll growth slowing sharply and prior months revised down by a record 258,000 jobs, economists and policymakers are now clashing over whether this signals the beginning of an economic downturn.

A Shocking Report

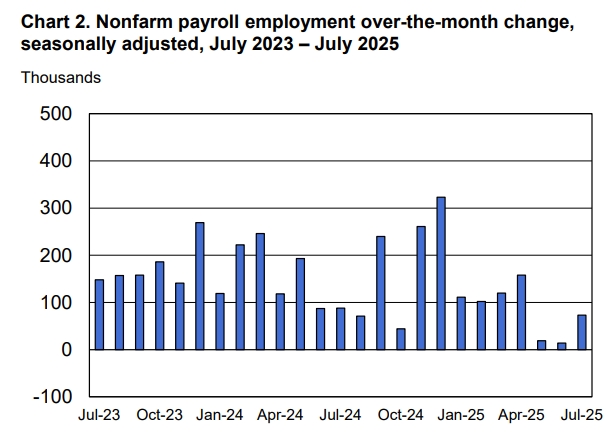

The July report was a major disappointment:

- Nonfarm payrolls rose by just 73,000, the weakest gain in nine months and well below the expected 150,000

- May and June employment figures were revised down by a combined 258,000 jobs — the largest downward revision since 1978, excluding the pandemic period

- Unemployment rate edged up from 4.1% to 4.2%, in line with expectations

Source: BLS – U.S. Nonfarm Payrolls

Morgan Stanley noted that the 258,000 downward revision is four to five times larger than the BLS’s typical adjustment, calling it a historic statistical event.

The Turning Point in the Economic Narrative?

For many analysts, the report marks a pivotal shift in the economic outlook.

Navy Federal Credit Union called it a “game-changer”, saying the labor market is deteriorating rapidly.

Wilmington Trust says that businesses are facing a fundamentally different cost structure due to tariffs. They need time to adjust — and that means delaying hiring.

ClearBridge Investments warned that the old market logic — that “bad news is good news” because weak data increases the chance of Fed rate cuts — may no longer hold.

This time, bad news might just be bad news. With job growth stalling and new tariff threats looming, the firm said negative nonfarm payrolls could appear in the coming months, raising serious recession concerns.

Questioning the Revisions

The BLS attributed the large revisions to delays in survey data collection, but Guotai Haitong Securities said this explanation is insufficient.

- The response rates for May and June were 68.4% and 59.5%, not significantly below historical averages

- The May data had already been slightly revised upward in June, when a follow-up survey achieved a 92.3% response rate

This suggests the downward revisions may reflect real weakness in private-sector employment, not just statistical delays.

Signs of Labor Market Stress

Beyond headline numbers, the report revealed troubling signs:

- July job gains were concentrated in education and health care; most other sectors saw declines

- The number of people unemployed for 27 weeks or more exceeded 1.8 million — the highest since 2017 (excluding pandemic years) — and now accounts for 25% of total unemployed, up from 20% a year ago

- Median unemployment duration rose from 9.5 weeks in July 2024 to 10.2 weeks

The Wall Street Journal noted that these trends reflect deepening challenges in the job market, driven by tariff uncertainty and cautious corporate hiring.

Diverging Views: Pessimism vs. Caution

Dovish FOMC members — Christopher Waller and Michelle Bowman — had already called for rate cuts in the July meeting, warning that delaying action could lead to deeper job losses.

But others remain more optimistic.

John Williams, President of the New York Fed, acknowledged the revisions were significant but said broader indicators — including job openings and initial jobless claims — still point to a gradual, moderate cooling of the labor market, not a collapse.

Beth Hammack, incoming 2026 FOMC voter and President of the Cleveland Fed, said the labor market remains “healthy and balanced”, though vigilance is needed. Their mistakes on inflation have been far greater than on employment.

Jason Tang, Senior Economist at TradingKey, argued that the discrepancy between weak payroll growth and stable unemployment can be partly explained by Trump’s immigration enforcement policies, which are reducing the foreign-born labor force and suppressing headline job creation — but not significantly affecting the unemployment rate.

Tang added that short-term fiscal stimulus from the “Big Beautiful Bill” and expected rate cuts in early 2026 will help offset near-term economic drag.

Morgan Stanley’s statistical model shows that large downward revisions are correlated with higher recession risk, but the impact is limited.A 258,000-job revision could raise the three-month recession probability by about 9 percentage points.

However, the firm maintains its base case of no rate cuts in 2025, arguing that the data, while weaker, does not yet signal a broad economic downturn.