The Battle for a September Rate Cut Heats Up as Fed Consensus Frays

TradingKey - The Federal Reserve’s July 2025 policy meeting ended as expected — with no change to interest rates — but it marked a historic turning point in internal Fed consensus, shattering decades of unified messaging. While the FOMC statement leaned dovish, Chair Jerome Powell’s tone was notably hawkish, sending rate cut expectations tumbling.

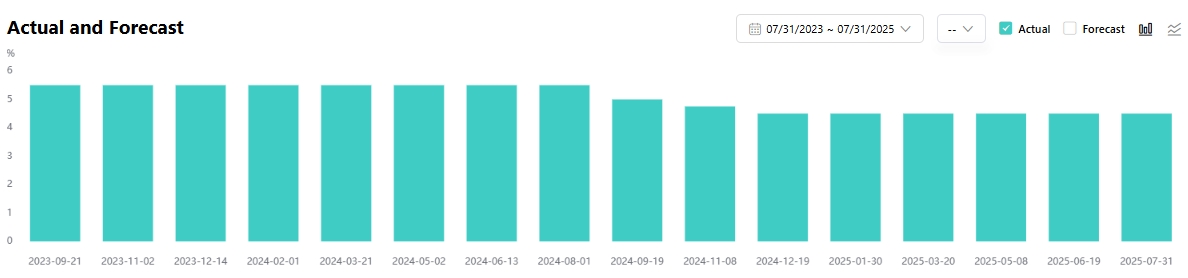

On July 30, the Fed kept the federal funds rate unchanged at 4.25%–4.50%, the fifth consecutive hold since pausing in December 2024 after a 100-basis-point easing cycle.

【Source: TradingKey – Federal Reserve Interest Rate Decisions】

A Split Message: Dovish Statement, Hawkish Powell

The FOMC statement introduced two key changes from June:

- Removed the phrase: “uncertainty about the economic outlook has diminished” — reinstating that uncertainty remains “elevated”

- Downgraded the economic growth assessment from “economic activity continued to expand at a solid pace” to “moderated in the first half of the year”

Bloomberg economists noted the second change was more dovish than expected, suggesting the Fed is acknowledging a meaningful slowdown — fueling speculation that a September rate cut is gaining momentum.

But Powell’s post-meeting press conference painted a different picture — one that undermined the dovish narrative.

Markets reacted sharply:

- Probability of a 25-bp cut at the September FOMC meeting fell from 63% to 43%

- Treasury yields rose, and equity dipped

Restrictive Policy Is Still Appropriate

Despite widespread market pricing of a September cut, Powell offered no clear signal. He said that it’s too early to determine whether a rate cut is appropriate in September.

He declined to rely on the June Summary of Economic Projections (SEP) — which showed a median forecast of two rate cuts in 2025 — saying policymakers are still assessing whether rates are at the right level.

On the revised growth language, Powell clarified:

- The slowdown reflects weaker consumer spending, not labor market deterioration

- Metrics like quits rate, job openings, and unemployment remain healthy

- No sign of significant labor market weakness

Powell said that almost all committee members agree that current policy is not overly restrictive. A modestly restrictive stance remains appropriate.

He acknowledged that consumer spending has slowed, but emphasized that households are still in solid shape — a view supported by the same-day GDP data.

Q2 GDP growth came in at 3.0%, a sharp rebound from Q1’s -0.5%, exceeding expectations.

But at the same time, the Fed and analysts are focused on a more telling metric: growth in private domestic final demand (PDFD) — which excludes volatile trade and inventory swings.

- Q2 PDFD: +1.2%

- Q1: +1.9%

- Q4 2024: +2.9%

This downward trend suggests that underlying demand is weakening, even as headline GDP improves.

Tariff Pressures Are Just Beginning

On inflation, Powell confirmed that tariffs are already feeding into prices.Core inflation is running about 3 to 4 basis points higher due to tariffs — and the full impact has not yet been felt.

He stressed that the pass-through to goods inflation has only just started, and while the final effect is uncertain, it won’t be zero. The Fed’s job is to ensure it doesn’t become entrenched.

Fed Unity Shattered

The Wall Street Journal’s Nick Timiraos noted that for the first time since 2020, more than one FOMC official dissented voted against Powell and more than one board governor dissent since 1993. It signal a deepening rift over inflation, growth, and independence.

- Christopher Waller (Richmond Fed) and Michelle Bowman (Kansas City Fed) voted for a 25-bp cut

- Both are seen as potential Trump-backed candidates for the next Fed Chair

Bowman’s shift from hawk to dove marks a rare reversal, while Waller’s push for cuts may reflect political ambition.

Markets Lose Faith in September Cut

With Powell’s caution and rising inflation risks, institutions are scaling back rate cut expectations:

- Allspring Global Investments: Expects only one rate cut in 2025, citing the Trump tax cut bill’s potential to boost growth by up to 1 percentage point

- Facet Wealth’s CIO Tom Graff: Forecasts 1–2 cuts, but says the Fed is in a difficult spot

- KPMG Chief Economist Diane Swonk: Believes the Fed won’t cut rates before year-end

- CICC: Warns that tariff-driven inflation will intensify, making a September cut unlikely — and delays possible if tariffs escalate

CICC also stressed that the market may be underestimating the Fed’s commitment to independence — even under political pressure.