Bitcoin Price Forecast: BTC slips below $67,000 ahead of US Nonfarm Payrolls data

- Bitcoin price is slipping below the lower consolidation boundary at $67,300 on Wednesday, and a decisive close below could support a deeper correction.

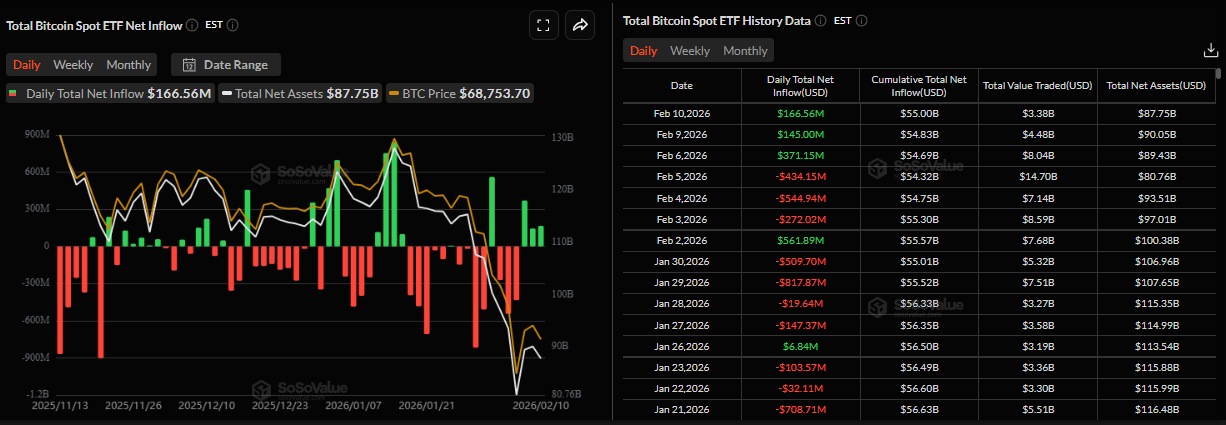

- US-listed Spot ETFs recorded a mild inflow of $166.56 million on Tuesday, marking the third consecutive day of net positive flows.

- Traders await US NFP data, which could influence the Fed’s interest rate decision, bringing fresh volatility in risky assets such as BTC.

Bitcoin (BTC) price extends losses, trading below the lower consolidating boundary at $67,300 at the time of writing on Wednesday. A firm close below this level could trigger a deeper correction for BTC. Despite the weakness in price action, institutional demand shows signs of support, recording mild inflows in Exchange Traded Funds (ETFs) so far this week. Meanwhile, market participants now await the US Nonfarm Payrolls (NFP) data, to be released on Wednesday, which could provide directional bias for the Crypto King.

Institutional demand records mild inflows amid falling prices

Institutional demand shows mild signs of recovery so far this week. According to SoSoValue data, spot Bitcoin ETFs recorded a mild inflow of $166.56 million on Tuesday, marking the third consecutive day of net positive flows since last Friday. If inflows continue and intensify, BTC could see some recovery.

US NFP could provide fresh volatility toward risky assets

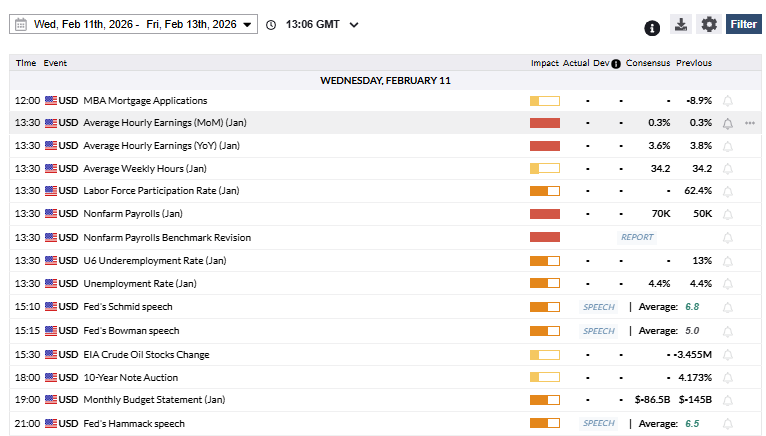

The United States (US) Bureau of Labor Statistics (BLS) will release the delayed Nonfarm Payrolls (NFP) data for January on Wednesday at 13:30 GMT, which could bring fresh volatility toward BTC.

Last week, the BLS reported that it had postponed the release of the official employment report, originally scheduled for Friday, due to the recent partial government shutdown. After the US House passed a package on Tuesday to end the shutdown, the agency announced it will release the labor market data this Wednesday.

Market participants expect January’s NFP to rise by 70K following the 50K increase recorded in December. In this period, the Unemployment Rate is expected to remain unchanged at 4.4%. At the same time, the annual wage inflation, as measured by the change in the Average Hourly Earnings YoY, is projected to soften to 3.6% from 3.8%.

This macroeconomic data could spark renewed volatility in the US Dollar (USD) and Bitcoin, providing further clues on the Federal Reserve’s (Fed) path forward on interest rate cuts.

In case of the NFP data coming in stronger than expected, indicating robust job growth, higher wages, and a strong economy, this could cause the Fed to maintain a hawkish stance for longer. As a result, expectations for interest rate cuts could be pushed further out, which could cause the Greenback to rise, while the crypto market could see further sell-off.

Conversely, weaker-than-expected NFP data would point to slowing economic growth, rising unemployment, and softer wage growth, increasing expectations that the Fed is moving closer to rate cuts. This scenario could weigh on the US Dollar while supporting a recovery in risky assets such as Bitcoin.

Bitcoin Price Forecast: BTC could head toward $60,000 mark

The Bitcoin price on the 4-hour chart shows that the Crypto King has been trading sideways between $67,300 and $71,751 after recovering from a low of $60,000 on Friday. As of writing on Wednesday, it is slipping below the lower boundary of this consolidation.

If BTC breaks and closes below the lower consolidation boundary at $67,300, it could extend the correction to revisit Friday’s low at $60,000.

The Relative Strength Index (RSI) on the 4-hour chart reads 37, below the neutral level of 50, indicating bearish momentum gaining traction. The Moving Average Convergence Divergence (MACD) lines also showed a bearish crossover on Tuesday, reinforcing the negative outlook.

If BTC recovers, it could extend the advance toward the 50-period Exponential Moving Average (EMA) on the 4-hour chart at $71,422, which roughly coincides with the upper consolidation boundary at $71,751.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.