Bitcoin's downtrend caused by ETF redemptions and AI rotation: Wintermute

- Bitcoin ETFs have been a key driver of the broader crypto downtrend, with more than $6.2 billion in outflows since November.

- The AI narrative is absorbing capital not only from Bitcoin but also from software stocks.

- Bitcoin may not recover until Coinbase Premium turns positive, alongside sustained ETF flows and stable basis rates.

Bitcoin's (BTC) fall from grace since the October 10 leverage flush has been spearheaded by sustained ETF outflows and a rotation into the AI narrative, according to Wintermute.

In a Tuesday report, the market-making firm noted that Bitcoin has lost all of its gains since US President Trump's November 2024 election victory. Over the past few months, the top crypto has experienced one of its largest drawdowns since 2022, with a more than 50% drop from an all-time high of $126,000 in October to about $60,000 last Friday.

Following the plunge between October and November, Bitcoin was largely rangebound in December and January, slowly accumulating leverage that was again wiped out by liquidations worth nearly $2.7 billion last week, the report states.

The downside pressure has largely been driven by the US market, as evidenced by the negative trajectory of the Coinbase Premium since December and heavy selling from US counterparties in over-the-counter (OTC) deals throughout last week, Wintermute highlighted.

Additionally, the report states that US spot exchange-traded funds (ETFs) have seen $6.2 billion in outflows since November, their longest streak. Notably, BlackRock's IBIT saw a notional volume of about $10 billion during the market crash on Thursday.

"When redemptions force sponsors to sell spot into falling prices, the feedback loop becomes self-reinforcing," wrote Jasper De Maere, Desk Strategist at Wintermute.

However, last week's decline wasn't limited to crypto. Broader markets also experienced a downturn, with precious metals and stocks seeing a correction. On the surface, crypto proved its negative skew once again, underperforming major asset classes during the decline — as it did during uptrends — in a pattern that Wintermute said is consistent with bear market conditions.

AI narrative boom comes at crypto and software stocks expense

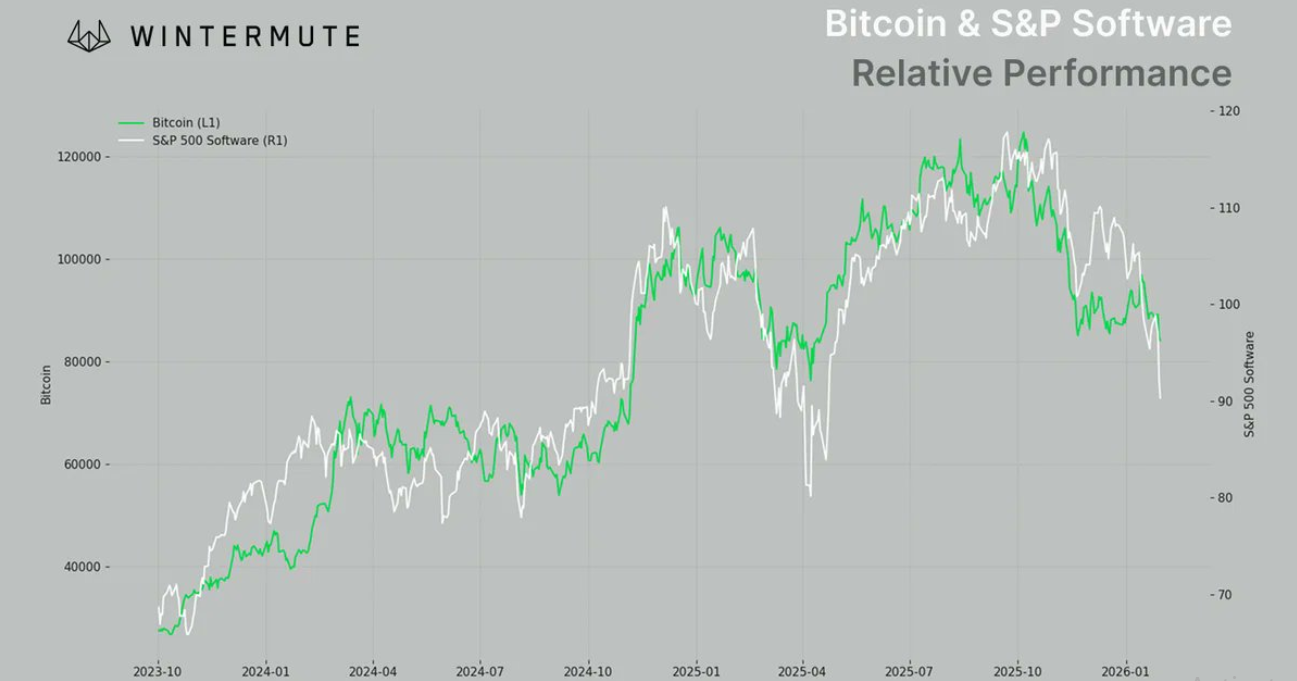

A further analysis by the firm showed that the resilience of stock indices during market uptrends and declines is largely attributed to rotation into the AI narrative rather than broader strength in the entire stock market. Wintermute noted that Bitcoin and S&P 500 software companies have largely traded in a similar pattern over the past two years.

"The real story is AI has been absorbing available capital for months at the expense of everything else [...] Strip out AI names from the Nasdaq and crypto's negative skew largely disappears," wrote De Maere.

"For crypto to outperform again, air needs to come out of the AI trade. Microsoft's weak print started that process, but more is needed," he added.

The report also highlights that spot demand, which is needed to kick-start a structural recovery, is currently weak. Digital asset treasuries (DATs), one of the main sources of buying momentum over the past year, are holding losses of $25 billion as prices slipped below their average purchase cost. The resulting compressed NAV premiums have limited their ability to raise funds to fuel demand once again.

"Until Coinbase premium flips positive, ETF flows reverse, and basis rates stabilize, it's hard to see sustained upside," Wintermute noted.

Bitcoin is changing hands around $69,700, down 0.3% over the past 24 hours as of writing on Tuesday.