AI Crypto Update: Bittensor plunges toward $142 lows as AI coins bleed

- Bittensor extends its decline for a third consecutive day, suggesting that investors are retreating to the sidelines.

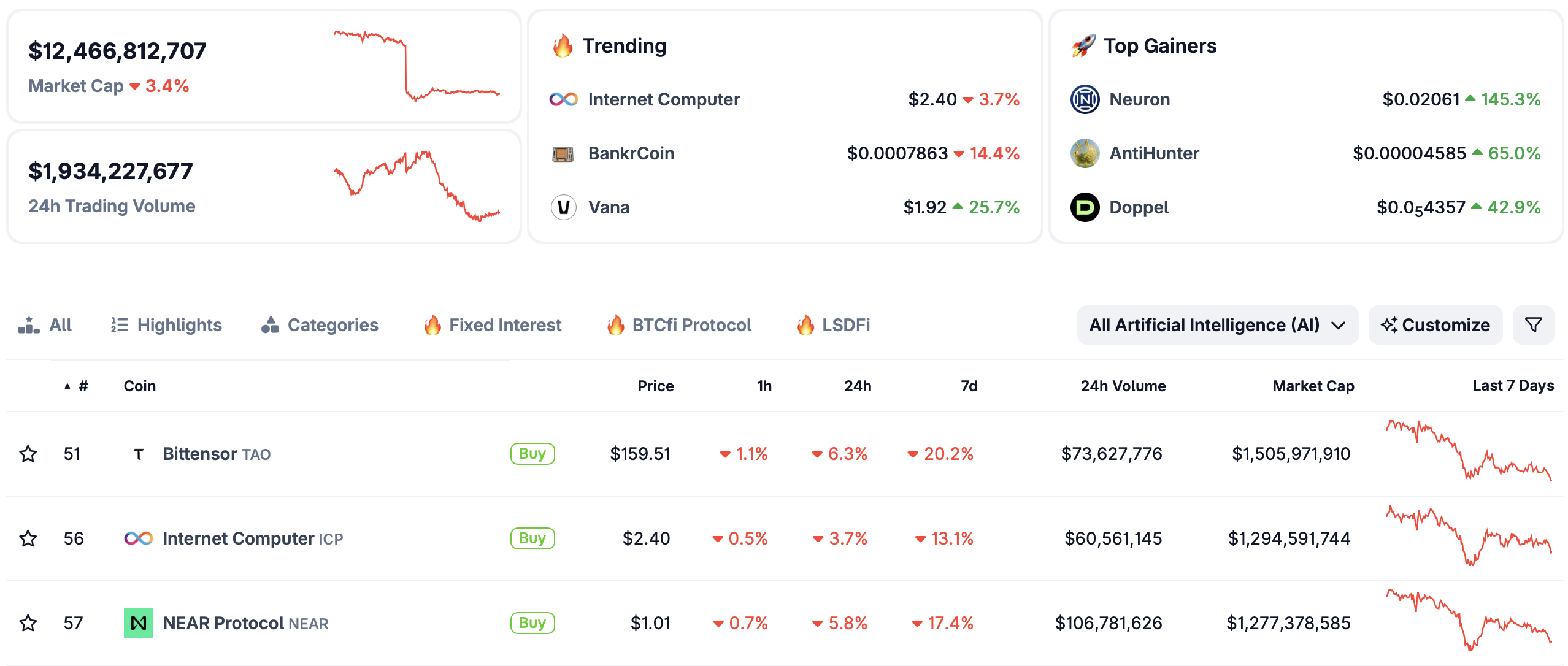

- AI crypto market capitalization drops by 3.4% to $12.5 billion, weighed down by the broader crypto market risk-off mood.

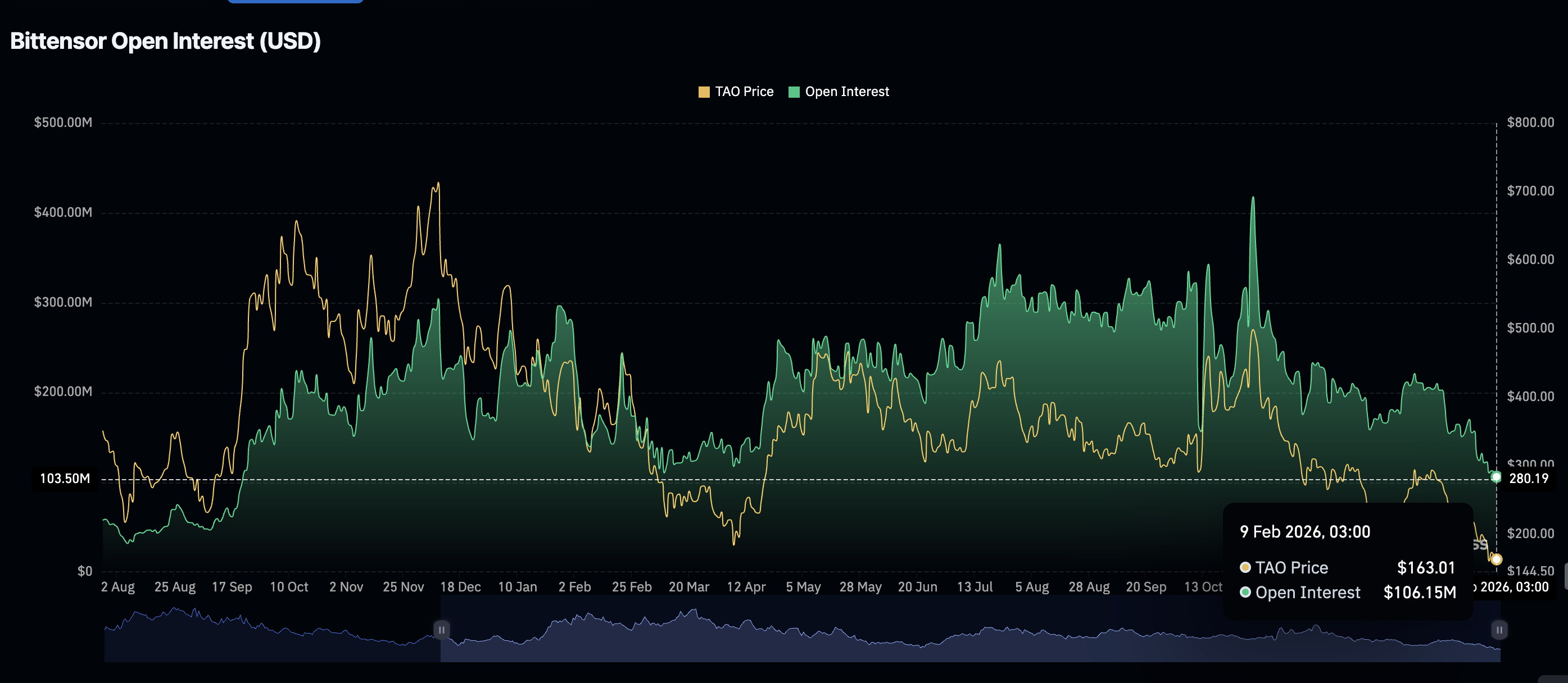

- The TAO derivatives market extends weakness, with futures Open Interest dropping to its lowest level since September 2024.

Artificial Intelligence (AI) coins, including Bittensor (TAO), Internet Computer (ICP) and Near Protocol (NEAR), are trading under heavy headwinds as risk-off sentiment spreads across the crypto market. The segment's total market capitalization has declined by 3.4% over the past 24 hours to $12.5 billion, undermining potential buy-the-dip opportunities.

Meanwhile, the leading AI token, Bittensor, is down nearly 3% intraday, trading at $158 at the time of writing on Monday. Internet Computer is down by almost 7% over the past 24 hours and approximately 20% over the past week. Near Protocol is also navigating immense overhead pressure, trading at $1.01 amid a 6% intraday loss and a 17% seven-day loss.

Low retail activity spurs Bittensor's sell-off

The weakness in the Bittensor derivatives market remains of great concern, as reflected by futures Open Interest (OI) falling to $106 million on Monday, for the the first time since September 2024, from $111 million on Sunday.

OI tracks the notional value of outstanding futures contracts. A steady decline in this metric suggests that investors lack confidence in Bittensor's ability to sustain an uptrend. Therefore, they'd rather close positions rather than open new ones. The futures OI hit a record high of $418 million in early November when TAO traded around $539.

Technical outlook: Bittensor risk 11% falling as technicals weaken

Bittensor hovers at around $158 and holds well below the 50-day Exponential Moving Average (EMA) at $232, the 100-day EMA at $264 and the 200-day EMA at $299. All three moving averages slope downward, reinforcing a bearish backdrop.

The Moving Average Convergence Divergence (MACD) indicator remains below the signal line, while the red histogram bars have been contracting, suggesting that bearish pressure could be fading, albeit gradually. Meanwhile, a daily close above the 50-day EMA could open room toward the 100-day EMA target.

Still, the descending trend line from $539 limits gains, with resistance near $218. The Relative Strength Index (RSI) at 28 (oversold) suggests downside momentum is overextended and a pause or minor bounce could develop. A break above that barrier would ease the bearish structure, with the RSI required to rise above the midline to sustain a longer uptrend. Failure to break above the descending trend line would keep rallies contained and increase the odds of an 11% drop to $142, a level tested on Friday.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

(The technical analysis of this story was written with the help of an AI tool.)