Ethereum Price Forecast: ETH faces pressure near $3,000 amid mixed onchain signals

Ethereum price today: $3,000

- Ethereum wallets across all major cohorts saw notable distributions over the past week.

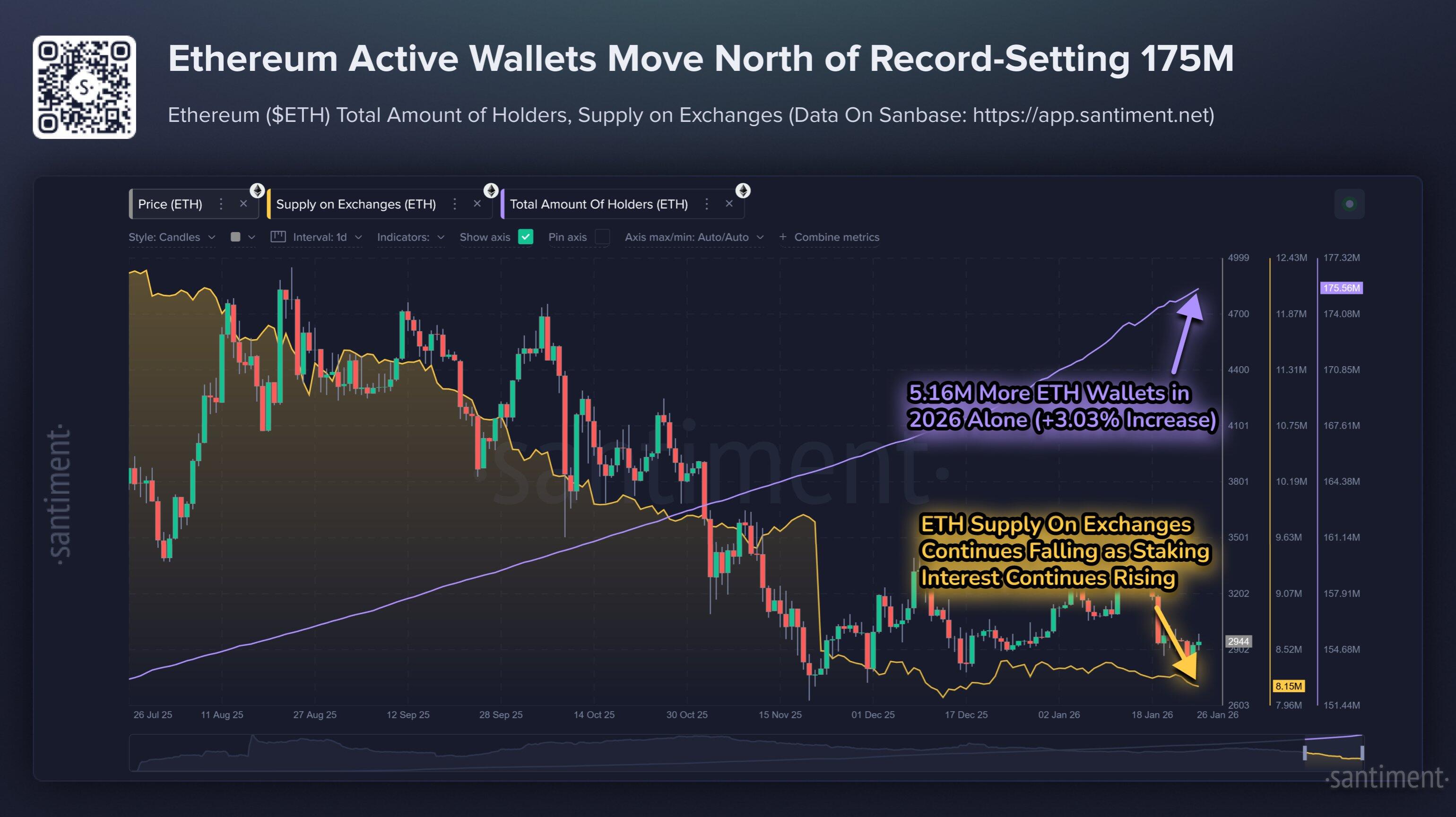

- Active addresses continued to post record figures while the supply of staked ETH climbed to new highs.

- ETH could fall to $2,880 if it sees a rejection at the resistance near $3,060.

Ethereum (ETH) is struggling to hold $3,000 on Wednesday amid mixed signals across several onchain metrics.

Key wallets distribute as active addresses and staked ETH surges to record highs

Ethereum wallets across all major cohorts have been seeing distribution over the past week.

Whales or wallets holding 10K-100K ETH, which have been major dip buyers over the past few months, are now expressing caution. The cohort distributed over 100K ETH over the past four days, sending their collective holdings to 20.39 million ETH, according to CryptoQuant data.

Wallets in the 100-1K ETH and 1K-10K ETH bracket continued scaling down their holdings, distributing 550K ETH over the past week.

Similarly, US spot ETH exchange-traded funds (ETFs) returned to net outflows on Tuesday, as $63.5 million exited the products, per SoSoValue data. The move comes after breaking a four-day outflow streak on Monday.

Some of these tokens were moved at a loss, considering steady negative flashes in the Network Realized Profit/Loss metric, per Santiment data. Notably, investors have booked losses of over $250 million on Wednesday.

[18-1769622276584-1769622276586.27.19, 28 Jan, 2026].png)

Despite clear signs of distribution, ETH has held steady during the period, briefly reclaiming the $3,000 level on Tuesday.

The slight uptick follows a steady rise in non-empty Ethereum wallets, or active addresses, which have reached a record high of 175.5 million. That figure increased by 5.16 million in just the first four weeks of 2026.

The steady growth of staked ETH supply is also another factor helping to potentially weather the distribution, adding nearly 1 million ETH since the beginning of the year, per Validator Queue data. An additional 3.53 million ETH is waiting in the validator entry queue to begin staking, while the exit queue is almost empty.

Ethereum treasury firm Bitmine Immersion (BMNR) accounts for the majority of the recent growth in staked ETH supply. The company has staked over 2 million ETH, about 50% of its entire ETH stack, according to its last report.

Ethereum Price Forecast: ETH faces potential rejection at resistance near $3,060

Ethereum saw $84.5 million in futures liquidations over the past 24 hours, driven by $67 million in short liquidations, according to Coinglass data.

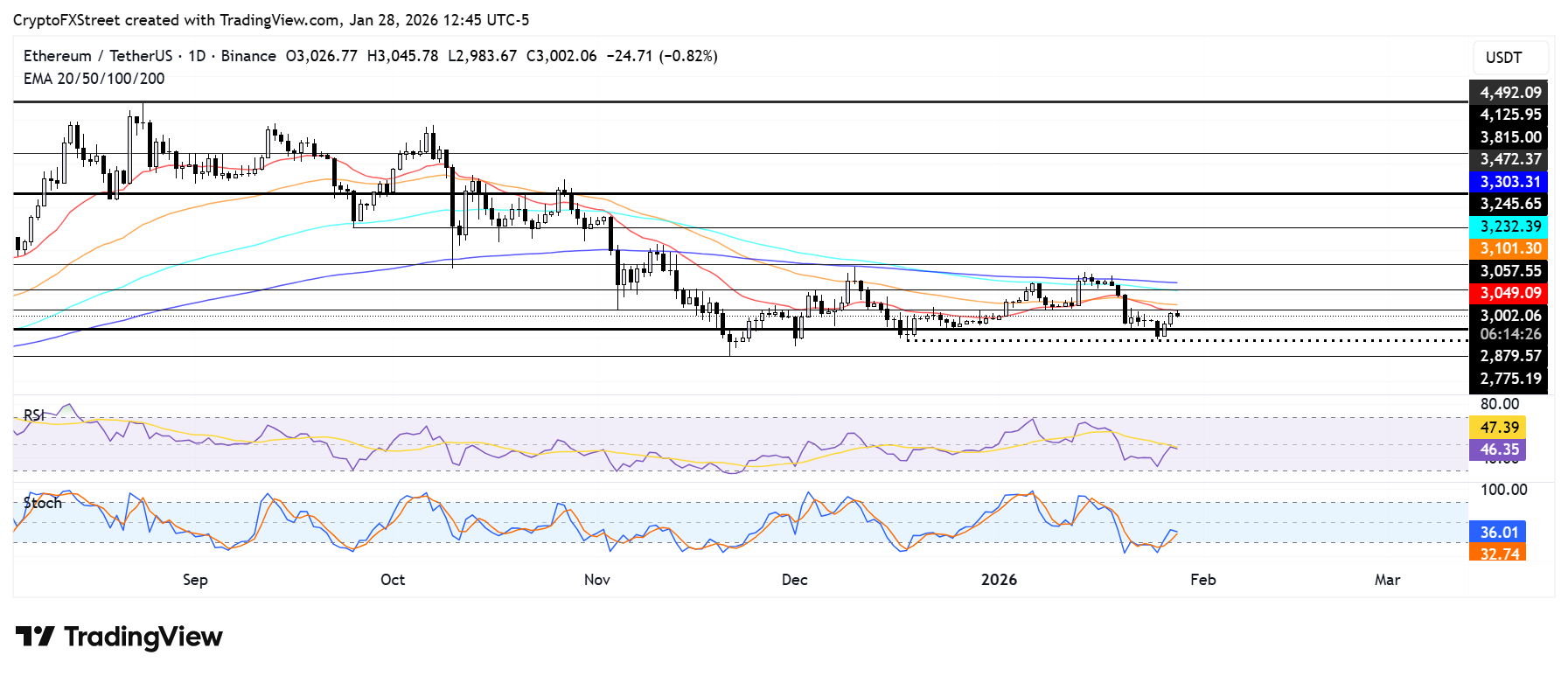

ETH is facing a potential rejection at the $3,057 resistance, near the 20-day Exponential Moving Average (EMA). A failure to rise above the level could push ETH to test $2,880. Further down is the $2,775 support.

On the upside, ETH could test the $3,245 resistance if it rises above $3,057.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are below their neutral levels and have halted their rise, indicating that the brief upward move is losing momentum.