Ethereum Price Forecast: ETH faces pressure near $3,000 as BitMine continues buying spree

- BitMine acquired 54,156 ETH last week, boosting its holdings to 3.56 million ETH.

- The company sits on $3 billion in unrealized losses following ETH's downturn in recent weeks.

- ETH eyes the $2,850 key level after breaching the $3,100 support.

Ethereum treasury company BitMine Immersion Technologies announced on Monday that it bought 54,156 ETH last week, pushing its holdings to 3.56 million ETH.

The firm also reduced its stake in Worldcoin (WLD) treasury Eightco Holdings (ORBS) from $61 million to $37 million. BitMine now holds $11.8 billion in total assets, including a 192 Bitcoin (BTC) stash and $607 million in unencumbered cash, according to a statement on Monday.

Last week's purchase marks BitMine's lowest acquisition since launching its ETH treasury in July. The slowdown follows sustained declines across the crypto market over the past few weeks.

The weakness across the market indicates a key market maker suffering from a falling balance sheet, noted BitMine's Chairman Thomas Lee.

"When a market maker has a 'hole' on their balance sheet, they are seeking to raise capital and are reducing their liquidity functions in the market," wrote Lee. "This is the equivalent of QT (quantitative tightening) for crypto and has the effect of dampening prices. In 2022, this QT effect lasted for 6-8 weeks. And this is probably happening today."

Despite the recent downtrend, Lee highlighted that crypto prices haven't peaked for the cycle, adding that a market top is 12-36 months away.

BitMine holding large losses following ETH's decline

Based on the time BitMine wallets have received their purchased ETH since its launch, the company sits on an unrealized loss of about $3 billion following the sustained decline in ETH over the past weeks, according to data compiled by CryptoQuant contributor Maartunn. "For context: at the depths of the bear market, MicroStrategy's unrealized loss peaked at $1.9 billion," wrote Maartunn in a Monday post on social media platform X.

Notwithstanding, BitMine remains the largest ETH treasury, trailed by SharpLink Gaming (SBET) and The Ether Machine (ETHM).

Meanwhile, US spot Ethereum exchange-traded funds (ETFs) recorded $728.5 million in net outflows last week, their third largest on record, per SoSoValue data.

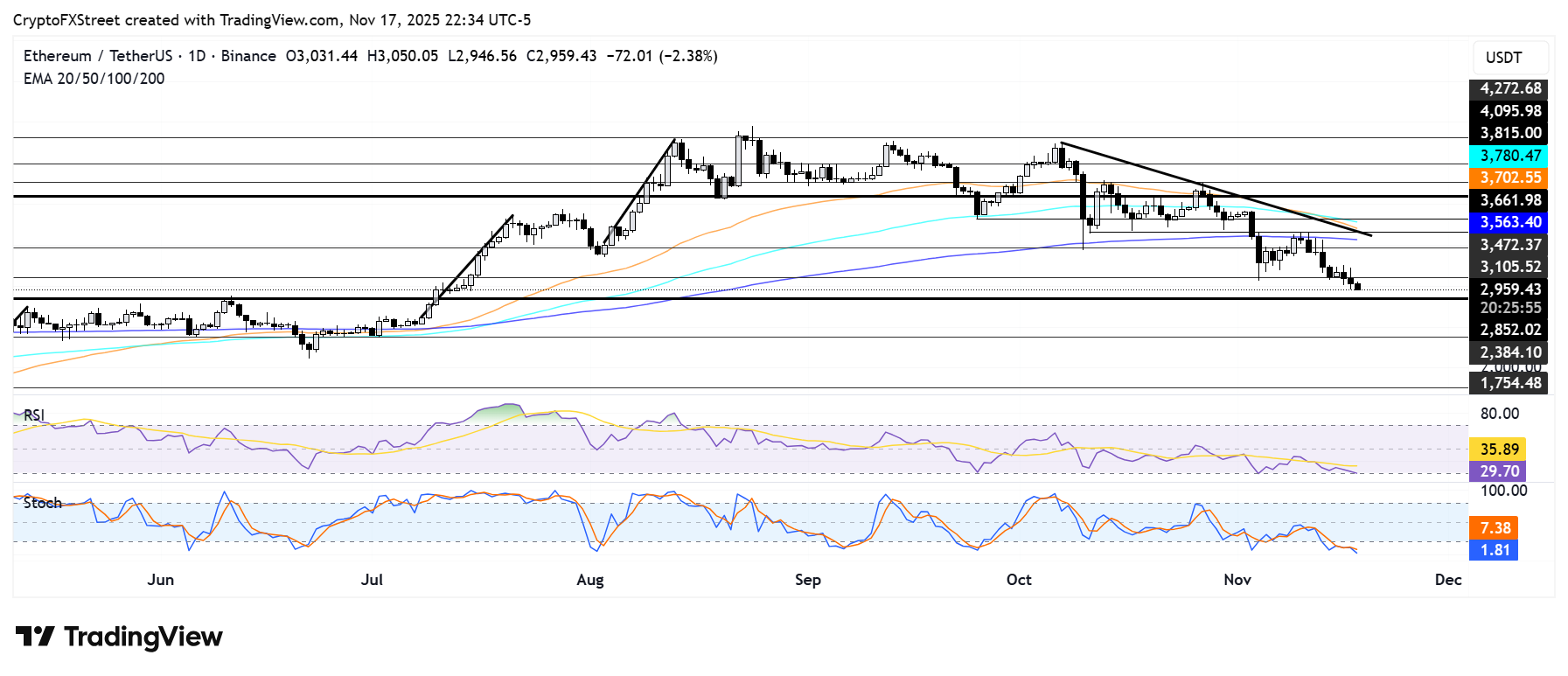

Ethereum Price Forecast: ETH eyes $2,850 after breaching the $3,100 support

Ethereum has recorded $166.8 million in futures liquidations over the past 24 hours, led by $132.1 million in long liquidations, according to Coinglass data.

ETH is under pressure near the $3,000 psychological level after breaching the support at $3,100. A failure to recover the $3,100 level could push ETH toward the $2,850 key level. Further down is the support near $2,380.

On the upside, ETH faces resistance at $3,470 if it recovers $3,100.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are around their oversold regions, indicating a dominant bearish momentum. On the other hand, oversold conditions in both momentum indicators have historically been a precursor to short-term recoveries.