Solana Corporate Playbook Expands With VisionSys AI’s $2 Billion SOL Treasury Plan

NASDAQ-listed VisionSys AI today announced that its subsidiary, Medintel Technology Inc., has signed an exclusive partnership with staking protocol Marinade Finance to launch a Solana-based (SOL) digital treasury program, valued at up to $2 billion.

Solana Corporate Adoption Gains Momentum

According to an announcement earlier today, VisionSys AI – a technology services firm specializing in brain-machine interaction and advanced AI systems – stated that its subsidiary is set to acquire and stake $500 million worth of SOL in the next six months.

In the announcement, VisionSys AI stated that the partnership is aimed toward strengthening the firm’s balance sheet, enhancing liquidity, and creating long-term strategic value through SOL acquisition.

Notably, Marinade Finance, a leading player in the Solana decentralized finance (DeFi) ecosystem, will function as VisionSys AI’s exclusive staking and ecosystem partner. Commenting on the development, Heng Wang, CEO of VisionSys AI, stated:

This partnership represents a once-in-a-generation opportunity to integrate digital assets into our corporate DNA. It positions VisionSys as a pioneer of AI-driven blockchain treasury management. By leveraging Marinade’s unparalleled expertise, we are not just strengthening our treasury; we are building a foundation for the future.

While the firm will start with buying and staking $500 million worth of SOL, it eventually plans to scale up and create a treasury worth $2 billion of SOL. That said, the announcement makes no mention of how VisionSys AI plans to buy SOL.

Assuming the firm can bag $500 million worth of SOL, then it would instantly find itself among the top five leading public firms with the largest Solana-based treasuries. Currently, the medical design firm Forward Industries holds the largest SOL treasury, worth $1.5 billion.

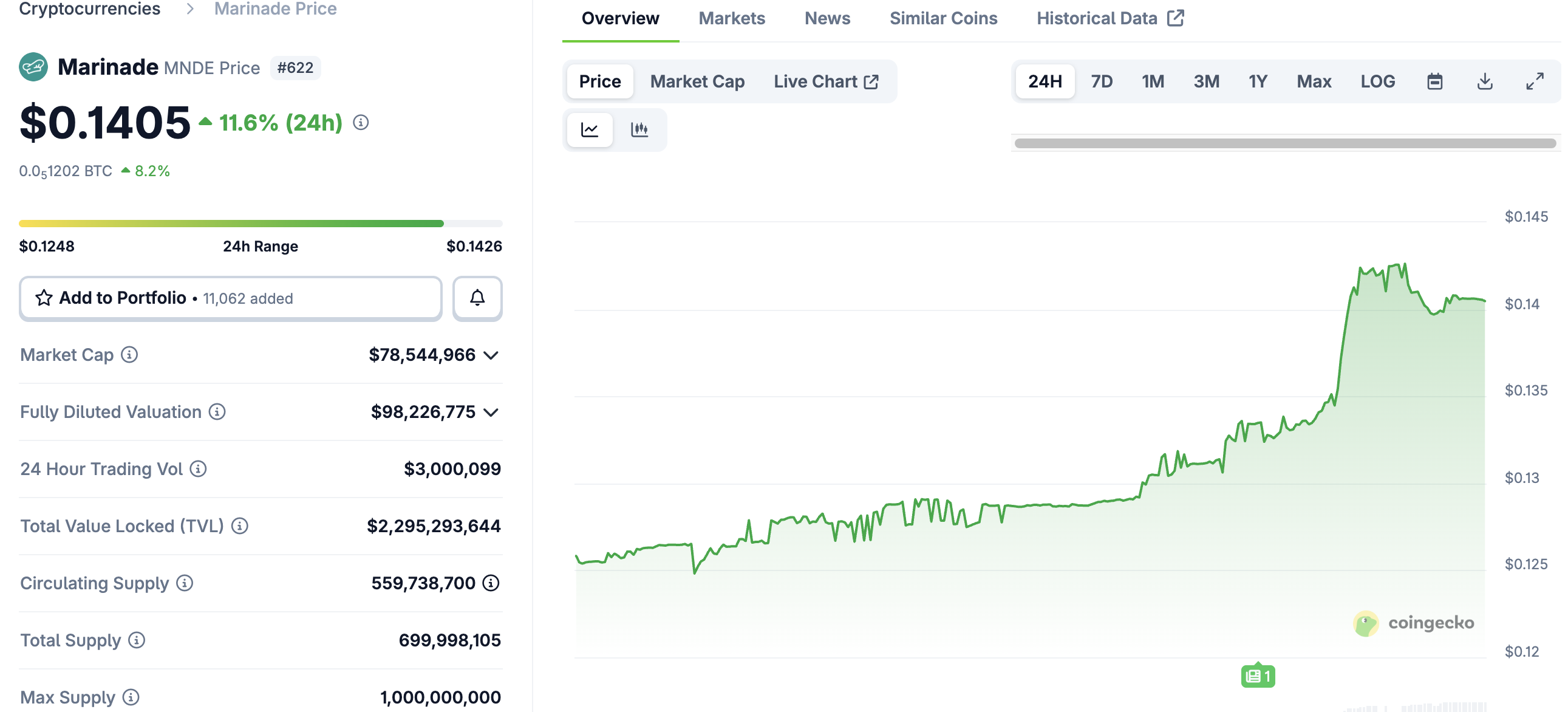

Meanwhile, DeFi protocol Marinade Finance currently holds more than 10.4 million SOL tokens, worth approximately $2.2 billion according to current market prices. According to data from Coingecko, the protocol’s native token, MRND, is up 11.6% in the past 24 hours, trading at $0.14.

On the contrary, VisionSys AI’s stock plummeted following today’s announcement. The stock is down a massive 35.17% in the past 24 hours, trading at $2.23 at the time of writing. However, it is up an impressive 462% over the last six months.

Where Is SOL Headed?

As corporate adoption of SOL continues at a rapid pace, analysts are not shying away from giving predictions about the digital asset’s price movement. Chinese AI tool DeepSeek recently forecasted that SOL could surge past $450 by the end of 2025.

Solana is also taking the spotlight from the two leading cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), as SOL-based crypto investment products recently attracted inflows to the tune of $291 million. At press time, SOL trades at $219.19, up 6.7% in the past 24 hours.