Pi Network unveils AI-powered KYC as whales accumulate during price consolidation

- Pi Network announces faster KYC verifications powered by built-in AI.

- Sign collaborates with the Pi Network community for its first-ever meetup in Seoul on Monday.

- PI remains muted within a consolidation range as CEXs' wallet balances decline.

- Large volume transactions in the last 24 hours indicate investors accumulating PI tokens.

Pi Network (PI) consolidates above $0.3500 for the fifth consecutive day, as the recently launched AI-powered Know Your Customer (KYC) fails to uplift investors' sentiment. Still, a decline in Centralized Exchanges (CEXs) wallet balances and the moves from whales suggest that large-wallet investors are buying the dip.

Pi Network releases fast-track KYC feature

Pi Network has announced a faster KYC flow with more AI features, which will allow network users, commonly referred to as Pioneers, to activate the mainnet wallet before completing the 30 mining sessions.

This feature is currently reserved for eligible users with fewer than the previously required sessions. The faster KYC only allows mainnet wallet activation and not mainnet migration of the PI tokens.

Sign collaborates with the Pi Network community for a get-together in Seoul

Sign protocol, an Ethereum-based digital verification protocol, announced an upcoming collaboration with Pi Network through a community meetup in Seoul on Monday. The meetup will begin at 10:30 hours GMT on Monday, featuring a chat between Sign Xin Yan's CEO and one of the Pi Network’s co-founders, whose name hasn't yet been confirmed.

Whales continue to accumulate as PI coin consolidates

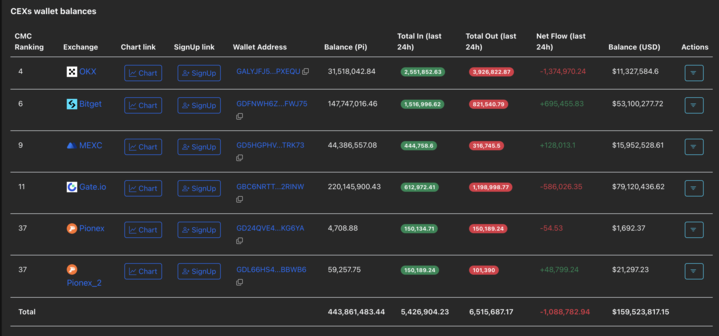

PiScan data indicates a net outflow of 1.08 million PI coins from the CEX's wallet balances, as investors accumulate at lower prices. Generally, a decline in exchange reserves often translates to lowered selling pressure, which could support prices.

CEXs wallet balances. Source: PiScan

Validating a rise in demand, PiScan data shows that four out of the five highest volume transactions on the network are from large wallet investors, popularly known as whales, withdrawing over 3.40 million PI coins. Typically, an increase in whale activity also serves as an early signal of a trend reversal.

Largest transaction on Pi Network. Source: PiScan

Selling pressure declines as PI extends consolidation

Pi Network above $0.3500 in a larger consolidation range between the $0.3220 support floor and the $0.4000 ceiling. A potential close above the $0.4000 could extend the rally to the $0.5032 level, marked by the June 22 close.

The momentum indicators on the daily chart remain unchanged as the Keltner channels sustain a sideways move, indicating lowered volatility. At the same time, the Relative Strength Index (RSI) remains flat at 50, suggesting that trend momentum is dampened.

Still, the Accumulation/Distribution line at -283 million, up slightly from -289 million on Thursday, indicates a decline in selling pressure.

PI/USDT daily price chart.

If PI slips below $0.3200, the $0.3000 round figure could act as the immediate support.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.