VivoPower boosts XRP holdings with discounted swap strategy

VivoPower International has confirmed that its subsidiary, Caret Digital, will expand mining operations and exchange mined tokens in XRP. The company said the move provides exposure to the asset at an effective discount of 65%.

Caret Digital mines Bitcoin, Litecoin, and Dogecoin, but did not specify what tokens would be traded or the magnitude of the conversion. XRP is trading near $3 with a market cap of around $182 billion.

“A key objective of this strategy is to secure XRP exposure at the lowest average cost possible, through a combination of token swapping from digital asset mining activities and by purchasing Ripple Lab shares.”

VivoPower International

The swap complements VivoPower’s broader plan to reduce acquisition costs by combining token purchases with equity deals based on Ripple Labs. The dual-pronged strategy exhibits an institutional model of treasury management in the altcoin market.

Ripple equity deals add to the discount strategy

The company’s XRP pivot was launched in May with a $121 million private placement by His Royal Highness Prince Abdulaziz bin Turki bin Talal Al Saud. Former Ripple board member Adam Traidman also joined as the advisory chairman.

In June, VivoPower partnered with BitGo to provide it as an exclusive custodian and trading partner for XRP acquisitions, as Cryptopolitan reported. Around the same time, the firm announced a $100M yield initiative with Flare, the Ripple Labs-backed blockchain network, signaling an intent to generate returns on treasury reserves.

Further deepening its stake, VivoPower revealed “definitive agreements” in August to purchase $100 million of Ripple Labs equity from existing shareholders, pending final approval. The deal would translate into 211 million XRP, or $0.47 per token worth of ownership, an 86% discount compared to market conditions at the time. These moves point to a systemic attempt to integrate discounted exposure with institutional-grade custody and yield solutions.

Treasury push extends into payments and yield

VivoPower’s XRP strategy is no longer limited to balance sheet management. Its electric vehicle subsidiary, Tembo, will now accept Ripple’s RLUSD stablecoins as payment. The integration of RLUSD promises to eliminate transaction friction and bank charges, while improving enterprise-grade crypto capabilities for VivoPower.

The company also recently announced a $30 million pilot with Doppler Finance, which will see the company deploy XRP into structured yield pools with direct reinvestment of proceeds in reserves. That initiative could grow to $200 million.

In parallel, VivoPower’s partnership with Flare has grown, deploying $100 million worth of XRP onto the chain to generate yield via decentralized finance applications. These integrations enable the treasury to be a yield-generating platform, instead of merely a passive holding strategy.

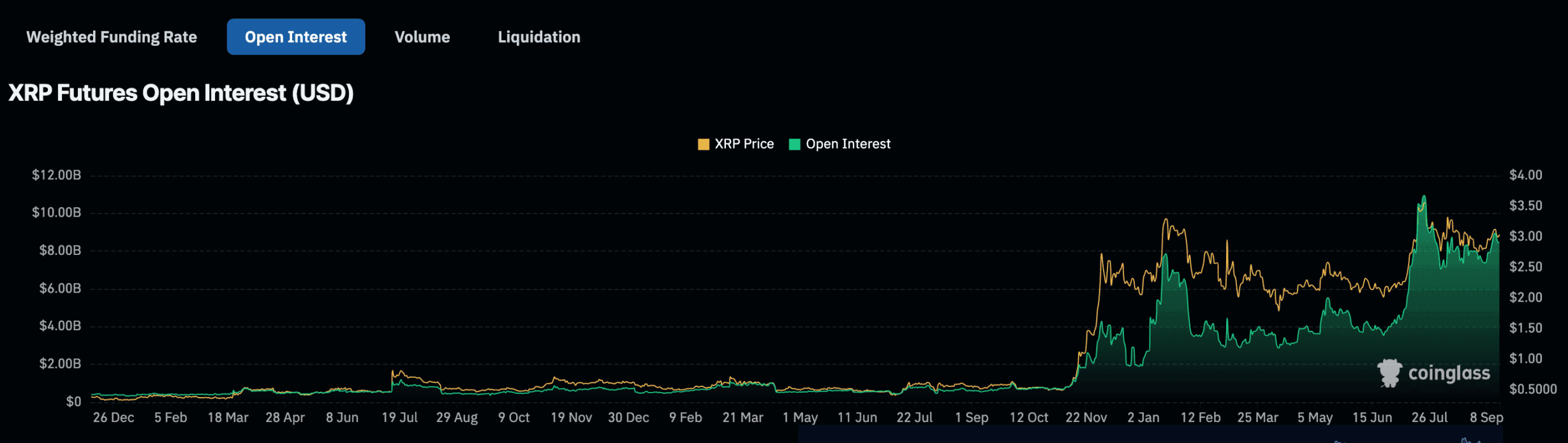

XRP’s market activity has also picked up with VivoPower’s announcements. Open interest in XRP derivatives jumped to $8.45 billion in recent weeks from $7.7 billion in August, when liquidations sparked a 30% drop. The rebound is an indicator of increasing speculative activity and renewed trader conviction.

Technical levels indicate that $3.05 could be a significant support level. Analysts believe XRP could break out of the $3.50-$4.00 range if defended. However, a breakdown below $3.05 is in danger of retesting $2.80.

KEY Difference Wire helps crypto brands break through and dominate headlines fast