Bitcoin Scarcity Index On Binance See Sharp Spike, Exchange Supply Shock Brewing?

After a sharp drop in August, Bitcoin is once again aiming bullishly at its current all-time high price, as the largest digital asset reclaims and holds above the $115,000 price mark. Following its renewed upward strength, it appears the surge has triggered a notable adoption among investors, leading to a spike in BTC’s Scarcity Index.

Binance Bitcoin Scarcity Index Major Surge

Just as Bitcoin is regaining upward traction, several crucial metrics are starting to exhibit a bullish trend. Presently, the mechanics of the supply of Bitcoin on exchanges are changing once more, as evidenced by the recent dramatic increase in Bitcoin Scarcity Index on Binance, the world’s largest cryptocurrency exchange.

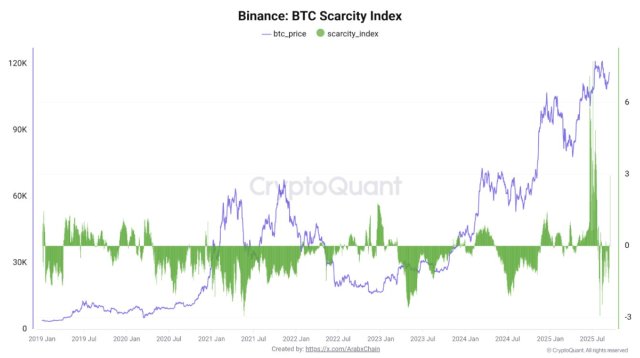

In a quick-take post on the CryptoQuant platform, Arab Chain, a market expert and author, reported that the recent sudden spike in this key metric, which occurred on Sunday, marked its first time since June. This spike indicates a tightening supply environment, implying that as investor accumulation increases, there are fewer coins accessible for trading.

Therefore, this move suggests that a large amount of BTC was removed from Binance or that sell orders sharply decreased, which causes supply to become limited on the platform. According to the market expert, this shift is typically linked to the arrival of big investors, such as institutions or whales, who made substantial purchases.

Interestingly, when immediate purchasing power surpasses supply, the Bitcoin Scarcity Index rises, giving the impression that buyers are vying for BTC on the market. It is worth noting that the last time the pattern took place last June, it continued for several days, and after that, BTC experienced a massive rally to its all-time high around $124,000.

During the surge, BTC experienced a wave of funds as this type of increase usually sparks positive news or sudden capital inflows. Should the index stay positive for a couple of days in a row, it would signal the start of a robust accumulation phase and might help the uptrend to continue.

However, in that case, if the surge is swift and is followed by an equally rapid decline, it can be a sign of speculative activity or order liquidations, which are frequently followed by a period of calm or a price correction. Looking at the scarcity chart, Arab Chain noted that this seems to be the case for BTC right now.

A Rise In The Metric To All-Time Highs

In recent months, the expert highlighted that the scarcity index has risen sharply, hitting all-time highs of over +6 before swiftly falling toward neutral and even negative territory. After this sudden spike, speculations are whether the development could impact the next market phase.

Arab Chain mentioned that this discrepancy between the high price and the index’s quick decline back to or below zero suggests that some of the robust buying impetus has started to wane. Nonetheless, this trend is validated mostly if supply is increasing or withdrawals from crypto platforms are slowing down, which is likely to influence BTC’s price trajectory.