Why a Satoshi-era Bitcoin wallet moved nearly $5 billion in BTC at a new all-time high

- A Bitcoin wallet from the Satoshi era moved over 40,000 BTC to Galaxy Digital.

- Bitcoin holders are guessing whether Satoshi, Roger Ver or another core developer is behind the transfer.

- Galaxy Digital’s over-the-counter trading desk could facilitate the sale of the 40,000 BTC, allowing the owner to take profits.

A Bitcoin wallet dormant for over 14 years moved 40,000 BTC, half of its holdings, on July 15. Analysts at on-chain intelligence tracker Lookonchain believe that the mysterious whale is set to take profits by selling its BTC holdings.

Bitcoin hit a new all-time high above $123,218 on Tuesday, July 15. BTC holders have consistently taken profits for nearly 100 days, but BTC has absorbed the selling pressure and climbed higher.

Mystery whale moves Bitcoin first time post Satoshi-era

A mysterious large wallet investor was identified by Lookonchain after a 40,000 BTC transfer to Galaxy Digital. The wallet held nearly 80,000 BTC previously and was dormant for 14 years, dating the last transaction back to the Satoshi-era. Satoshi was active online until 2011, the period between 2009 and 2011 is termed the Satoshi-era.

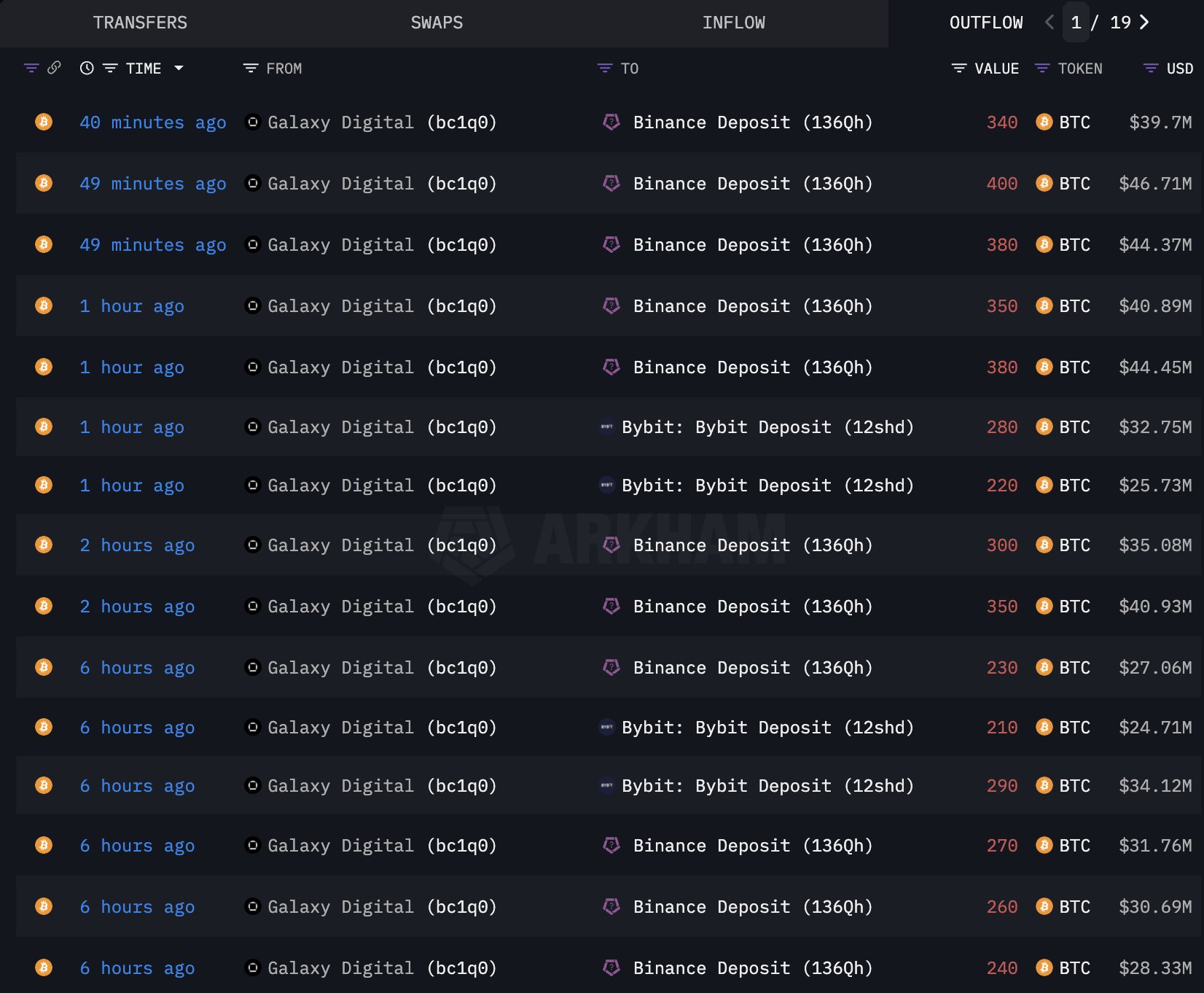

Bitcoin transfers from mysterious whale wallet | Source: Lookonchain

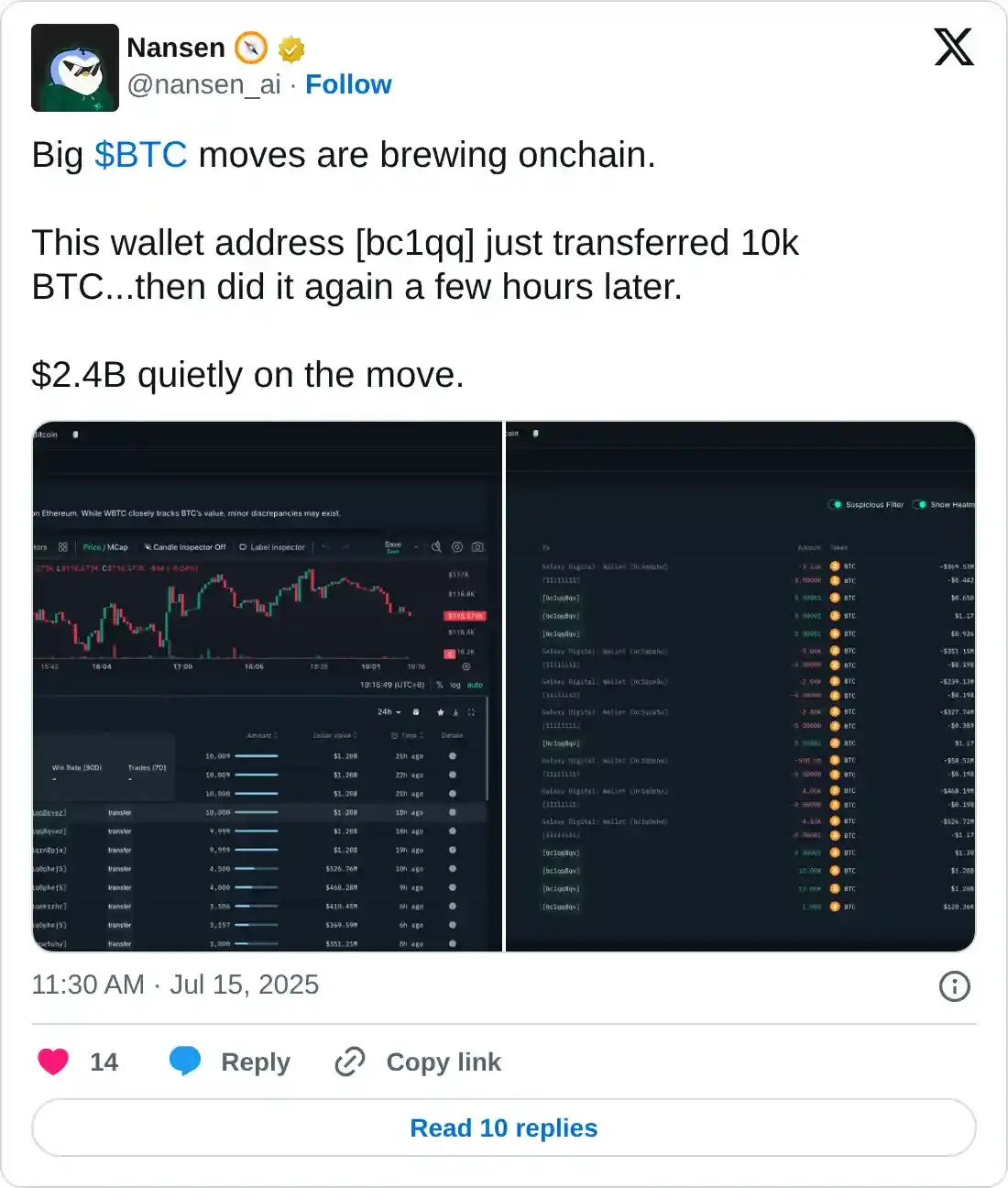

The whale wallet held $9.46 billion in BTC, nearly 80,009 tokens and transferred half to the crypto asset manager. Tracking the deposit, analysts at Nansen identified Galaxy Digital’s transfer of 6,000 BTC to Binance and Bybit.

The exchange transfers could represent Galaxy Digital’s over-the-counter (OTC) desk’s sale of Bitcoin.

With no concrete data on the owner’s identity, Bitcoin holders are speculating whether the wallet belongs to BTC creator Satoshi Nakamoto or Roger Ver.

The mystery whale’s profit-taking failed to dampen investor sentiment. The Crypto Fear & Greed Index reads 73, on a scale of 0 to 100, meaning traders are bullish or “Greedy.” Santiment data shows traders have taken profits for over 100 days in a row, and Bitcoin continues rallying higher as bulls absorb the selling pressure on exchanges.

Fear & Greed Index | Source: Alternative

Bitcoin entered price discovery on July 9, since then the king crypto has been in an upward trend. BTC hit a peak of $123,218 on Tuesday before retracing to the $116,000 level. The recent correction in Bitcoin price may be short-lived and experts predict further gains in BTC in the short term.

Andrejs Balans, risk manager at YouHodler, an EU-based fintech platform, told FXStreet that BTC could hit $150,000. Balans said:

“Although institutional exposure has increased through ETFs and custody services, most allocations remain modest relative to traditional asset classes. Concerns about volatility, operational risk, and compliance continue to limit more substantial commitments. Without a broad shift in institutional sentiment, it is unlikely that inflows alone will propel Bitcoin to $150,000 swiftly.”