COIN declines 3% in after-trading hours as Coinbase Q1 earnings misses estimates

- Coinbase reported a total revenue of $2.03 billion, underperforming estimates of $2.2 billion.

- While its EPS came at $1.94, above estimates of $1.85, it fell more than 40% Q/Q.

- COIN declined nearly 3% during after-trading hours following the earnings report.

Coinbase (COIN) share price fell 3% during after-trading hours on Thursday as its lower-than-estimated Q1 earnings report cooled earlier bullish sentiment from its Deribit acquisition.

Coinbase misses Q1 earnings estimates

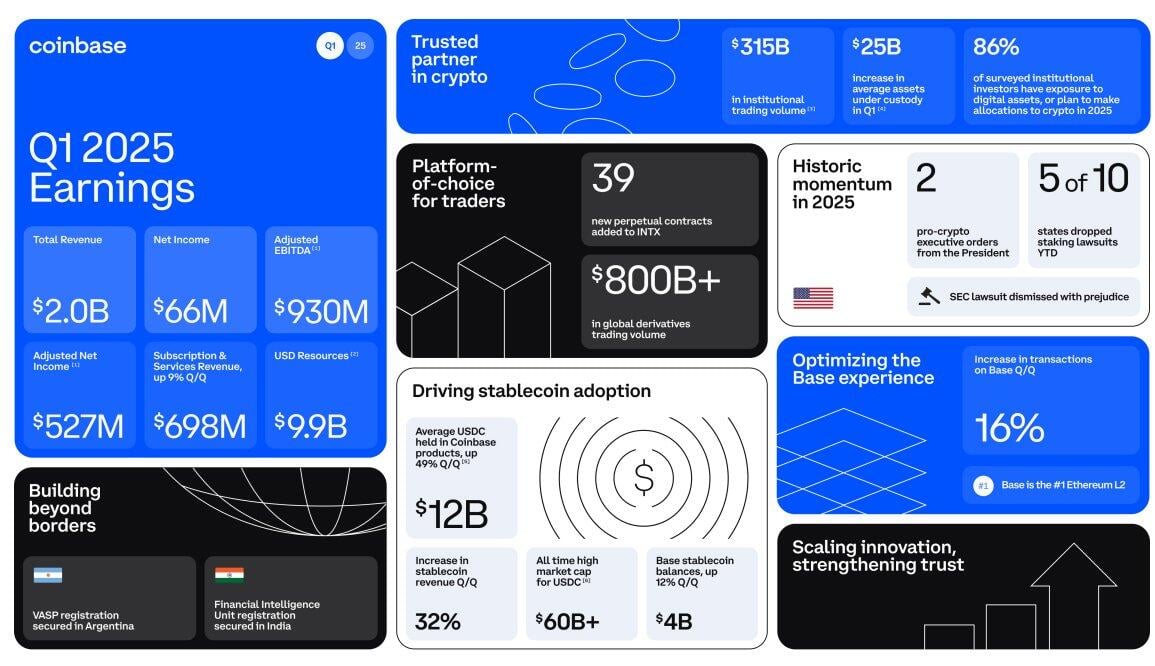

Crypto exchange Coinbase reported a total revenue of $2.03 billion, below analysts' estimated $2.2 billion and 10% below its revenue in Q4. Its transaction revenue declined 19% Q/Q to $1.26 billion, while subscription and services revenue rose 9% Q/Q to $698 million.

Following the decline in total revenue, Coinbase's adjusted earnings per share (EPS) came in at $1.94, beating estimates of $1.85, but were 40% below that of Q4, per Nasdaq data.

The drop in revenue follows the general crypto and stock market crash in Q1 after President Trump announced tariffs on international trading partners.

However, Coinbase managed to rack up points in its stablecoin sector, with revenue rising 32% Q/Q and the average USDC balance across its products jumping 49% Q/Q to $12 billion. The growth in its stablecoin sector can be traced to positive sentiment surrounding stablecoin regulation in the United States. The Senate Banking Committee approving the GENIUS Act with bipartisan support in March likely contributed to interest in the exchange's USDC products.

Coinbase Q1 earnings. Source: Coinbase

Other key points in the report include Coinbase securing a Virtual Asset Service Provider (VASP) registration in Argentina and Financial Intelligence Unit registration in India. Coinbase also recorded a major legal win in Q1, with the Securities and Exchange Commission (SEC) dropping its lawsuit against the exchange.

Coinbase earlier announced on Thursday that it would acquire Deribit, the largest crypto options trading platform, in a $2.9 billion deal involving cash and stocks.

Coinbase's stock COIN rose over 5% on Thursday following the announcement but has retraced in after-trading hours, down over 3% since releasing its Q1 earnings report. The decline comes amid Bitcoin and Ethereum surging above $100,000 and $2,100, respectively.