Crypto Today: Bitcoin, Ethereum and XRP trade in the green as crypto lost to hacks and fraud plunge by 40%

FXStreetSep 26, 2024 8:26 PM

- Bitcoin has moved above the $65,000 psychological level after flipping a key resistance, XRP sees a slight 1% gain.

- Ethereum trades around $2,650, up over 3% in the past 24 hours, as it attempts to tackle the $2,707 key resistance.

- The crypto industry lost $413 million to hacks and fraud in Q3: Immunefi.

Bitcoin, Ethereum and XRP updates

- Bitcoin (BTC) trades around $65,100 on Thursday, up 3% on the day. The move saw the largest cryptocurrency by market capitalization breaking a key resistance around $64,700. Bitcoin ETFs recorded a positive net flow of $105.9 million on Wednesday, extending their streak to five consecutive days of net inflows, per Farside Investors data.

- Ethereum is trading around $2,650, up nearly 3% in the past 24 hours. On the upside, the top altcoin faces resistance around the $2,707 price level. Ethereum ETFs recorded a second consecutive day of inflows after posting net inflows of $43.2 million.

- Ripple's XRP is up over 1%, trading around $0.593 at press time. XRP could see a massive rally if it sustains a move above the upper trendline of a key price boundary near $0.615. However, it risks a massive correction if prices move below the $0.573 level.

Market updates

- The web3 ecosystem suffered a loss of nearly $413 million to hacks and fraud, down 40% from the ~$686 million stolen in Q3 2023, according to bug bounty platform Immunefi. The losses were dominated by the attacks on India-based exchange WazirX and Singapore-based exchange BingX, which suffered losses of $235 million and $52 million, respectively.

The report highlights a switching tide in attackers' success rate between decentralized finance (DeFi) and centralized finance (CeFi). While DeFi saw more attacks with 31 incidents in Q3, the amount of stolen funds dropped by 79% YoY to ~$104 billion. On the other hand, CeFi saw only three successful attacks, but its total losses increased by 66% to $309 million YoY.

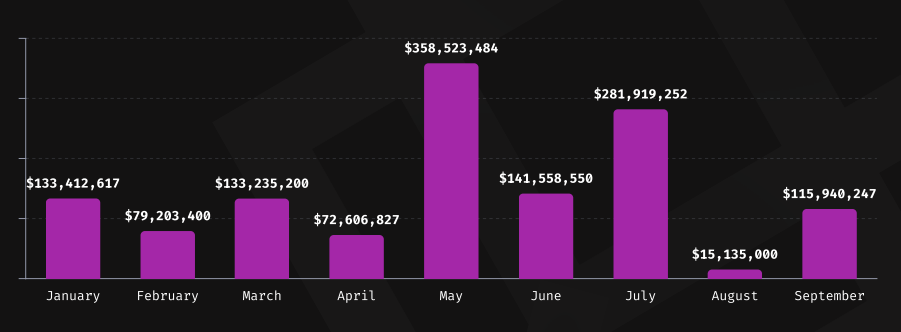

Crypto losses year-to-date - Synthetic stablecoin USDe issuer Ethena Labs announced the launch of a new isolated stablecoin product, UStb, backed by BUIDL from BlackRock and Securitize. UStb will function like traditional stablecoins and provide Ethena with the capacity to mitigate USDe's risk during negative funding rate environments by reallocating assets to the new product, the company said in an X post on Thursday.

Chart of the day: Shiba Inu (SHIB)

SHIB/USDT daily chart

- SHIB is the largest gainer among the top 100 cryptos by market capitalization, soaring over 20% in the past 24 hours.

- The move has seen SHIB break above a key resistance that has held prices at bay since the market crash on August 5. If SHIB fails to see a rejection around $0.000002005, it could rally further toward $0.000002398.

- The Relative Strength Index (RSI) and Stochastic Oscillator momentum indicators are in their respective oversold region above 70 and 80, indicating a potential correction.

Disclaimer: The information provided on this website is for educational and informational purposes only and should not be considered financial or investment advice.