Bitcoin bulls eye for $70,000 if it breaks above the consolidation zone

- QCP Capital’s report highlights how recent global macroeconomic developments support Bitcoin growth.

- Ki Young Ju, founder of CryptoQuant, posts on X about the rising US dominance in BTC holdings and the rebound in spot ETF demand.

- Arkham’s intelligence data shows some concern about Bitcoin’s rise as MT. Gox wallet is on the move.

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week. QCP Capital’s report highlights macroeconomic developments that could bolster risk assets like Bitcoin. At the same time, Ki Young Ju, founder of CryptoQuant, notes rising US dominance in BTC holdings and rebounding spot ETF demand, suggesting a potential rally in the coming days.

Bitcoin optimism grows amid supportive global macroeconomic developments

QCP Capital’s report on Wednesday highlights a series of macroeconomic developments that could be more bullish for risk assets, including crypto.

According to the report, “The People’s Bank of China (PBoC) introduced several policies aimed at kickstarting their sputtering housing market and anemic equity market. It has apparently worked (for now) as Chinese A50 futures closed 8% higher, with Chinese and Hong Kong indices following suit.”

The report continued, “The PBoC also announced an unprecedented 500bn RMB swap facility that allows non-bank financial institutions to buy Chinese shares. This facility was previously only available to national banks.”

QCP analysts expect further easing from the PBoC following the recent interest rate cut by the US Federal Reserve (Fed); all major central banks (except the Bank of Japan) are ready to inject more liquidity into the market.

The report also highlights the widened yield spread between the 2-year and 10-year US Treasury notes over the past month, which moved 40bps higher and is now trading at 21bps. A widening spread generally suggests optimism about economic growth, which supports risk assets in the medium to long term.

Additionally, on the US political front, Kamala Harris spoke positively about AI and digital assets at her fundraiser. Following her speech, rallies in AI-related coins were observed. The SEC approving options trading on IBIT (BlackRock’s Spot BTC ETF) also shows the growing acceptance and demand for digital assets as an asset class.

Ki Young Ju, founder and CEO of CryptoQuant, an on-chain data and analytics company, posted on X on Wednesday that “The US is regaining dominance in Bitcoin holdings. Its ratio compared to other countries is rising, driven by spot ETF demand.”

The U.S. is regaining dominance in #Bitcoin holdings. Its ratio compared to other countries is rising, driven by spot ETF demand. Only known entities are included. pic.twitter.com/a9XOb5134E

— Ki Young Ju (@ki_young_ju) September 26, 2024

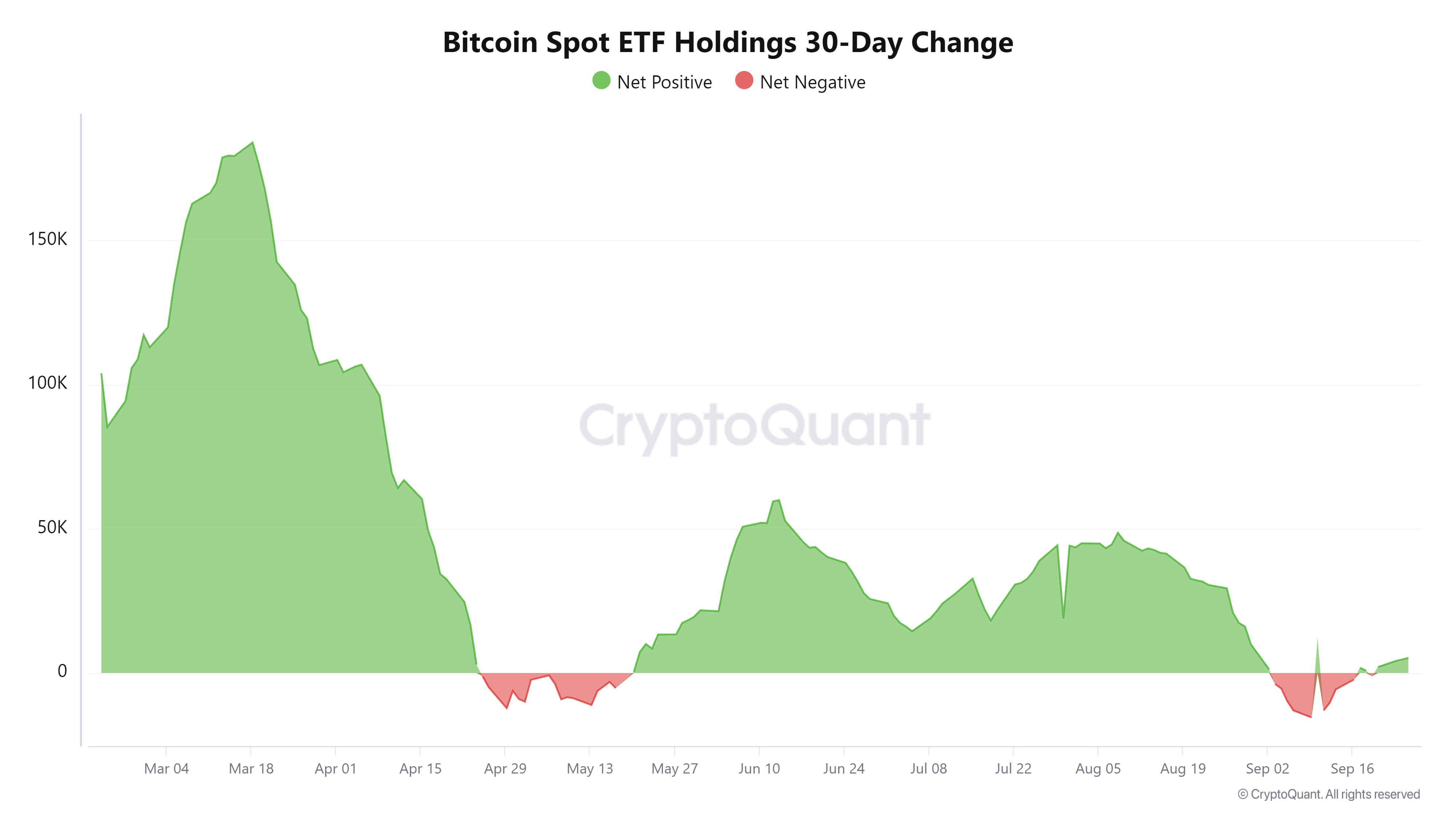

He also posted, “Bitcoin spot ETF demand has rebounded, with the 30-day net change in total holdings turning positive.” These are positive signs for Bitcoin, as they indicate increasing confidence among investors and rising institutional demand.

Bitcoin Spot ETF Holding 30-Day Change Chart

However, Arkham’s intelligence data shows some concern about Bitcoin’s rise. The data show that the defunct crypto exchange MT. Gox wallet is on the move.

On Wednesday, they emptied four of their wallets after receiving $370,000 funds in BTC from the Kraken exchange. This move could be the repayments to the creditors coming soon. If repayments proceed to the creditors, fear, uncertainty, and doubt (FUD) could be sparked among the traders, as these creditors’ are more likely to transfer their BTC into centralized exchanges to sell. Investors must be cautious about such activity. Mt. Gox wallet currently holds 44,899 BTC worth $2.85 billion.

MT. GOX BTC ON THE MOVE

— Arkham (@ArkhamIntel) September 25, 2024

Mt. Gox emptied 4 of their wallets last night after receiving $370K in BTC from Kraken.

More repayments coming soon?

Mt. Gox currently holds 44,899 BTC ($2.85B). pic.twitter.com/Zh1OKQOygW

Technical analysis: BTC extends consolidation between $62,000 and $64,700

Bitcoin’s price has been consolidating between the $62,000 and $64,700 key levels for over a week after rallying 7.5% last week. On Wednesday, it was rejected from the $64,700 level for the third time. As of Thursday, it trades slightly higher, around $64,000.

If Bitcoin’s price breaks above this consolidating range around $64,700, it could first rise to retest its daily resistance level at $65,379. A daily close above this level could extend the rally by 7% to retest its July 29 high of $70,079.

The Relative Strength Index (RSI) on the daily chart has declined slightly since Tuesday but currently points upwards, trading at 61. For Bitcoin to break above the consolidating zone, the RSI must rise and head towards its 70 level. However, traders should be cautious if it exceeds the overbought level of 70.

BTC/USDT daily chart

On the other hand, if BTC breaks and closes below the consolidation zone around $62,000, it could decline 7% to retest its September 17 low of $57,610

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.