Avalanche eyes nearly 18% gains with over $250 million bridged from Ethereum

- DeFi token Avalanche gains 5% early on Monday, large wallet holder QCP Capital pulls AVAX from exchange wallets.

- Avalanche has over $230 million in value bridged from the second largest cryptocurrency chain, Ether.

- Daily transactions cross 1.23 million, 21% of AVAX holders are profitable at the current price level.

- Avalanche trades at $28.75, likely to extend gains further as sentiment is bullish among traders.

DeFi token Avalanche (AVAX) trades at $28.75, as Bitcoin sustains close to $69,000 early on Monday. Data from crypto intelligence tracker IntoTheBlock shows that the sentiment among traders is positive. AVAX extends gains by nearly 5% on the day as the DeFi token shows bullish potential.

Avalanche on-chain metrics signal bullish potential

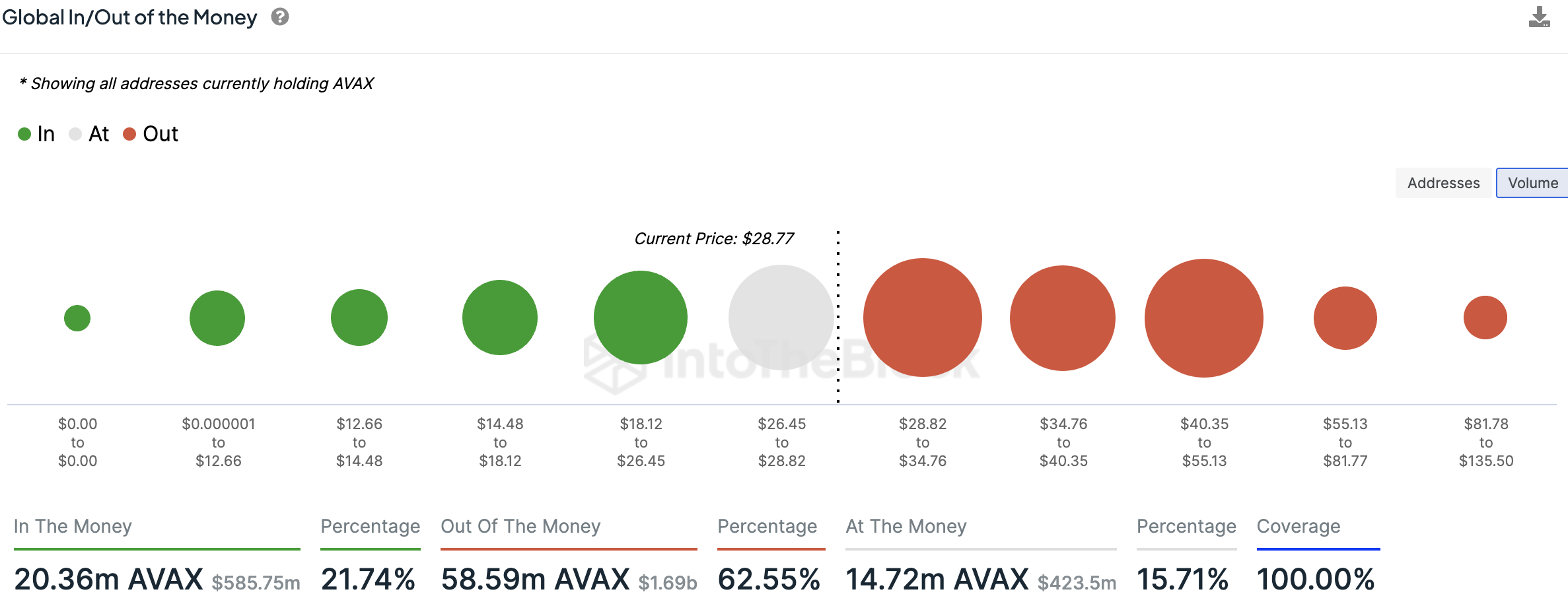

On-chain data from IntoTheBlock shows the sentiment among traders is “bullish” as of Monday. Global In/Out of the Money (GIOM) metric is used to track the profitability of wallet addresses holding the asset at a given price. At $28.77, 21.74% of the wallet addresses holding Avalanche are profitable.

On the other hand, at the current price, 62.55% of wallet addresses holding Avalanche are sitting on unrealized losses. This makes the cluster of addresses less likely to realize losses and sell the asset. The metric, therefore, supports a bullish thesis for Avalanche.

Global In/Out of the Money

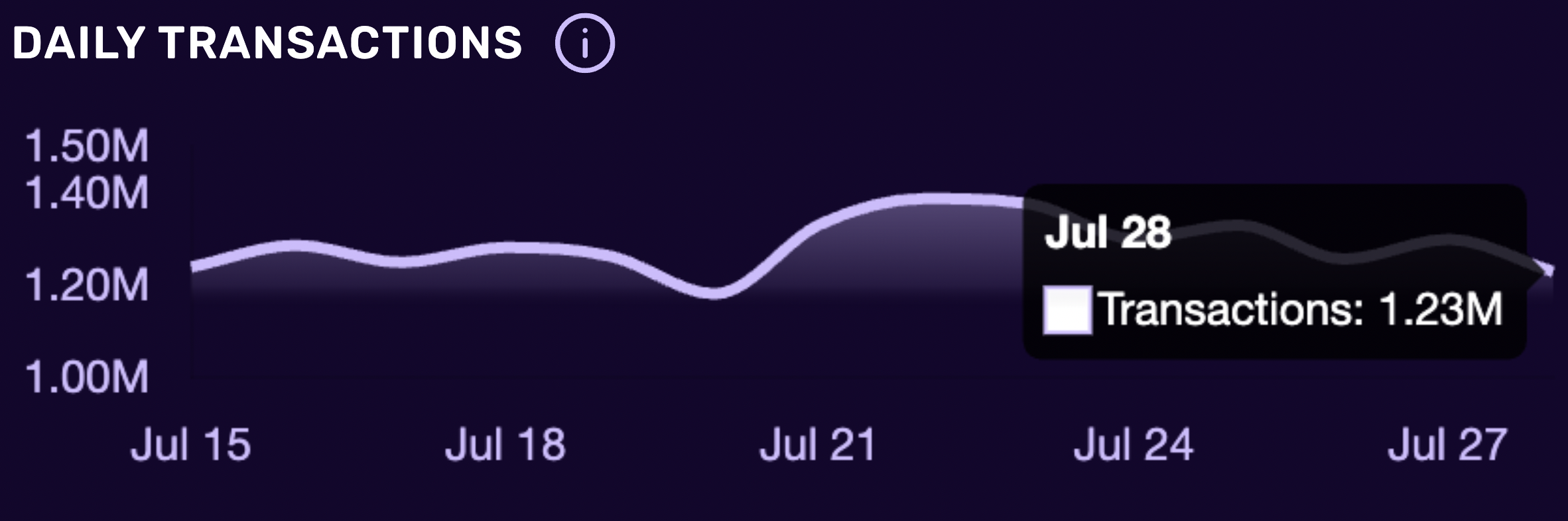

Daily transactions, a measure of the number of transactions on Avalanche, shows utility and demand for the DeFi token. Daily transactions reached 1.23 million on Sunday, per data from Avascan.

Daily transactions on Avalanche

Data shows $253.11 million in value is bridged from the Ethereum chain to Avalanche. This means traders trust the DeFi network and move a large volume of assets to the chain, which is bullish for long-term adoption.

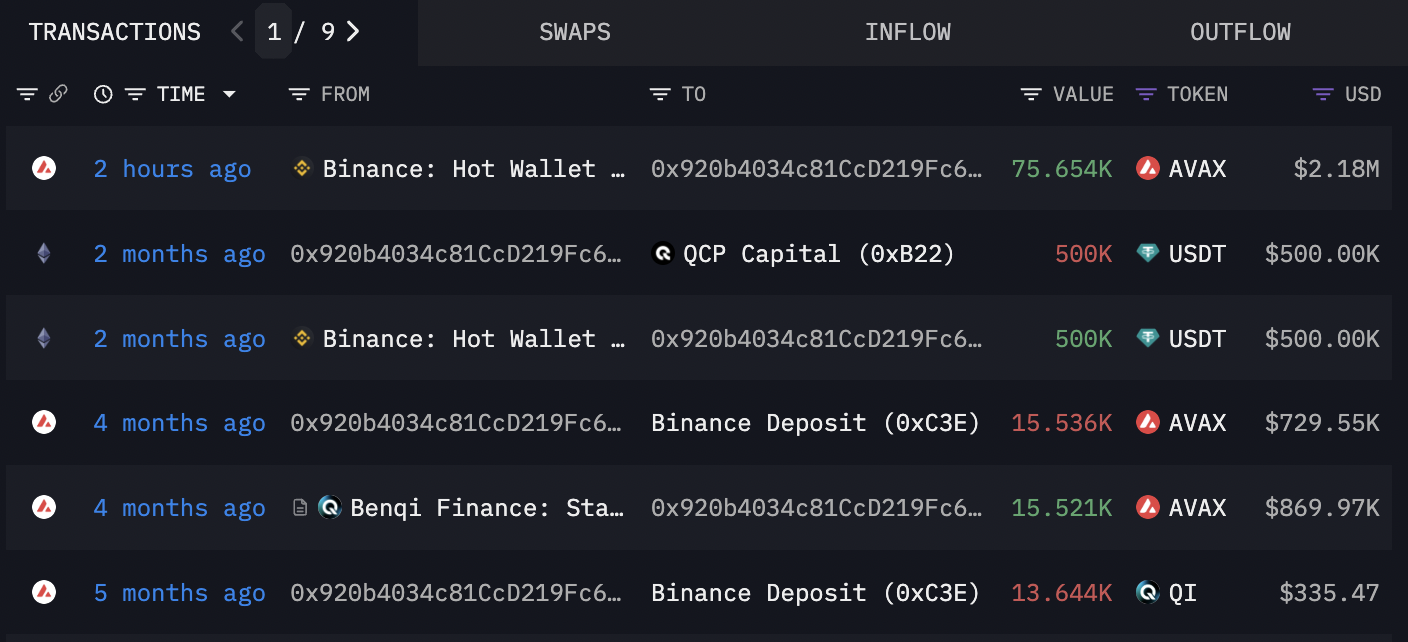

Whales pull AVAX off exchanges

QCP Group, a digital assets trading group from Singapore, withdrew over 75,000 AVAX worth $2.18 million from Binance on Monday. Data from Arkham Intelligence tracker shows that Bitcoin and Ethereum are the two largest holdings in the portfolio of the firm, with 1,641 BTC (worth over $114.23 million) and 7,023 Ether (worth $23.69 million).

The withdrawal reduced the supply of Avalanche on the exchange wallet, likely contributing to the reduced selling pressure.

Avalanche withdrawn from Binance

Avalanche eyes nearly 18% gains

The Avalanche price was in a downward trend. Since its March 18 peak of $65.39, the DeFi token has consistently declined in value. Attempts to break out of the downtrend failed on May 22, June 7, and July 1.

On July 13, AVAX noted a trend reversal, and since then, the DeFi token has sustained above the key support at $25.53, as seen in the AVAX/USDT daily chart below.

The Moving Average Convergence Divergence (MACD) momentum indicator shows an underlying positive momentum in AVAX.

Avalanche could sweep support in the Fair Value Gap (FVG) between $23.30 and $24.45 before rallying towards its target at the FVG between $33.73 and $35.72. A rally to this level represents nearly 18% gains from the current price of $28.75. AVAX faces resistance at $31, a key level for the DeFi token.

AVAX/USDT daily chart

Traders need to watch the MACD closely for signs of a reversal. If MACD crosses below the signal line, the underlying momentum in Avalanche price could turn negative and signal an impending correction in Avalanche.

Looking dows, the June 24 low of $23.51 could act as support for AVAX.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.