Crypto Today: Bitcoin dormant wallet reactivated, market sees extreme greed for first time since June

- Bitcoin wallet that held 37 BTC nearly 12 years ago has been reactivated, per on-chain data.

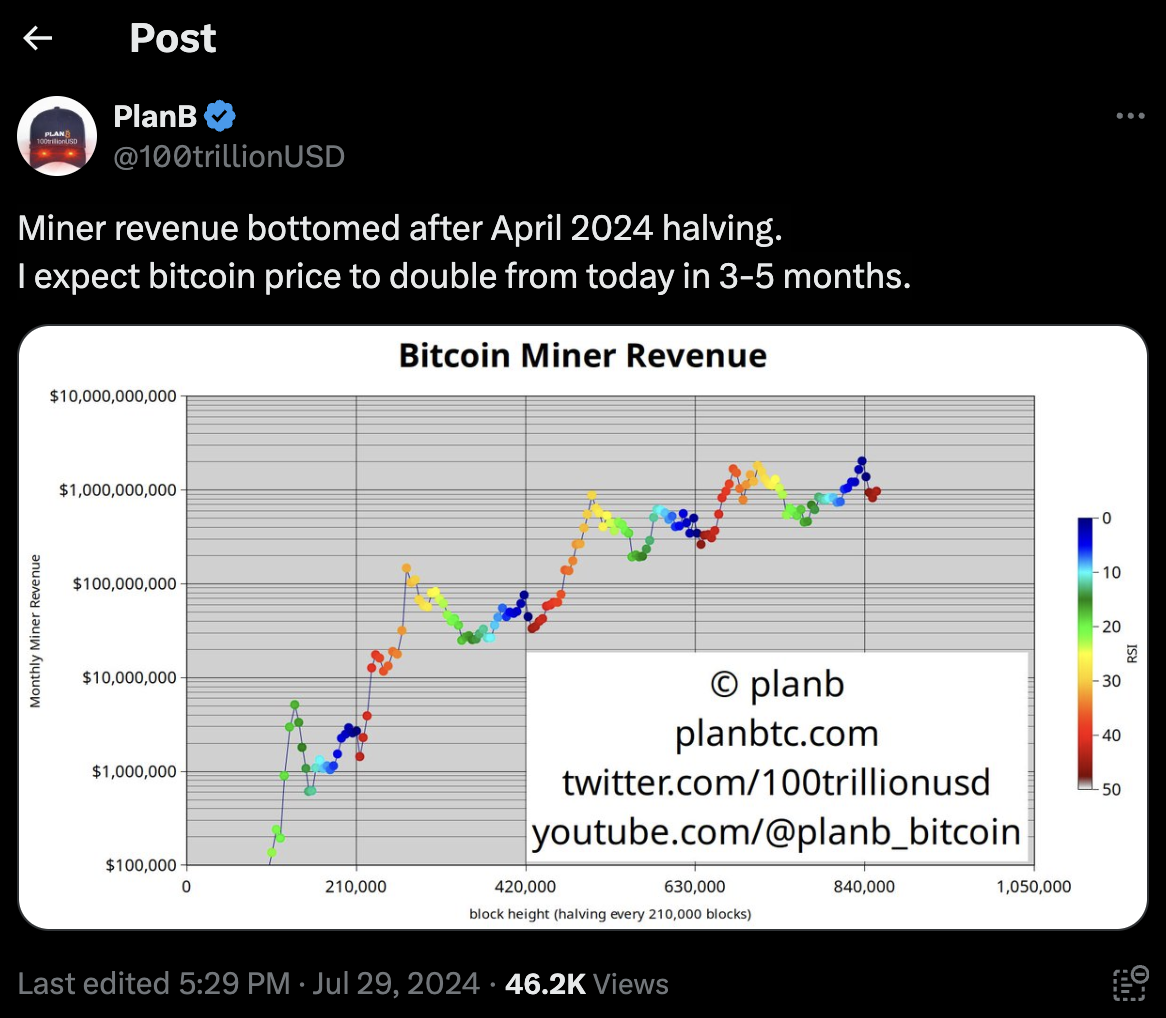

- Bitcoin price is expected to double in the next three to five months, says analyst.

- Ripple lawsuit could end this week with a final ruling from Judge Analisa Torres.

- The launch of Ethereum ETF attracted $2.2 billion in inflows, Bitcoin inflow capped at $519 million last week.

Bitcoin, Ethereum, XRP updates

- Bitcoin trades close to $70,000 early on Monday as BTC investment products garnered an inflow of $519 million, per CoinShares digital asset report.

- Bitcoin inches closer to $70,000 as Donald Trump says SEC Chair Gary Gensler will be fired.

- Ethereum ETFs recorded $2.2 billion in inflows in the first week of trade. Ether struggles under key resistance at $3,500. Solana outperformed Ether in several metrics, per Solana Floor data.

- Ripple lawsuit could end before July 31, a ruling by Judge Analisa Torres is anticipated. XRP hovers above the psychologically important $0.60 level. Ripple update: What to expect from XRP and Ripple lawsuit this week

Chart of the day

LTC/USDT daily chart

Litecoin (LTC) broke out of its downward trend on July 16. The altcoin is currently rallying towards the Fair Value Gaps (FVGs) between $76.77 to $78.63 and $80.16 to $84.16. Litecoin could extend gains by over 11% to $84.83, the 50% Fibonacci retracement level of the decline between the April 1 top of $112.80 and the July 5 low of $56.86.

LTC could find support at $66.42, the July 11 low for Litecoin.

Market update

- Bitcoin influencers slam Senator Cynthia Lummis for suggesting that “excess” bank reserves be used to buy BTC.

A thread on some issues raised by @SenLummis's proposal, so far as I'm able to understand it. https://t.co/Qef3MhNpPB

— George Selgin (@GeorgeSelgin) July 29, 2024

- Aptos approaches $1 billion in total value of cryptocurrencies locked (TVL), top 10 projects ranked by TVL growth in the past thirty days.

Top 10 Projects on Aptos by 30D TVL Growth @Aptos TVL has reached $985 million and is approaching $1 billion.@TruFinProtocol +101%@EchelonMarket +70.6%@AriesMarkets +69.2%@CellanaFinance +17.2%@superp_fi +16.9%@PancakeSwap +13.8%@ThalaLabs +13.6%@AmnisFinance +7.5%… pic.twitter.com/2LgZTHuNCI

— CryptoRank.io (@CryptoRank_io) July 29, 2024

- Solana left Ethereum behind in 24 hours decentralized exchange (DEX) volume, active addresses, fees and revenue generation per data from Solana floor on X.

BREAKING BIG: Solana now tops Ethereum in 24H DEX volume, active addresses, fees, and revenue generation. pic.twitter.com/nMezlu2Jzv

— SolanaFloor (@SolanaFloor) July 29, 2024

Industry update

- Hong Kong lawmaker follows Donald Trump in proposing strategic Bitcoin reserve.

- DePIN emerges as a key narrative this cycle with over $20 billion in market capitalization.

DePIN is emerging as a key narrative of this cycle, with a market cap of over $20 billion!

— IntoTheBlock (@intotheblock) July 29, 2024

Today, we’re focusing on @iotex_io , a layer 1 blockchain optimized for DePIN projects. pic.twitter.com/Nm1lqcKBkV

- A dormant Bitcoin wallet holding 37 Bitcoin worth $476 in 2012 was activated after nearly 11.8 years, and the BTC is worth over $2.5 million.

A dormant Bitcoin wallet holding 37 BTC (worth 476 USD in 2012) has been activated after 11.8 years.

— Onramp.money (@onrampmoney) July 29, 2024

$476 -> $2.5M pic.twitter.com/FjsryVHa5F

- Crypto Fear & Greed Index is at a score of 74 out of 100, nearing "extreme greed" levels, this is similar to levels seen previously in June 2024.

Crypto fear and greed index

- Analyst behind the X handle @100trillionUSD predicted Bitcoin price could double in the next three to five months, in a recent tweet.

Plan B tweet on Bitcoin

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.