Gold rebounds above $3,670 as dip buyers step in despite firm US Dollar

- Gold bounces from weekly lows near $3,630, trades at $3,668 in North American session.

- Bullion bulls ignore strong US Dollar, high US Treasury yields.

- Swiss exports to US collapse on tariff confusion, but China and India demand surged, underpinning Bullion.

Gold price reverses its course on Friday after printing back-to-back bearish session, rises over 0.69% despite overall US Dollar strength across the board. Buyers emerged near the lows of the week at around $3,630 and drove the non-yielding metal higher. The XAU/USD trades at $3,670 during the North American session.

XAU/USD recovers after Fed cut, outlook buoyed by low-rate environment and resilient Asian demand

Bullion is recovering ground on Friday, following the decision by the Federal Reserve (Fed), which cut rates by 25 basis points and laid the path for two additional rate cuts toward the end of the year. Nevertheless, Fed Chair Jerome Powell's press conference was perceived as hawkish as he said that the reduction is a “risk-management cut,” and failed to say that tariff inflation is “transitory.”

Nevertheless, the outlook for non-yielding metal looks promising as it tends to perform well in low interest rate environments.

Swiss Gold exports to the US in August tumbled 99% after the US Customs & Border Protection revealed that bars would be subject to tariffs. The White House then backpedaled on that matter, and the exemption was formalized in early September.

Nevertheless, China came to the rescue as shipments more than tripled in August from 9.9 tonnes to 35, its highest level since May 2024, while exports to India rose as well.

Daily market movers: Gold surges amid strong US Dollar

- The US Dollar Index (DXY), which tracks the buck’s performance against a basket of six currencies, is up 0.26% at 97.61.

- US Treasury yields are rising steadily with the 10-year Treasury note up two and a half bps at 4.137%. US real yields surged almost three bps to 1.757%.

- Minnesota Fed President Neel Kashkari said he supported this week’s rate cut, citing rising risks to employment as justification for action. He argued it is unlikely that tariffs will push inflation much above 3%. He added that if the labor market strengthens and inflation rises further, the Fed should pause on additional easing. He also noted he remains open to raising rates again should economic conditions warrant.

- Fed Governor Stephen Miran said that he was the one that voted for a 50 bps cut and with the lower dot in the “dot plot.” He said that the economy should have an interest rate not too far from the neutral rate now. He added that he will announce a review on his views on Monday.

- Next week, the US economic docket will feature S&P Global Flash PMIs, Durable Goods, Jobless Claims, GDP data and the release of the Fed’s favorite inflation gauge, the Core PCE. Alongside this, a flurry of Fed officials will hit the media.

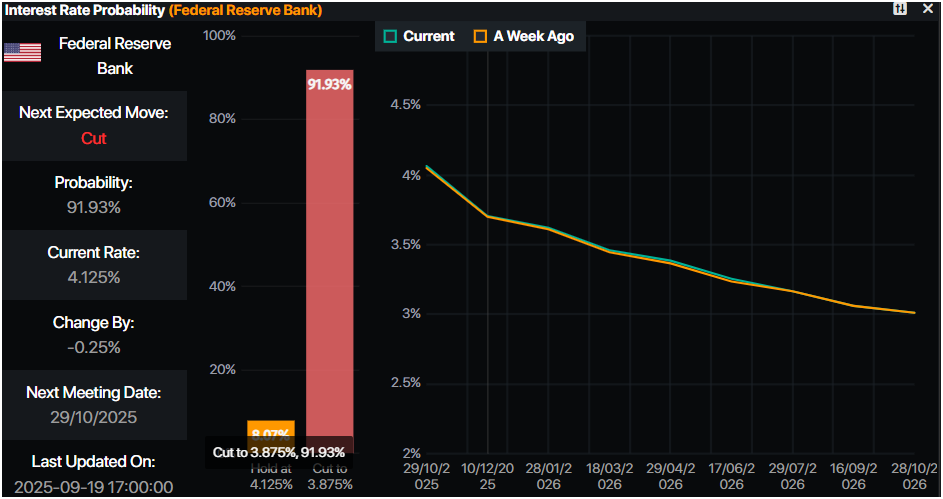

- Money market futures expectations for the October 29 meeting are at 91% for a 25-basis-point rate cut, revealed by the Prime Market Terminal interest rate probability tool.

Source: Prime Market Terminal

Technical outlook: Gold price uptrend resumes above $3,650

Gold price uptrend resumes with the yellow metal climbing back above $3,670, opening the door for a test of the record high of $3,703. It is worth noting that the Relative Strength Index (RSI) bounced off the 70 overbought territory, hinting that bulls are gathering traction.

In that outcome, the next key resistance levels would be $3,750 and $3,800. Conversely, if XAU/USD tumbled beneath $3,650, this clears the path to challenge the September 11 low at $3,613, and the $3,600 mark.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.