Palantir Q3 Earnings Preview: Will Another 50% Growth Beat Continue Its Run of Defying Expectations?

TradingKey - Palantir (PLTR), the defense-focused AI software company, will report its Q3 2025 earnings after market close on November 3. Despite a 165% year-to-date surge in its stock price and persistent concerns over sky-high valuation, Wall Street expects Palantir to deliver another quarter of ~50% revenue growth, reinforcing its premium and silencing skeptics. With deepening defense partnerships and accelerating enterprise AI adoption, long-term momentum appears strong.

According to Seeking Alpha, analysts forecast:

- Revenue: $1.09 billion, up 50.24% YoY

- EPS: $0.17, up 70% YoY

If confirmed, this would mark:

- The second consecutive quarter above $1 billion in revenue

- A beat against Palantir’s own guidance of $1.083–1.087B

- An acceleration from Q2’s 48% growth and last year’s Q3 30%

Dual Engine: Defense & Commercial Growth

Palantir specializes in big data analytics and artificial intelligence, serving government agencies — especially the U.S. Department of Defense — and enterprise clients with platforms for data integration, analysis, and decision-making.

Its business is built on four core platforms:

- Gotham: Defense intelligence and decision support for government

- Foundry: Data integration and business intelligence for enterprises

- Apollo: Software deployment and management infrastructure

- AIP (Artificial Intelligence Platform): LLM-integrated AI platform

Launched in 2023, AIP has become the central growth driver amid the AI boom.

While labeled a “defense + AI” play, Palantir is rapidly evolving into a broad-based AI data provider with balanced commercial expansion.

In Q2:

- Government revenue: $553M (+49% YoY), 55% of total

- U.S. commercial contracts: +93% YoY, +20% QoQ → $306M

- Commercial revenue: $451M (+47% YoY), 45% of total

- U.S. government contracts: +53% YoY, +14% QoQ → $426M

Per Zacks Investment, Q3 forecasts are:

- Government revenue: $602.53M (+47.6% YoY)

- Commercial revenue: $493.66M (+56% YoY)

Deepening Defense Ties, Expanding Commercial Reach

From July to September, Palantir solidified its role as a core defense intelligence partner. In August, the U.S. Army awarded a 10-year, $10 billion contract to Palantir for digital transformation — a major validation of its strategic importance.

In September, Palantir announced a landmark partnership with Boeing, integrating its AI platform across Boeing’s Defense, Space & Security division. This marks the first large-scale entry of an AI software firm into core military manufacturing processes.

Analysts see this not just as a commercial deal, but as proof that AI is evolving from an efficiency tool into a central decision-making system in defense and space industries.

At NVIDIA GTC 2025 last month, Nvidia announced a deep collaboration with Palantir, integrating its GPU-accelerated computing, open-source models, and data pipelines into Palantir’s AIP Ontology system.

Some analysts say the Boeing deal confirms Palantir’s shift from a niche government contractor to a mainstream AI operating system provider, while the Nvidia tie-up accelerates its expansion into industrial verticals.

Dan Ives, Wedbush analyst, said that Palantir is on the ‘Golden Path’ — and could be the next Oracle.

He highlighted new partnerships with Snowflake and Nvidia as key catalysts, driving more enterprise AI deals. With broad AIP adoption and rising demand across sectors, he projects U.S. commercial revenue growth of over 85% in FY2025.

Growth Crushes Peers — Justifying Sky-High Valuation?

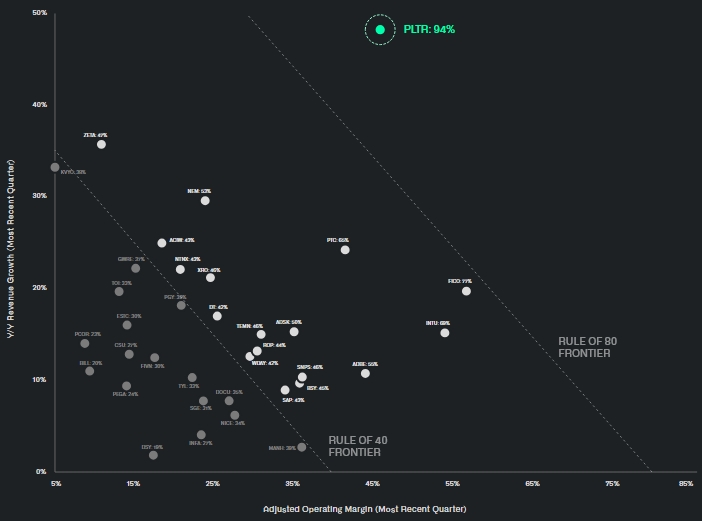

The “Rule of 40” — where a healthy SaaS company’s revenue growth rate plus profit margin should equal or exceed 40% — is a benchmark for high-growth software firms.

Palantir dominates this metric:

- Q2 Rule of 40 score: 94% — the only major software company above 80%

- Far ahead of peers: Adobe (55%), Synopsys (46%), SAP (43%)

Palantir’s Rule of 40, Source: Q2 2025 Earnings Report

This momentum shows no signs of slowing. Analysts expect Q3 revenue growth above 50%, far outpacing recent results from peers including Strategix(+10.9%) and Confluent (+19.3%).

Year-to-date, Palantir shares have surged over 165%. The rally has pushed its PE ratio to a staggering 666.23x, making it the most expensive stock in the S&P 500. Its forward PE of 231x dwarfs leaders like Crowdstrike (122x), Datadog (72x), Palo Alto (56x), and AppLovin (48x).

Analysts note that Palantir must sustain 50%+ revenue growth for at least four more years to bring its P/E down to typical tech levels. In other words, 50% growth is now the baseline for justifying its valuation.

CEO Alex Karp addressed valuation concerns last quarter, stating that they’ve invested for years, faced ridicule — but their growth has accelerated. Skeptics have either left or been proven wrong.

He added that AI breakthroughs are fueling their climb — it’s steep and upward. Their growth is unprecedented. They aim to be the dominant software company of the future — and the market is starting to realize it.”

Stock Outlook and Risks

Per TradingKey, the average analyst target price is $154.93 — about 23% below current levels, reflecting widespread belief that the stock is overvalued.

Of 26 analysts covering PLTR:

- 3 “Sell” ratings

- ~65% hold at “Hold” — indicating cautious standing

Despite high risk, Palantir has consistently beaten expectations — EPS has met or exceeded consensus in 11 straight quarters.

Palantir EPS History, Source: SeekingAlpha

In the past four post-earnings sessions, the stock rose three times (gains of 7.85% to 23.99%), though it fell 12% after Q1 2025 results.

Citi analysts said strong government demand and a growing commercial pipeline support near-term growth — but warned that sky-high valuation and limited visibility into mass enterprise adoption remain key risks.

They expect AI-driven contracts to sustain revenue growth, but emphasize monitoring execution and margin trends.

Notably, Cathie Wood’s ARK Invest has reduced its stake in Palantir, selling shares in August and October — drawing market attention.