Is Alibaba Stock a Warren Buffett-Worthy Investment?

Key Points

- Alibaba's P/E ratio could make the stock attractive to some value investors.

- Buffett's business partner, the late Charlie Munger, was once an Alibaba investor.

- Political risks may have deterred some investors.

- 10 stocks we like better than Alibaba Group ›

A cursory inspection might make some investors wonder why Warren Buffett and his company, Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), have never taken a position in Chinese tech conglomerate Alibaba (NYSE: BABA). It's the leading e-retailer in China and has many similarities to Berkshire-holding Amazon, possibly making it a logical choice.

Buffett and his team often make unexpected investment decisions, and investment proposals often fall through upon closer inspection. Nonetheless, researching whether one can view Alibaba as a "Buffett stock" could provide valuable insights on whether average investors should take a position in it.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Alibaba Group.

Why Alibaba might look like a fitting Buffett holding

At first glance, Alibaba has many attributes that would draw an investor like Buffett. As mentioned before, it's the e-commerce industry leader in one of the world's largest countries.

An investor like Buffett can buy the stock at a considerable discount. For one, it sells at a price-to-earnings (P/E) ratio of just 17. That is far below Amazon, which trades at 35 times earnings, or Alibaba's counterpart in Latin America, MercadoLibre, which trades at 61 times earnings.

Looking at its financials, revenue for the first quarter of fiscal 2026 (ended June 30) was just under $35 billion. That 2% yearly increase lagged the 6% rise in fiscal 2025 (ended March 31) and has slowed from historical growth levels.

Still, in fiscal Q1, Alibaba earned $5.9 billion in net income, up 76% annually. That and the 77% yearly profit increase in fiscal 2025 make its P/E ratio seem extremely inexpensive.

Moreover, Buffett's team has not had an aversion to investing in foreign stocks, including those in China. It once owned and may still own BYD, though it no longer has to disclose that holding. Other non-U.S. stocks it owns include alcohol company Diageo and Irish consulting firm Aon Plc.

Investors should also note that Buffett's longtime business partner, Charlie Munger, was an Alibaba investor in 2021, likely for some of the reasons above.

Alibaba may not be "Buffett worthy" for these reasons

However, Munger quickly decided the Alibaba holding was a mistake. He later described the investment as "highly competitive." Munger also came to see Alibaba and Chinese stocks in general as risky when he saw how the Chinese authorities reacted to some of Alibaba co-founder Jack Ma's comments. As a result, his fund began selling shares.

Indeed, since American investors can't legally own Chinese stocks, they must buy an American depositary receipt (ADR), a holding company linked to Alibaba, to invest in the stock. Still, the risks extend well beyond that.

In 2021, the Securities and Exchange Commission (SEC) investigated Chinese companies, threatening to delist them if they didn't provide greater financial transparency. Ultimately, the SEC reached an agreement with these companies, but that threat has reemerged in recent months, highlighting the risks associated with owning Chinese stocks.

What's more, Buffett had an adverse reaction in 2022 when his lieutenants bought shares of Taiwan Semiconductor. Buffett reversed that decision quickly, citing geopolitical fears related to China.

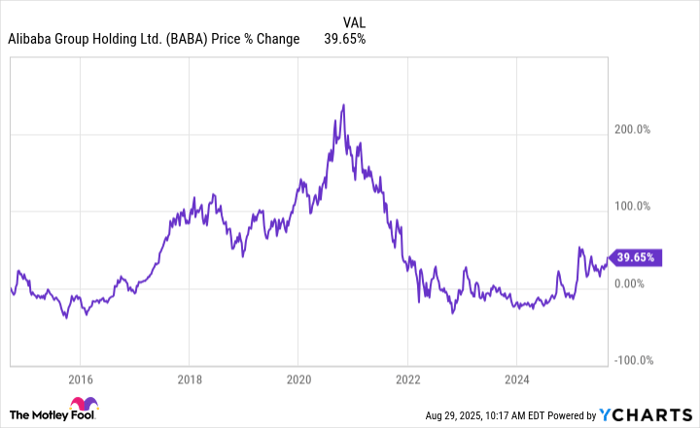

In a sense, that's a strange reaction, since Berkshire owns or has owned BYD shares, and China is the No. 1 manufacturing hub of its largest holding, Apple. Hence, one would have to assume that Berkshire stock would drop significantly if the U.S. cut all ties to China. Nonetheless, these risks highlight the dangers of investing in China and may explain why the stock has only risen 40% since it began trading on U.S. exchanges 11 years ago.

Is Alibaba stock "Buffett worthy?"

Considering the state of Alibaba, Buffett is unlikely to take a stake in this company, and that indicates it's probably not a suitable choice for the average investor.

Indeed, Alibaba seems to offer the type of growth that Buffett's team looks for in a stock, and the 17 P/E ratio likely makes it a tempting buy.

However, the complications with dealing with China and its government's tenuous relationship with Jack Ma add to the risks of owning Alibaba. Those factors also likely explain the relatively slow growth of the stock over the last 11 years. Given those conditions and its past performance, Alibaba is probably not the "Buffett stock" it initially appears to be.

Should you invest $1,000 in Alibaba Group right now?

Before you buy stock in Alibaba Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alibaba Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $651,599!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,067,639!*

Now, it’s worth noting Stock Advisor’s total average return is 1,049% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of August 25, 2025

Will Healy has positions in Berkshire Hathaway and MercadoLibre. The Motley Fool has positions in and recommends Amazon, Apple, Berkshire Hathaway, MercadoLibre, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Alibaba Group, BYD Company, and Diageo Plc. The Motley Fool has a disclosure policy.