Seth Klarman Portfolio

TradingKey - Seth Klarman, the Baupost value investor, long had the distinction of navigating doubt with surgeon-like precision. The technique is married to asymmetric bets, deep margin-of-safety work, and, of course, in many cases, a dash of contrarian genius.

Baupost’s latest positioning of its book is more than a glimpse into how Klarman is coping with an evolving macro and valuation environment, is a signpost of where he is thinking the superior risk-adjusted returns can be had.

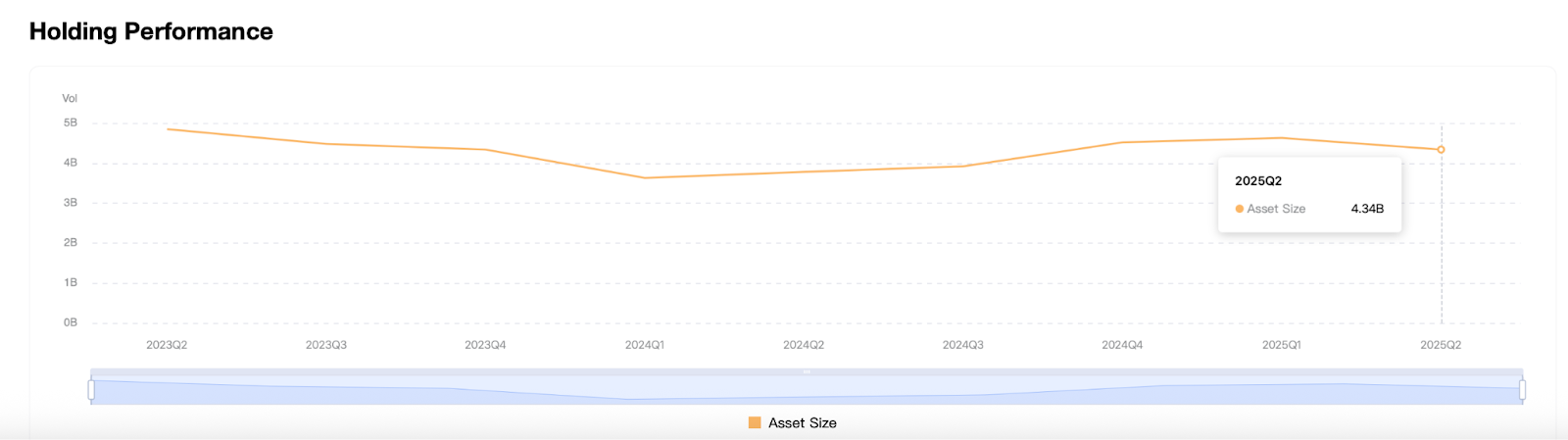

Let’s decompose his $4.34 billion portfolio in Q2 2025 through four main prisms: sector positioning, portfolio concentration, recent trade activity, and underlying strategy development.

Sector Shifts: From Dominance to Diversification

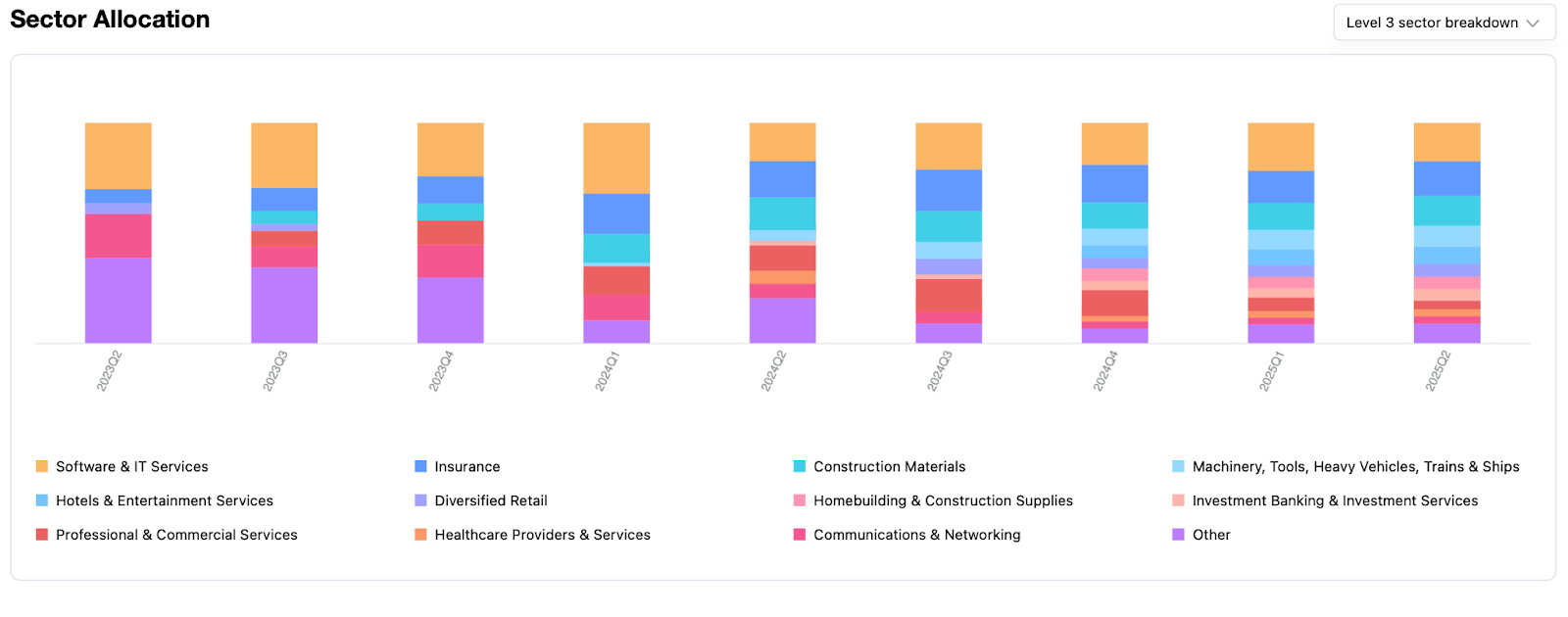

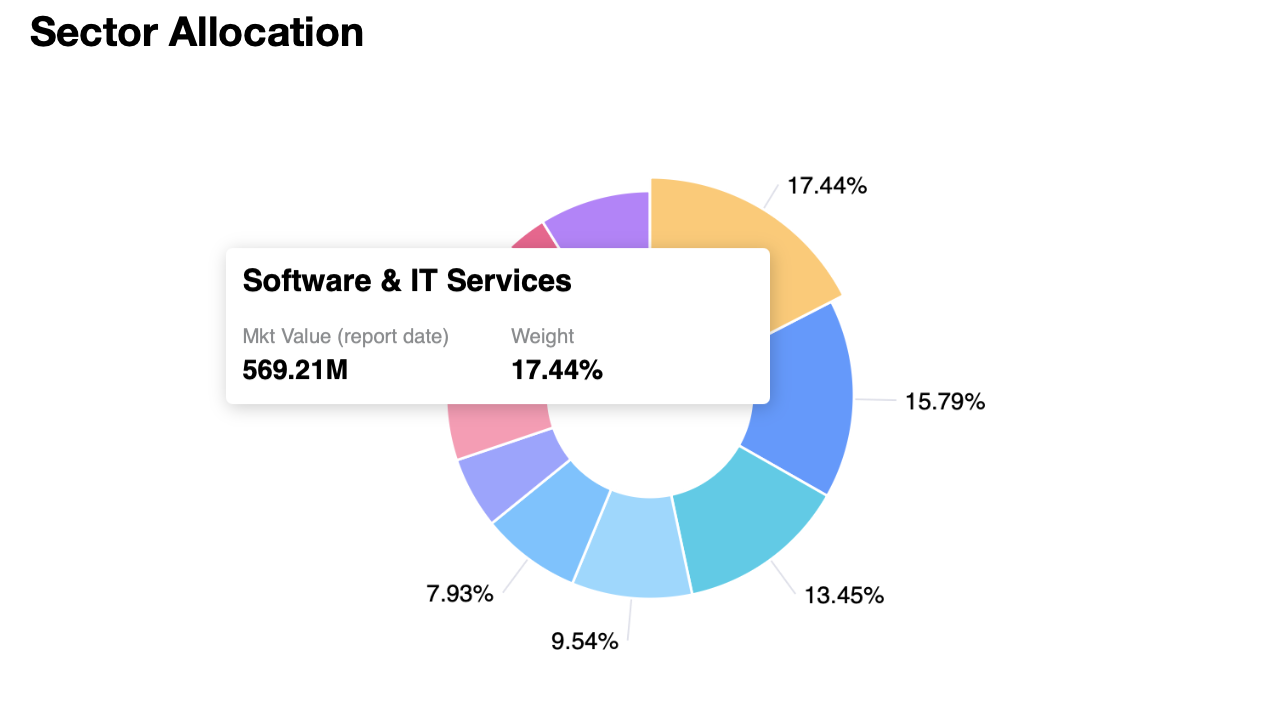

Previously, Klarman had made bets on concentrated sectors, on media, health care, and software. However, sector allocation of Baupost had moved modestly in the last year. Now while Software & IT Services remains at the peak weight of 17.44% ($569M approx.), sector exposure of the company is more diversified.

A quarter-to-quarter comparison reflects the intentional decline of mid-2023 top holdings Diversified Retail and Healthcare Providers. Software, Insurance, and Construction Materials were in motion by Q1 2024. The current top five industries, Software, Insurance, Construction Materials, Machinery, and Financials, encompass combined holdings of over 65% of the portfolio, reflecting greater diversification.

Significant is the shift in rotation as opposed to composition. Baupost reduced holdings in usually noisy industries such as Communications & Networking and Retail, in favor of more defensible, cash-generating industries such as Insurance (15.79%) and Construction (13.45%). It is a sign of being more cautious with a value bias, possibly looking through macro headwinds, pressure as a result of inflation, or rate stability lasting long-term.

Strength of the Few through Concentration and Strong Beliefs

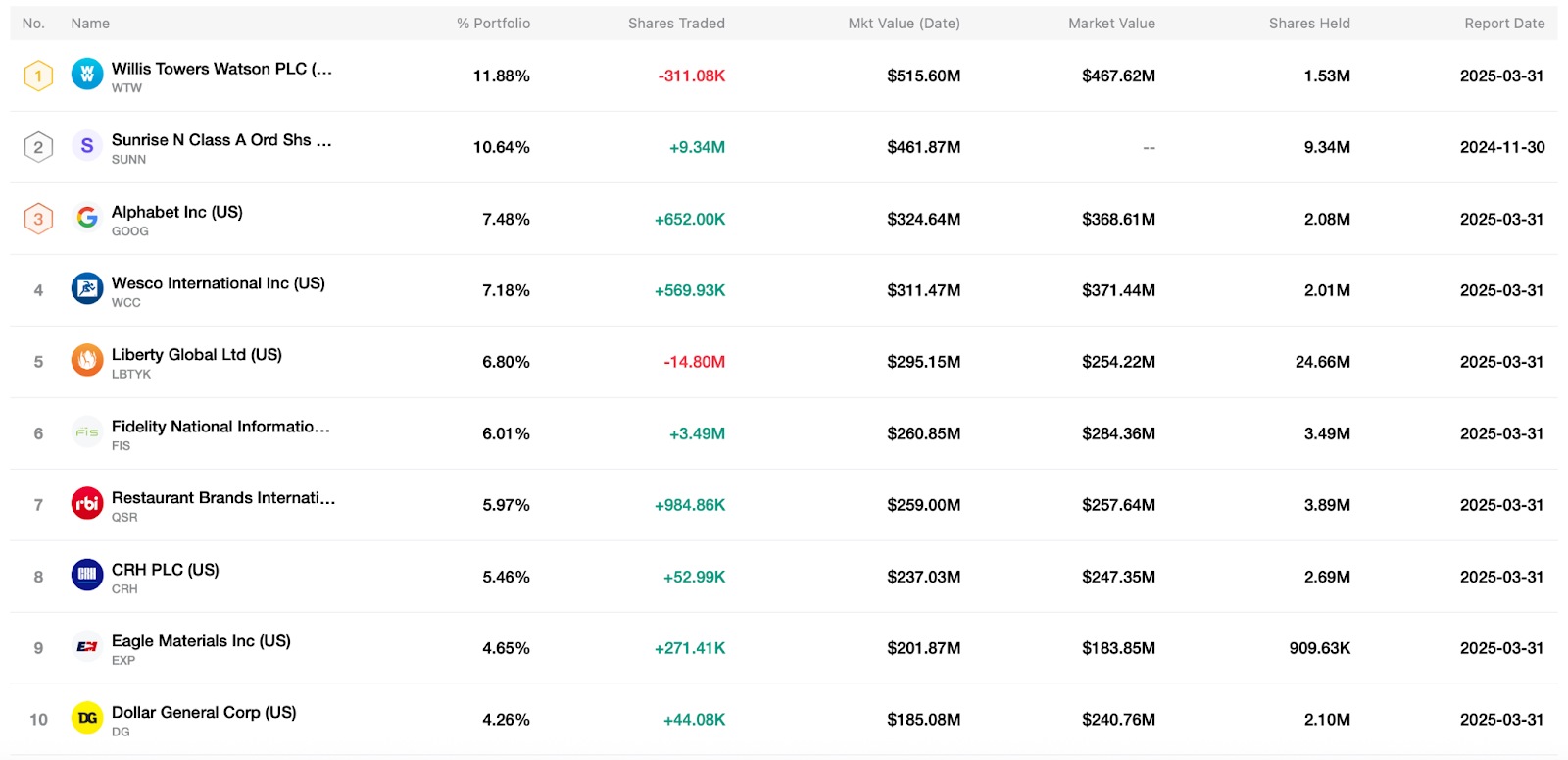

Even with diversifying sector exposure, Klarman remains a high-conviction manager. The top 10 holdings alone account for over 70% of the entire portfolio, not unusual for his style, where capital is focused where risk-reward is tilted most.

At the top of the list is Willis Towers Watson (WTW) with 11.88%, having lost 311,000 shares. With a market cap of $467M, it’s a defensive compounder with predictable free cash flow and relatively low cycle sensitivity, all of Baupost’s core holdings criteria.

Next is Sunrise Communications (10.64%), whose valuation data is quite outdated. The magnitude of the position, 9.34 million shares, reflects very high conviction, which is presumably motivated by structural telecom infrastructure and residual cash flows. The third-biggest position is that of Alphabet at 7.48%, recently added 652,000 shares by Baupost, presumably in recognition of recovering margin possibilities and rising monetization tailwinds of AI.

Some other interesting holdings include Wesco (7.18%), Liberty Global (6.8%), and a new large position in Fidelity National Information Services (6.01%), all of which once again reflect Baupost’s tilt towards infrastructure, transaction-processing, and platforms with intrinsic pricing power.

Such tiered attention tells you much. Such diversification is diversification around moats. And each of those top holdings exhibits pricing power, recession resistance, or monetization lock-in.

Trade Activity: Exits, Rotations & Tactical Bets

Recent quarter action within Q1 2025 is a good illustration of the Klarman playbook in action. Baupost declined substantially on seven holdings such as Clarivate (-70.2), Rentokil (-48.8), and Just Eat Takeaway (-63), and assumed fresh exposure in businesses with fitter cash flows and neater balance sheets.

Significant increases include Fidelity National Information Services, whose ownership went up by 3.49 million shares. As an enablement fintech foundation of merchant commerce and core banking functionality, it falls very much in the mold of infrastructure-like businesses that Klarman likes, as being long-term, deeply ingrained, and structurally margin-accretive. Its recurring revenue profile and business resilience give the kind of defensiveness that falls very much within Baupost’s risk-averse framework.

One of the more interesting additions is SGI, a relatively unknown name, with 703,000 shares. Not showy, it’s likely an intentional small-cap bet within an extremely defined vertical, perhaps undercovered or mispriced. The fairly modest size and niche-centric profile suggests it’s an intentional strategic bet as it is looking at unrecognized upside within a niche vertical.

Alphabet also recorded a 652,000-share gain, signaling a potentially opportunistic trade by Baupost. The transaction is being attributed to recent valuation retreat, as well as long-term upside possibilities Klarman may view within Alphabet’s AI monetization stacks. It rotated capital, harvested profits in bubbly industries, and shifted into margin-of-safety plays, all textbook Klarman.

Q2's modest-to-moderating asset growth can be deliberate, an investment call generating cash, accumulating dry powder, or repricing underperforming high-conviction holdings. In fact, such stability in the midst of general volatility is discipline, not indecision.

Final Thoughts: It's the Long Game for Klarman, Played Quietly

It is not a flashy 2025 book by Seth Klarman, and that is the strategy. It is an indicator of risk-weighted capital allocation master class. With sector weightings reweighted back towards sheltered-by-inflation industries, high-conviction holdings held or added, underperforming holdings cut or sold, Baupost is positioning for the world of slower growth, higher volatility, and selective opportunity. Investment bets on optimism rather than on smugness.

The firm's lean towards stocks with such names as FIS, Alphabet, and Wesco is an indicator of attempts at intrinsic infrastructure and monetization predictability. The high-beta play repricing and richly valued disruptor play is an indicator of the fact that Klarman is okay with sacrificing near-term fads in favor of long-term compounding.