Post-NFP Shocker: What It Means for Your Portfolio

TradingKey - The latest data from the U.S. Bureau of Labor Statistics delivered a wake-up call. Job gains from the prior two months were revised down by 258,000 — a surprisingly large downgrade. This raises a difficult but important question: in the face of rising tariffs, was the “resilient” labor market narrative simply a case of statistical distortion?

Let’s look at the breakdown of recent job creation. The U.S. added just 73,000 new jobs in July — and virtually every one of those came from healthcare and social assistance. While these sectors typically show steady growth due to demographic trends like population aging, they’re also lower productivity areas. Growth here tends to be automatic and doesn’t really tell us much about the real strength of the labor market.

Outside of these sectors, things were far less encouraging. As Bloomberg’s Matt Boesler pointed out, if you exclude healthcare, net job growth over the last three months was negative in May and June — down 53,000 and 45,000 jobs respectively — and essentially flat in July with a loss of 300 jobs.

Meanwhile, tech stocks continue to capture the spotlight. Meta, for example, saw its market cap soar by nearly $200 billion in a single session after its earnings beat consensus. But when it comes to hiring across the tech industry, the story isn’t nearly as upbeat. Outside of a few megacap winners in the AI space, employment prospects remain soft. Microsoft — one of the big beneficiaries of the AI boom — has enjoyed sharp growth in cloud revenue this year, but it too continues to lay off staff.

Simply put, we don’t see widespread expansion across the real economy. Even the Federal Reserve acknowledged this shift at its July FOMC meeting, revising its language from saying economic activity was “expanding at a solid pace” to “growth moderated in the first half of the year.” That’s a notable change — and an implicit confirmation that the U.S. economy is losing steam.

At the same time, inflation isn’t letting up. The Fed’s preferred measure — the core PCE index — rose 0.26% month-over-month in June, which equates to an annualized pace of 3.2%. That still sits well above the Fed’s long-term target of 2%.

While U.S. authorities have made some progress in recent trade negotiations — with potential longer-term benefits like boosting domestic manufacturing — near-term effects from tariffs are inflationary. The cost burden continues to fall on U.S. consumers, who are already feeling the squeeze. This suggests that inflationary pressures are likely to persist in the coming quarters.

Once a buzzword of the past, “stagflation” — slow growth with persistent inflation — may well be moving back to the center of the market conversation.

U.S. Stocks: As Rate-Cut Optimism Builds, Valuations Are Getting Out of Sync With Fundamentals

Markets have grown increasingly convinced that the Federal Reserve is preparing to cut rates — as soon as September, according to current pricing. That belief has lit a fire under risk assets, with lower rates serving as the dominant bullish narrative.

However, investors should be cautious not to overlook growing cracks in that story.

So far this earnings season, the major U.S. tech names have generally delivered. Even Apple, which had received subdued expectations leading up to its report, managed to beat consensus. But interestingly, many stocks didn’t see much of a rally even after these solid results.

Why? Much of the optimism was already priced in.

We’ve entered a phase where markets are no longer rewarded simply for meeting — or even beating — expectations. Instead, earnings beats are being met with muted responses, or in many cases, outright profit-taking. That’s what you often see when gains are driven more by anticipation than by follow-through.

This disconnect is clear in the numbers. According to Goldman Sachs, 327 companies in the S&P 500 — roughly 69% of the index — have reported results. And 63% of those beat analyst estimates, the highest beat rate in 25 years. Despite that, prices haven’t moved much — or at all — for many of these names.

Looking ahead, corporate fundamentals could face new pressures. Tariffs may increase production costs further, and many firms will likely respond by raising prices to protect margins. But doing so could end up hurting consumer demand — which would pose risks to revenue and profitability in the second half.

U.S. Bond Market: Steepening Yield Curve Trades Return

While equities are struggling with valuation risk, the bond market has been far more responsive to shifting rate expectations. Steepener trades — where investors bet that long-term yields will rise while short-term yields drop — have made a strong comeback.

Last Friday, trading volume in U.S. Treasury futures surged to about three times the average daily level, reflecting growing confidence in this strategy. The yield spread between 2-year and 30-year Treasuries saw its largest one-day move since early April, driven by a sharp adjustment lower in front-end yields.

Adding fuel to the move, the Treasury is set to auction 125 billion of new debt this week, including 67 billion in 10- and 30-year bonds. That much new supply coming to market will likely push long yields higher, extending the current steepening trend.

That said, the long end of the curve still faces structural constraints. Concerns over America’s growing fiscal deficit and long-term debt sustainability continue to weigh on bond sentiment. These issues may keep long yields from falling much, even if the Fed ultimately begins cutting rates.

Where Should Your Portfolio Go from Here?

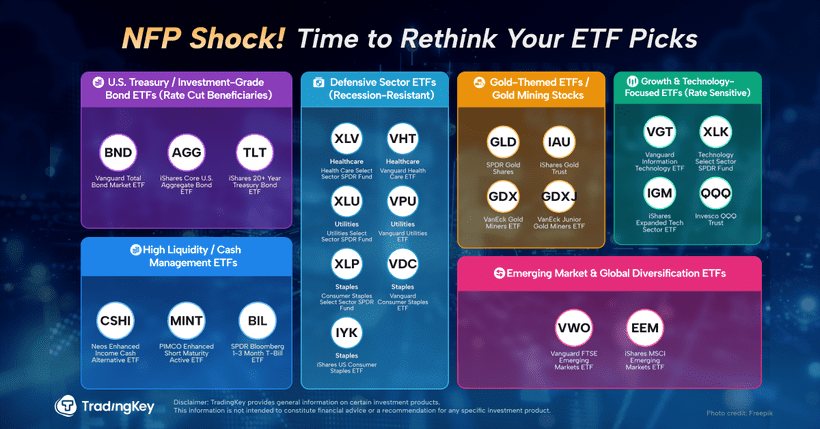

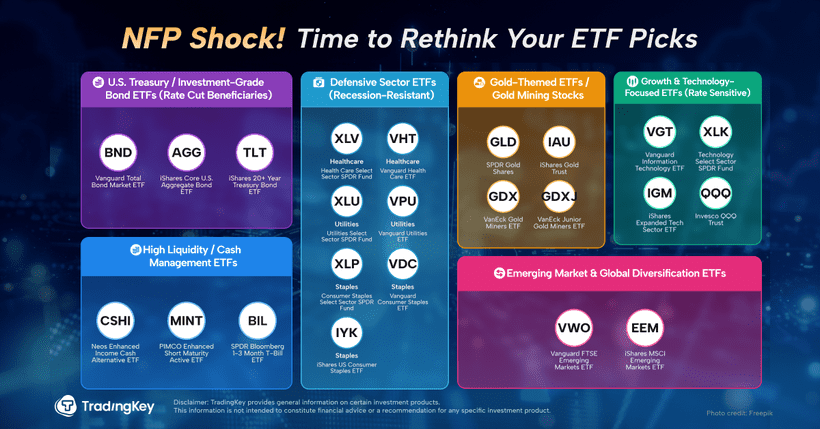

With rate-cut trades back in focus, stagflation concerns rising, and tariff uncertainty lingering, it's time to reassess portfolio strategy. Here are six ETF themes to consider in today’s environment:

1. Treasuries & Investment-Grade Bonds Falling yields are boosting bond prices. For capital preservation with lower risk, consider:

- Vanguard Total Bond Market ETF (BND)

- iShares Core U.S. Aggregate Bond ETF (AGG)

- iShares 20+ Year Treasury Bond ETF (TLT)

2. Gold & Gold Miners In a high-inflation, low-growth world, gold regains its role as a hedge. Miners offer higher upside when gold rallies. Watch:

- SPDR Gold Shares (GLD)

- iShares Gold Trust (IAU)

- VanEck Gold Miners ETF (GDX)

- VanEck Junior Gold Miners ETF (GDXJ)

3. Defensive Sectors: Healthcare, Utilities, Staples Stable earnings and consistent demand make these sectors resilient in weak economic cycles. Key picks:

- Health Care Select Sector SPDR Fund (XLV)

- Vanguard Health Care ETF (VHT)

- Utilities Select Sector SPDR Fund (XLU)

- Consumer Staples Select Sector SPDR Fund (XLP)

- Vanguard Consumer Staples ETF (VDC)

4. Short-Duration & Cash-Like ETFs For liquidity and low-volatility yield, short-term fixed income tools are ideal. Focus on:

- NEOS Enhanced Income Cash Alternative ETF (CSHI)

- PIMCO Enhanced Short Maturity Active ETF (MINT)

- SPDR Bloomberg 1-3 Month T-Bill ETF (BIL)

5. Tech Growth ETFs Rate cuts support long-duration growth stocks — especially those exposed to AI, cloud, and automation. Consider:

- Vanguard Information Technology ETF (VGT)

- Technology Select Sector SPDR Fund (XLK)

- iShares Expanded Tech Sector ETF (IGM)

- Invesco QQQ Trust (QQQ)

6. Emerging Markets & Global Diversification With U.S. equities richly valued, global diversification helps capture growth and reduce concentration risk. Explore:

- Vanguard FTSE Emerging Markets ETF (VWO)

- iShares MSCI Emerging Markets ETF (EEM)