Tesla Q2 FY2025 Earnings Review: Balancing Short-Term Pressures with Long-Term Autonomy Goals

TradingKey - Tesla, Inc. (NASDAQ: TSLA) released its Q2 FY2025 earnings on July 23, 2025, after the U.S. market close, posting results that missed expectations amid demand challenges and declining revenues in both automotive and energy segments. Following the announcement, Tesla’s stock dropped over 4% in after-hours trading, reflecting investor concerns.

Source: TradingKey

Key Financial Results

Metric | Q2 FY2025 | Q2 FY2024 | Beat/Miss | Change |

Revenue | $22.5B | $25.5B | Miss | -12% |

Adjusted EPS | $0.40 | $0.52 | Miss | -23% |

Total Gross Margin | 17.2% | 18% | N/A | -0.8pp |

Automotive Revenue | $16.66B | $19.88B | Miss | -16% |

Energy Storage Revenue | $2.79B | $3.01B | Miss | -7% |

Services and Other Revenue | $3.05B | $2.61B | Miss | +17% |

Source: Tesla, TradingKey

Guidance & Conference Call

· Q3 2025 Guidance: Tesla projected revenue of $23.0B–$24.5B, slightly above consensus estimates of $22.8B, with automotive gross margins expected to stabilize around 15%. The company anticipates continued growth in energy storage, targeting 10–12 GWh of deployments.

· Full-Year 2025 Outlook: Tesla refrained from reinstating full-year delivery guidance, citing ongoing trade policy uncertainties and competitive pressures. Management emphasized cost reduction initiatives and progress toward affordable vehicle models.

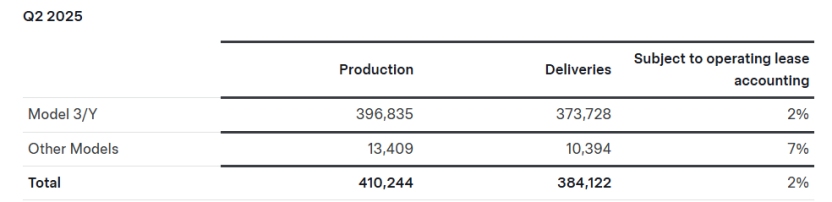

Tesla delivered 384,122 vehicles in Q2, missing estimates by approximately 2%, with notable weakness in China and Europe due to intensified competition from BYD and legacy automakers. Automotive margins contracted due to sustained price reductions and a declining contribution from regulatory credits, which fell 20% YoY. This contributed to a 42% YoY drop in operating income to $0.9 billion, bringing the operating margin down to 4.1%. Despite these pressures, Tesla maintained a strong liquidity position, ending the quarter with $36.8 billion in cash and investments. However, the energy storage segment continued its upward trajectory, deploying 9.6 GWh of Megapack and Powerwall units, bolstering revenue diversification.

Management highlighted strong global performance of the refreshed Model Y, which became the best-selling car in multiple countries. Cybertruck production is ramping but remains well below 10,000 units per month. The company reiterated focus on affordable models with production scale-up expected slower than planned, targeting availability around 2026. Tesla reported continued major improvements in Full Self-Driving software, including plans to increase neural net parameters dramatically. The Robotaxi service launched successfully in Austin with no one behind the wheel, and Tesla is expanding the service area while working toward approvals for nationwide deployment. Optimus humanoid robot development is advancing, with new “Optimus three” prototypes expected by year-end and plans to scale production next year.

Regarding CEO Elon Musk’s recent political engagements, including his role in founding the American Party, management affirmed that Tesla's strategic priorities remain unchanged. Nonetheless, investor concerns persist about possible distractions that could affect operational execution and brand perception.

Conclusion

Tesla’s Q2 FY2025 results confirm the complex challenges of weakening demand, margin compression, and intensifying competition, particularly in automotive sales. Price reductions and shrinking regulatory credit contributions continue to pressure profitability, highlighting near-term headwinds. Yet, Tesla’s strategic shift is clear: accelerating energy storage deployments, advancing Full Self-Driving and robotaxi initiatives, and gearing up affordable vehicle production signal a purposeful move toward a more diversified and innovation-driven model. How effectively Tesla executes these priorities amid regulatory uncertainties and competitive pressures will be crucial not only for sustaining operational momentum but also for maintaining investor confidence and supporting its stock valuation in a volatile market environment.

Tesla Q2 FY2025 Preview: Navigating Demand Challenges and Autonomy Ambitions

TradingKey - Tesla, Inc. (NASDAQ: TSLA) is scheduled to release its Q2 2025 earnings on Wednesday, July 23, 2025, after the U.S. market closes. The company will hold its earnings conference call and webcast at 5:30 p.m. Eastern Time the same day, providing insights into its financial performance and strategic direction.

Market Forecast

.jpg)

Source: Nasdaq, UBS, Tradingkey

.jpg)

Where Investors Should Watch

Tesla's vehicle deliveries in Q2 2025 reached 384,122 units, slightly lower than market expectations. Among them, sales in major markets such as China and Europe have declined significantly, reflecting fierce market competition. At the same time, with the upcoming cancellation of the US federal electric vehicle tax incentives and the possible increase in car purchase costs caused by the tariff policies, consumers' concerns about the safety of autonomous driving continue to exist, and Tesla needs to further strengthen confidence building. Management's comments on demand dynamics and the latest delivery guidance are crucial, especially in the context of the company's earlier withdrawal of its full-year outlook due to trade and policy uncertainties.

Source: Tesla

Margins remain under pressure, with automotive gross profit expected to compress due to sustained price cuts and reliance on regulatory credits, which are set to phase out. In contrast, the energy segment shows growth, with 9.6 GWh of storage deployed in Q2 through Megapack and Powerwall products, providing diversification against automotive headwinds.

Product execution needs to be closely watched, particularly the ramp-up of the refreshed Model Y, the ongoing production of the Cybertruck, and progress toward launching more affordable models. Success in these areas will be key to revitalizing growth.

Long-term prospects increasingly depend on advances in autonomy. Updates on FSD software rollout, progress in robotaxi in Austin, and milestones related to the Optimus humanoid robot are critical indicators of future value creation. With mounting regulatory scrutiny and competition from rivals such as Waymo, delivering tangible progress is essential.

It is also worth mentioning that Musk has been involved in politics more deeply recently and established the American Party, which might also affect the company's strategy and market expectations to a certain extent.

Conclusion

Tesla’s upcoming Q2 2025 earnings report is expected to reveal it navigating significant challenges and critical decisions. Near-term headwinds such as slowing demand, margin compression, and rising competition have challenged its traditional growth trajectory. Going forward, Tesla’s success will rely heavily on effective execution of product refreshes, the rollout of more affordable models, and real-world progress in autonomy and energy solutions. Tesla’s ability to maintain its market position and valuation will depend on steady progress and consistent execution alongside its long-term vision.