Investing in Fintech

- Fintech revenues continue to grow at double-digit rates, outpacing traditional finance and proving its staying power beyond hype cycles.

- The industry’s expansion is driven by digital adoption, AI integration, wealthtech growth, and financial inclusion across global markets.

- Competition is multilayered, with consumer giants, tech titans, and niche disruptors all shaping the landscape.

- Risks remain in valuations, regulation, and macroeconomic sensitivity, but the long-term upside makes fintech one of the most attractive secular investment themes of the next decade.

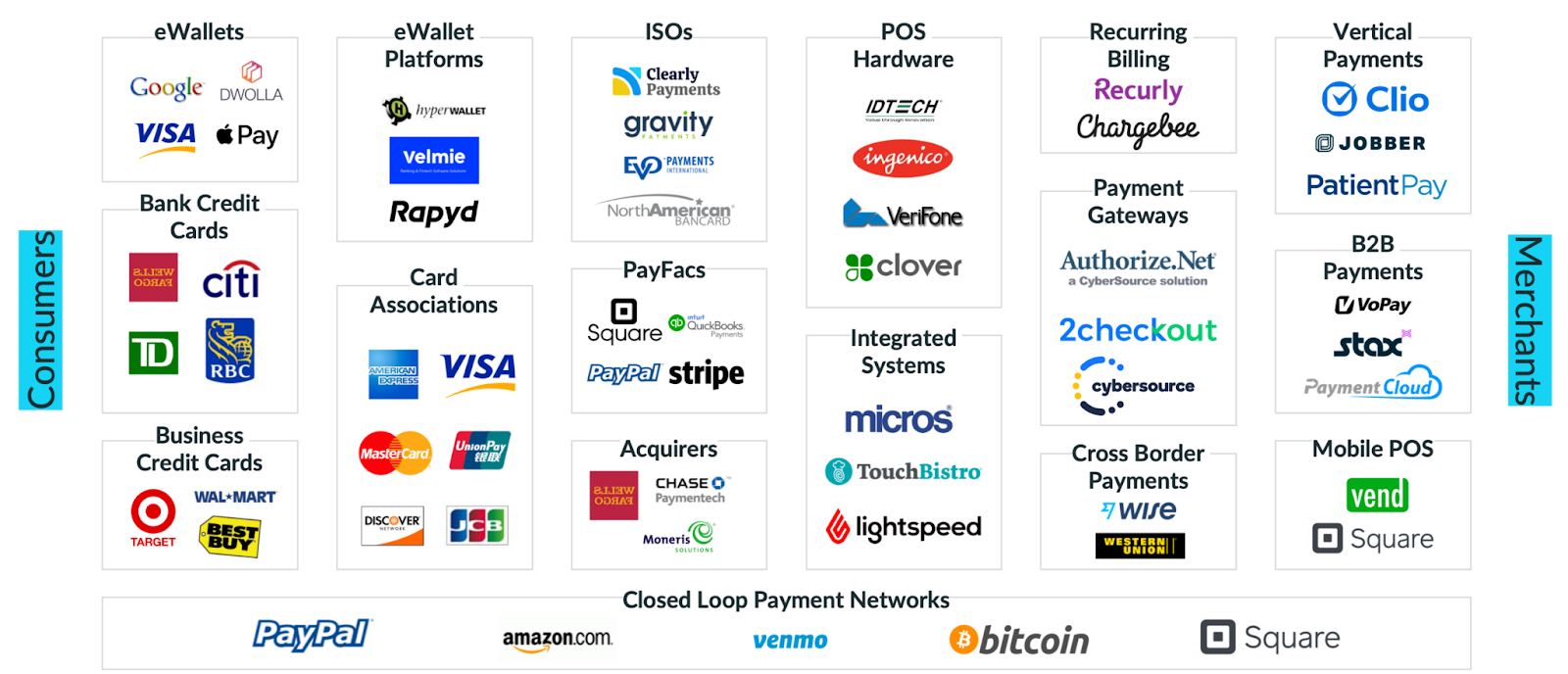

TradingKey - Fintech went from a small sector of experimental apps and payments instruments to a cornerstone of the world financial infrastructure. What was once a group of small startup companies trying to update antiquated bank procedures has transformed into a multihundreds-of-billions-of-dollars industry that touches everything from credit and lending to investing, insurance, and cross-border payments.

The revolution goes deep. Ten years ago, “fintech” literally translated to mobile banking or payments platforms. Today the term encompasses a massive ecosystem: mobile-device wallets, robo-advisers, blockchain platforms, peer-to-peer lending platforms, buy-now-pay-later platforms, and artificial-intelligence-powered systems that operate fraud detection or automated financial planning. Those were once afterthoughts; now they’re the marquee event of the business on which financial services operate.

Even though venture money slowed down after the bubbly years of 2021, the fundamental tailwind hasn’t gone away. Fintech revenues keep surging past the growth rate of conventional financial institutions, demonstrating to investors that the sector isn’t merely another fleeting technology fad, it’s a vital part of the way businesses and individuals deal with money in a digital-centric world.

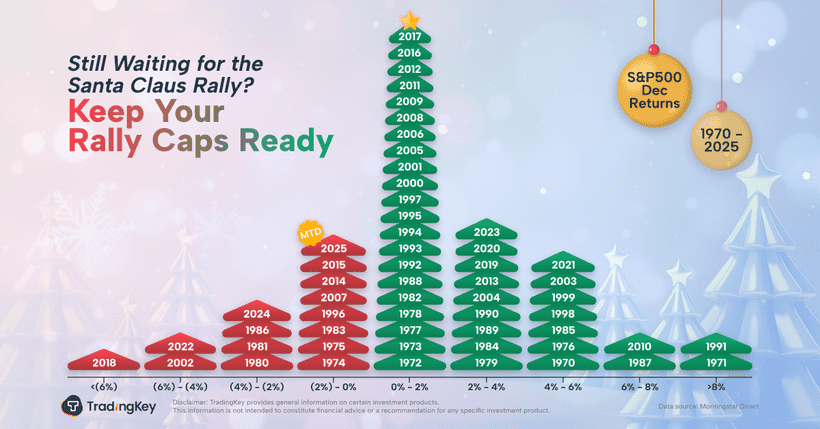

Source: https://www.marketdataforecast.com

Market Tailwinds and Secular Growth

One of the most appealing things about fintech is that its development is supported by long-term secular trends rather than business cycle booms. The first is the behaviour of the consumer. Individuals no longer wish to queue at a branch office to get their money, write paper checks, or place orders over the phone to buy into investments. They demand financial services to be there immediately, on the press of an app, on the same hassle-free service that they enjoy from e-commerce or streaming.

This behavioral change has unleashed an explosion in digital finance. Wealthtech, or digital wealth management, is growing particularly fast as more investors trust algorithms and platforms to manage their portfolios. Robo-advisors are gaining millions of users, while fractional share investing has brought stock markets to demographics previously locked out by high minimums.

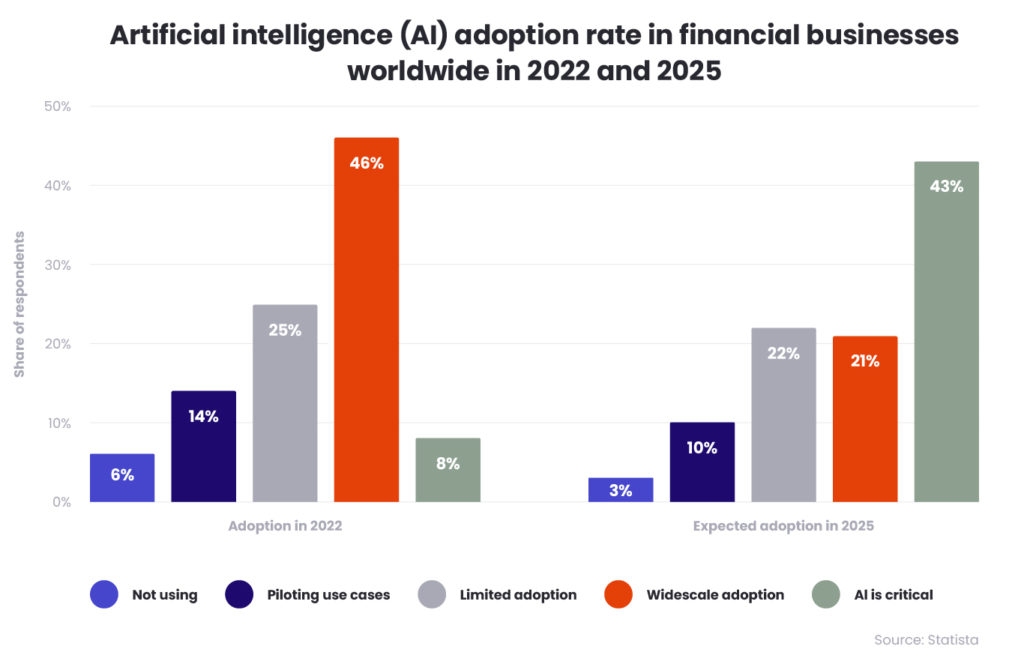

Artificial intelligence is another accelerant. Fintech platforms are deploying AI to detect fraud, automate credit scoring, and provide personalized financial advice. These tools reduce costs while increasing efficiency, which improves scalability. More importantly, AI allows fintech companies to serve millions of users simultaneously without the constraints that traditional banks face with staffing or physical infrastructure.

Global expansion provides another dimension of growth. In the U.K., the U.K., already-developed market where fintech platforms manage billions of dollars in assets, there remain value-oriented investors whose interest is piqued by platforms sitting on modest valuations. In emerging market countries such as India, meanwhile, platforms such as asset managers and digital brokers add millions of new customers annually to ride a financial inclusion wave. Investors take comfort in the global reach, making the fintech story neither merely a Silicon Valley phenomenon nor merely an Indian one. Rather, the phenomenon is global with multiple vectors of growth.

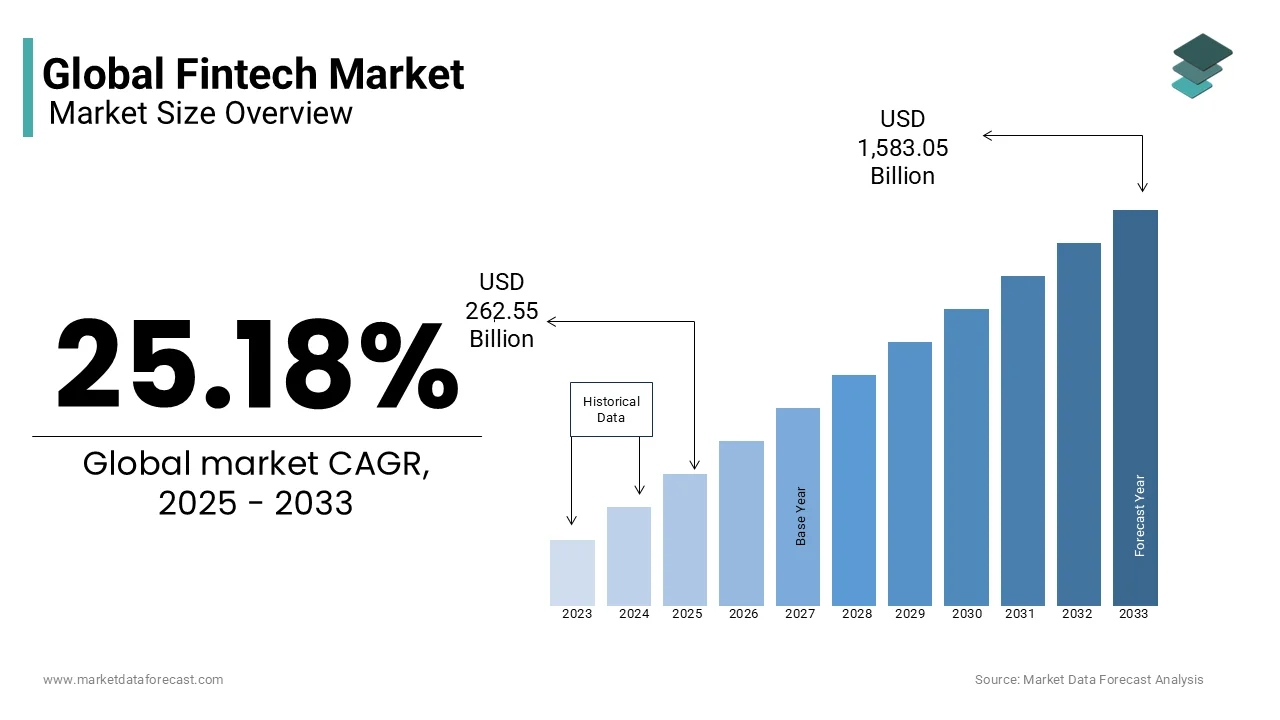

The Competitive Landscape

The fintech industry is diverse and thriving. On the top-end, the large consumer-facing platforms like Revolut, Robinhood, and PayPal have reached tens of millions of users, redefining the manner in which commonplace consumers spend, save, and even invest. Scaling is on their side for these players, and their brand names form a strong moat that keeps the users within their ecosystem.

But scale does not necessarily mean innovation. Specialized players keep innovating where agility is more important than scale. Crowdfunding platforms bring early-stage investing to accredited investors, infrastructure providers fuel the “rails” of cross-border money movement. Still others develop expertise in identity verification, fraud prevention, or blockchain-based settlement, segments important to preserving confidence in digital transactions.

Added to the blend is the role of technology groups like Apple, Google, and Amazon. Apple Pay and Google Pay dominate the mobile sector, and Amazon ingrains payments within its massive e-commerce platform. The businesses have massive user bases and brand equity built up but tend to partner with specialist fintechs on premium or specialist offers. Even conventional banks are no longer twiddling their thumbs.

A large proportion have built their own digitally native subsidiaries or bought fintech businesses outright. The outcome is a many-layered competitive ecosystem in which incumbents, giants, and startups vie for prominence. It makes it tougher to forecast outright champions on the part of investors, yet it affords a wide choice of investable opportunities on varying risk levels.

Source: https://www.clearlypayments.com

Risks and Market Realities

For all its promise, fintech investing comes with real risks. One of the biggest is valuation volatility. Fintech companies, especially those publicly traded, are often priced at high revenue multiples. When growth slows even slightly, or when the market mood shifts, these stocks can tumble quickly. The last two years offered plenty of examples: many fintech names lost 50–70% of their market value during tech’s broader correction, even if their underlying businesses were still growing.

Another wildcard is regulation. Since fintech lies at the intersection of financial services and technology, it tends to come into the crosshairs of financial authorities as well as data-privacy regulators. Data-sharing laws, payment-security regulations, and money-transfer regulations across borders may change rapidly, impacting the manner in which businesses conduct their business. An intensifying regulatory environment may dampen growth or incur costs that early-stage fintechs cannot afford.

Macroeconomic trends add to the mix. Higher interest rates, reduced credit margins, and inflation can impact lending-based fintechs and consumer demand for discretionary financial products. By contrast to banks that stand to benefit from higher rates, the majority of fintechs rely on volume-driven transactions and lending spread margins that fall when the macro environment tightens.

Lastly, competition is a double sword. In a crowded industry like this, even promising businesses may fall through the cracks, resulting unfortunately in failures or consolidation. For investors, it is important to do their due diligence to prevent supporting companies that appear innovative yet may lack staying power.

The Long-Term Opportunity

Even though there is risk involved, the long-term argument for fintech is strong. In the decade to come, the sector should become part of daily living just like the utilities or telecom sectors. Just as there is little debate over the necessity to have electricity or an internet connection, financial technology will be a presupposed aspect of business and personal existence.

Hybrid models will dominate the near term, blending human expertise with AI-driven tools to create more tailored and efficient financial services. Over the medium term, innovations in blockchain and quantum-proof encryption could redefine transaction security and settlement. And in the long run, fintech will likely merge so seamlessly into daily activities that people won’t think of it as “fintech” anymore, it will simply be finance as usual.

Fintech provides investors something that's unusual: resilience and growth. It benefits from secular trends in digital adoption, breakthroughs in artificial intelligence, and financial inclusion in emerging regions. Its business models, often subscription- or transaction-based, offer strong margins and recurring revenues that resemble software companies. That blend provides fintech with a defensive aspect on the downswings while preserving long-term upside on the cycles.

Source: https://spyro-soft.com

The secret, as it always is, is discernment. Not all fintech stocks win. There need to be distinctions drawn between those possessing strong durable customer stickiness, fortified competitive moats, and scalable infrastructures on the one hand, and those racing to the top with unsustainable economics on the other. But long-term patient capital, it is one of the brightest long-term opportunities that exist today in the global market.

.jpg)