Investing in Electric Vehicles & Mobility

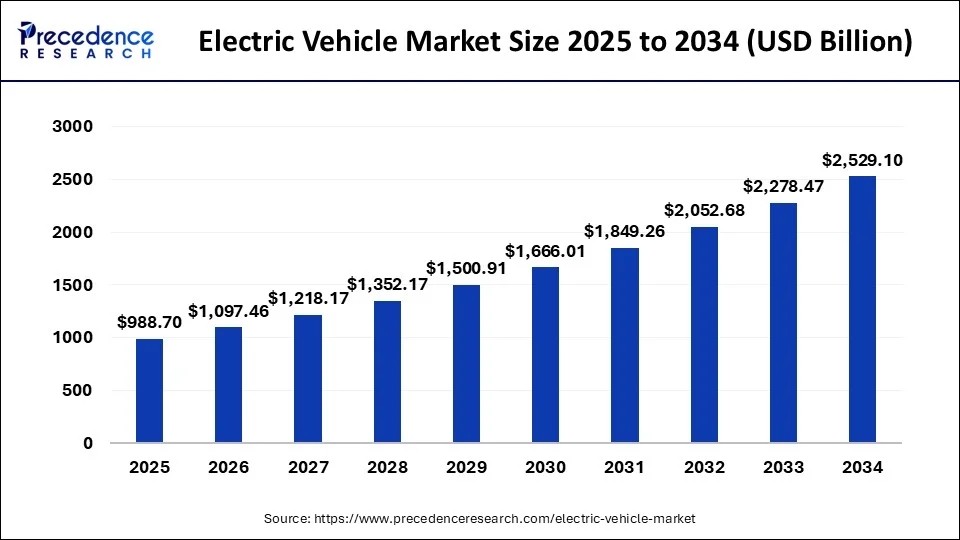

The electric vehicle market is expected to grow from $988.7 billion in 2025 to $2.53 trillion by 2034.

- Market expansion reflects a compound annual growth rate (CAGR) of over 10% across the forecast period.

- Growth is fueled by global policy support, falling battery costs, and rising consumer adoption.

- By 2034, EVs will represent a multi-trillion-dollar industry, reshaping mobility and energy demand worldwide.

Electric vehicles (EVs) went from future novelties to mainstream investments. Ten years ago, the prospect of battery cars dominating highways was far-off. Today, EVs roll off the production line by the millions every quarter and are redefining the way mobility and energy usage come to mind. That shift is experimental no longer, it’s unwavering.

Powering the growth is an exceptionally strong combination of consumer demand, government mandate, and business planning. Consumers choose EVs on the back of cost savings and green credentials. Governments impose reductions in emissions and offer incentives. Automakers, once skeptical, are racing to catch up with an industry that is electrifying faster than most had expected. Investors adore the industry due to the unusual mix of growth, strength, and structural transformation.

Therefore, the global electric vehicle market is projected to more than double from $988.7 billion in 2025 to $2.53 trillion by 2034, reflecting a steady compound growth trajectory.

Source: https://www.precedenceresearch.com

Drivers of Long-Term Growth

There are multiple pushes driving this market forward. Policy support is the first: subsidies, tax incentives, and carbon targets turn EV deployment less an option than an obligation. Governments from Europe toAsiahave drawn firm lines in the sand on the phaseout of fossil fuel engines.

Second is consumer take-up. No longer are EVs luxury-only propositions. Affordable products are arriving on forecourts, and outright performance cars continue to push technology envelopes. New market economies too are turning towards electrification, stimulated by city pollution and the expensive cost of fossil fuel.

Third is technology. The cost of batteries dropped precipitously over the last decade, making EVs competitive. Advances in energy density and charging speed are freeing longer ranges and decreasing one of the highest adoption barriers. Meanwhile, software integration and artificial intelligence are making EVs rolling computers that are unlocking totally new revenue streams after the sales of cars.

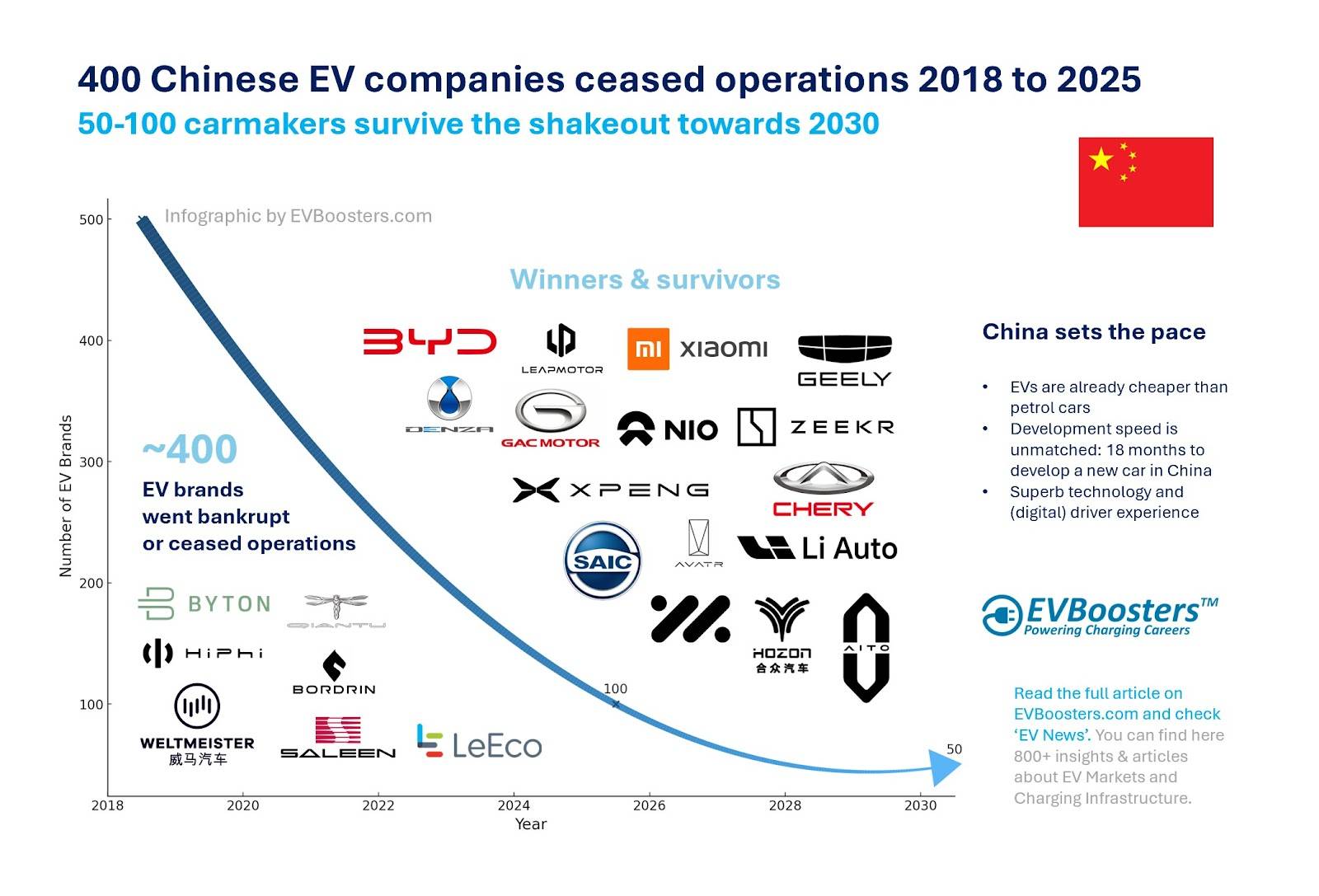

A Highly Competitive and Fragmented Market

The Industry of Electric Vehicles is Anything But Monolithic. On the one extreme, there exist global leaders such as Tesla and BYD whose dominance comes from scale, brand value, and vertically integrated supply chains. Tesla leads through software and charging infrastructure, whereas BYD competes due to low-cost volume production and government support flooding the market across multiple pricing levels.

Legacy automotive companies that were once endangered now lead. Ford, GM, Volkswagen, and Toyota spent billions on electrification. Their advantage is distribution networks, loyalty built among customers, and the ability to build by the million. But their challenge is cultural: breaking the century-old combustion habit and constructing the future on batteries and code.

Then there are startups and niche players. Some, like Rivian or Lucid, target high-margin luxury buyers. Others focus on commercial vehicles, scooters, or two-wheelers, especially in emerging markets where low-cost transport dominates. The industry is further complicated by suppliers and infrastructure builders, battery makers, charging providers, and mobility-as-a-service platforms, all competing for a share of the value chain.

This fragmentation generates risk as well as opportunity. There isn’t a dominant company owning the complete landscape, so disruptors and innovators can take their profit-generating niches.

Source: https://evboosters.com

Roadblocks Along the Way

The journey to electrification isn’t smooth sailing. Infrastructure is the biggest challenge. Charging stations are increasing, though slowly enough in most geographies. Absence of consistent access to fast charging causes adoption to stagnate. Governments are spending significantly on infrastructure, though the pace is patchy.

Prices also come into play. Though battery costs have fallen, raw materials such as lithium, cobalt, and nickel continue to fluctuate. Supply chain interruptions may drive costs higher, impacting profit margins and affordability to the consumer.

Regulation may be encouraging on the one hand but it may also lead to uncertainty. Abrupt incentive shifts, tariffs, or rules on trade impact multilateral players. Car manufacturers must deal with geopolitical risk due to the strong concentration of key minerals used to manufacture batteries in key countries.

Finally, competition is fierce. With dozens of companies entering the space, not all will survive. Investors need to be cautious, separating hype-driven firms from those with durable business models and strong balance sheets.

The Wider Mobility Ecosystem

It is not just about cars. The whole mobility ecosystem is quite intriguing. Public transport is being transformed by electric buses. City mobility is being redefined by e-bikes and scooters. Commercial fleets are becoming electric, reducing the cost of logistics and carbon footprints.

Mobility-as-a-service platforms that blend ride-hailing platforms with EV fleets are becoming lucrative hybrids of transport and technology. Autonomous driving is still in its early days but stands to merge with the adoption of EVs to produce cars that come both electric and autonomous.

Battery second-life application and recycling add another aspect. When the million-odd EV batteries come to the end of their service life, those that can be applied or recycled will create new value chains and an environmental remedy.

The Decade of Acceleration

The next decade will bring acceleration. By 2030, the sales share of EVs will be significant on a global level, and penetration levels will be above 40% in certain markets. This is not merely a change in product, it is a shift in energy demand, supply chain dynamics, and customer conduct.

Early positioners will be rewarded with exponential growth. Pure-play EV manufacturers, turnaround plays by traditional automakers that successfully transform their businesses, battery manufacturers, and charging infrastructure companies offer opportunities. But there will be a need to wait patiently, volatility is extreme, and every firm won’t be a winner.

For those willing to navigate the risks, the reward potential is immense. Just as oil companies dominated the 20th century, EV and mobility firms are shaping up to be the industrial titans of the 21st.

.jpg)