Understanding the U.S. Fiscal Framework: Is Trump’s Tariff-for-Tax-Cut Strategy Viable?

TradingKey – With the U.S. Senate and House of Representatives passing the budget resolution for President Donald Trump's second administration (Trump 2.0), his fiscal blueprint—centered on tax cuts, slashing government spending, and debt reduction—is moving forward. However, with federal debt at record highs and the debt ceiling still a looming constraint, many of Trump’s policy promises face strong headwinds.

Trump 2.0’s Core Fiscal Policies

Trump’s economic plan relies on three pillars:

- Tariffs to raise revenue

- Tax cuts to stimulate growth

- Major reductions in federal spending, led by the newly established Department of Government Efficiency (DOGE)

The overarching goal is to reduce the federal debt burden while maintaining or even enhancing economic competitiveness. But critics argue that these policies may be contradictory, especially the idea of using tariffs to fund tax cuts.

Quick Guide to the U.S. Fiscal Framework

At its core, the U.S. fiscal system can be broken down into two components:

1. Revenue Sources

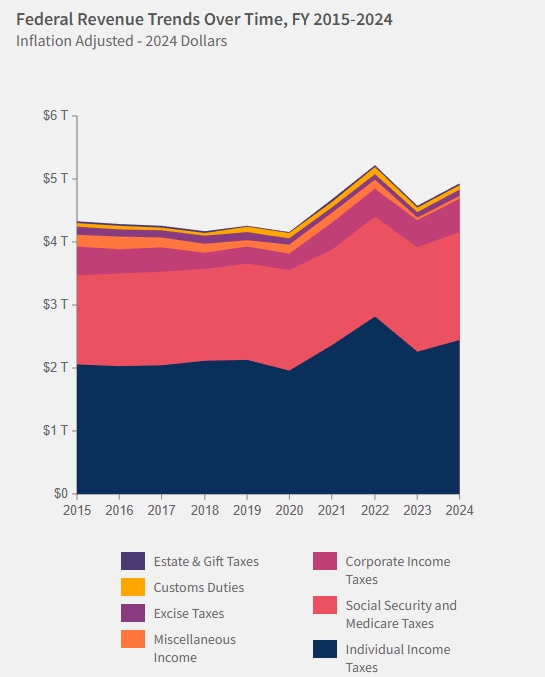

The U.S. federal government collects revenue primarily through:

- Personal income taxes: ~40–50% of total revenue

- Payroll taxes (Social Security & Medicare) : ~30–35%

- Corporate income taxes: ~10%

- Other sources: including excise taxes (~2%), customs duties (<2%)

While tariffs are often politically prominent, they currently account for less than 2% of total federal revenue.

Federal Renvenue Trends, Source:fiscaldata

2. Expenditures

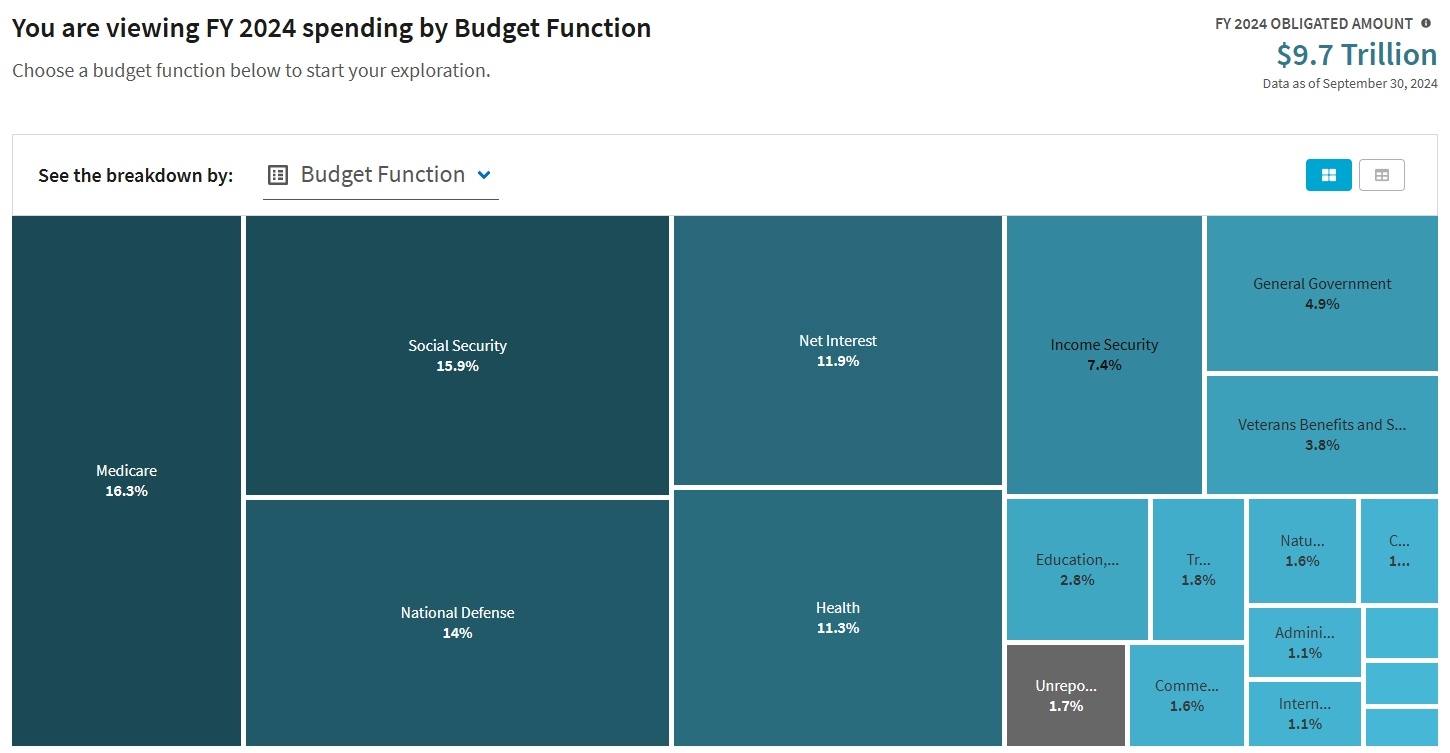

U.S. federal spending is divided into:

- Mandatory Spending (~70%): Includes Social Security, Medicare, Medicaid, interest on the national debt, etc.

- Discretionary Spending (~30%): Must be approved annually by Congress; includes defense, education, infrastructure, and scientific research.

FY2024 Spending by Budget Function, Source: usaspending

Fiscal debates usually center around discretionary spending, as mandatory spending is largely dictated by law and demographic trends.

Tariffs: Trump’s “New” Source of Revenue?

Despite their minimal role in the federal budget, Trump has aggressively promoted tariffs as a way to boost government revenue and reduce trade imbalances.

In early April 2025, Trump announced plans to impose average effective tariffs of 28%, the highest level in over a century. He claims this could generate $20–35 billion per day in additional revenue—an implausibly high figure.

According to the Tax Foundation, under a long-term tariff regime, cumulative revenue gains over 10 years would be about $2.9 trillion, or roughly $300 billion per year —far below Trump’s projections.

According to a July report by Morgan Stanley, U.S. customs net revenue reached $27.3 billion in June, annualizing to $327 billion, equivalent to 1.1% of Q1 GDP.

The report noted that if tariffs are treated as taxes, they would amount to 65% of 2024 corporate income tax revenue, 10% of withheld personal income and FICA tax revenue, and 32% of non-withheld personal income tax revenue.

Morgan Stanley pointed out that regardless of whether businesses or consumers bear this significant cost, it poses downside risks to the U.S. economy. In both scenarios—where companies fully absorb tariff costs or fully pass them on to consumers—annualized corporate profit margins are projected to decline by 0.5 percentage points from the 15-year average, falling from 13.8% to 11.7%.

Moreover, tariffs come with major risks:

- They can raise inflation, hurting consumer purchasing power.

- They risk trade retaliation, reducing export demand.

- They may slow GDP growth, undermining the very economy they aim to strengthen.

Jim Bianco of Bianco Research argues that Trump sees tariffs not just as a tool for trade fairness but as a lever to devalue the dollar, which could help reduce the real value of U.S. debt relative to GDP.

DOGE: Trump’s “Drain the Swamp” Experiment

In an unprecedented move, Trump appointed Tesla CEO Elon Musk to lead the Department of Government Efficiency (DOGE), tasked with cutting $2 trillion from federal spending over 10 years.

DOGE’s strategy includes:

- Large-scale layoffs of federal workers

- Eliminating or defunding independent agencies like NPR, the National Endowment for the Arts, and the Peace Corps

- Reducing discretionary spending across key departments

However, early results have been mixed:

- From January to April 2025, federal spending increased by 6.3% YoY, or $156 billion, even after adjusting for inflation.

- While DOGE claims to have saved $160 billion, nonpartisan watchdogs estimate it actually cost $135 billion amid administrative chaos and program disruptions.

Bloomberg columnist Justin Fox noted that DOGE has had little impact on the budget but massive political fallout, disrupting the functioning of the federal bureaucracy.

On July 7, 2025, a sudden flood struck central Texas, resulting in at least 90 deaths. According to The New York Times, citing expert opinions, mass layoffs at the National Weather Service left key positions vacant in local offices, making coordination between forecasting agencies and local emergency personnel more difficult. Although the White House later denied it, concerns remain that government functions have been compromised due to budget cuts.

Can Tariffs Fund Tax Cuts?

In early July, Trump formally signed the "Big and Beautiful" Act into law. This is the central question of Trump’s fiscal agenda.

- The Trump administration proposes using tariff revenue to offset the cost of making the 2017 Tax Cuts and Jobs Act permanent, which would require about $5.3 trillion over 10 years, according to House estimates.

- However, the Tax Foundation estimates that tariffs would bring in only $2.9 trillion, while costing the economy $4.5 trillion in lost output due to higher prices and reduced trade.

This suggests that the net economic effect of "tariff-funded tax cuts" could be negative, potentially worsening deficits and slowing growth.

Major Wall Street banks—including Goldman Sachs, JPMorgan Chase, Bank of America, Barclays, and Deutsche Bank—have warned that Trump’s tariff policies increase the risk of recession and have revised down their forecasts for the S&P 500 index for 2025.

On the other hand, tax cuts are not a universal economic accelerator. Some analysts have described Trump's tax cuts as a "Sword of Damocles" hanging over the U.S. economy.

- On one hand, businesses hope the tax cuts will expand profit margins, and Trump aims to boost the economy from a supply-side perspective.

- On the other hand, concerns remain about whether the tax cuts will further increase debt pressure amid rising government deficits and trigger a chain reaction.

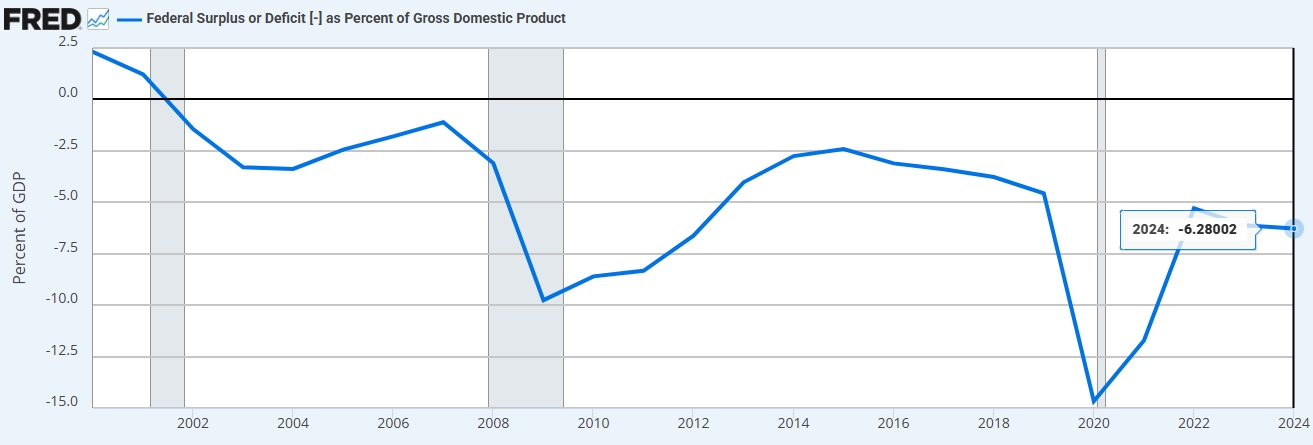

The Congressional Budget Office (CBO) estimates that Trump’s "Big and Beautiful" Act will push the U.S. debt-to-GDP ratio from the current 123% to 134% by 2034. The U.S. fiscal deficit is projected to reach 7% in 2026, with an average deficit rate of 6.3% over the next decade.

US Federal Surplus or Deficit to GDP, Source:stlouisfed

In the U.S. tax reform practices over past decades, tax cuts have generally helped boost GDP growth and reduce total government debt. However, this logic may not hold in today’s macroeconomic environment: since 2017, both federal government debt and the Federal Reserve’s total assets have expanded rapidly, yet economic growth has shown limited improvement, reflecting increased fiscal intervention and rising costs of stimulating the economy.

2025 | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | |

Inflation Rate (%) | 2.40 | 2.95 | 4.12 | 8.00 | 4.70 | 1..23 | 1.81 | 2.44 | 2.13 |

Unemployment Rate (%) | 4.10 | 4.1 | 3.6 | 3.70 | 5.30 | 8.10 | 3.70 | 3.90 | 1.10 |

Economic Growth Rate (%) | -0.50 | 2.80 | 2.89 | 2.51 | 6.06 | -2.16 | 2.58 | 2.97 | 2.46 |

Federal Government Debt (trillion USD) | 37.04 | 36.22 | 34.00 | 31.42 | 29.62 | 27.75 | 23.20 | 21.97 | 20.49 |

Federal Reserve Total Assets (trillion USD) | 6.66 | 6.89 | 7.71 | 8.55 | 8.76 | 7.36 | 4.17 | 4.08 | 4.45 |

Source: World Bank, St. Louis Federal Reserve, 21st Jingji, TradingKey

The Mar-a-Lago Accord: A Dollar-Debt Scheme?

Inspired by the 1985 Plaza Accord, some analysts speculate that Trump 2.0 may pursue a new international agreement—the so-called Mar-a-Lago Accord —to weaken the dollar and restructure U.S. debt.

Key elements reportedly include:

- Coordinated currency devaluation to boost U.S. exports

- Pressuring foreign holders of U.S. Treasuries to roll over short-term debt into 100-year bonds

- Threatening tariffs or withdrawal of security guarantees for countries that refuse

However, economists widely dismiss this idea:

- The U.S. trade deficit is more a result of structural factors like low domestic savings than unfair trade practices.

- Weakening the dollar could undermine confidence in the global reserve currency status of the U.S. dollar.

- Long-term bonds would lock in higher interest costs for the U.S. government.

JPMorgan analysts argue that such a deal is highly unlikely, as it contradicts both U.S. interests and the willingness of other nations to comply.

Conclusion: A High-Risk Gamble on Debt Reduction

Trump’s fiscal strategy hinges on the belief that tariffs can replace traditional taxes and that aggressive spending cuts will slim down the federal government without harming essential services.

But reality paints a different picture:

- Tariffs are inefficient revenue tools that hurt consumers and businesses.

- DOGE has failed to deliver meaningful savings and instead created operational chaos.

- Using tariffs to fund tax cuts may worsen deficits and slow growth.

- The Mar-a-Lago Accord remains a speculative idea with low feasibility.

While Trump’s policies reflect a bold vision for reshaping U.S. fiscal policy, most experts agree that they carry significant economic risks and may ultimately fail to achieve their stated goals of reducing debt sustainably.