U.S. May PCE Preview: Tariff Inflation Effects Continue to Delay – Can the U.S. Market Ignore the Report?

TradingKey - On Friday, June 27, the U.S. will release Personal Consumption Expenditures (PCE) price index for May, widely regarded as the Federal Reserve’s preferred inflation gauge and a key reference for FOMC officials in assessing inflation trends and shaping monetary policy decisions.

Economists expect that, given the weaker-than-anticipated CPI and PPI readings in May, the inflationary impact of Trump tariffs has yet to clearly show up in the data. As a result, the PCE index is expected to rise moderately rather than surge significantly.

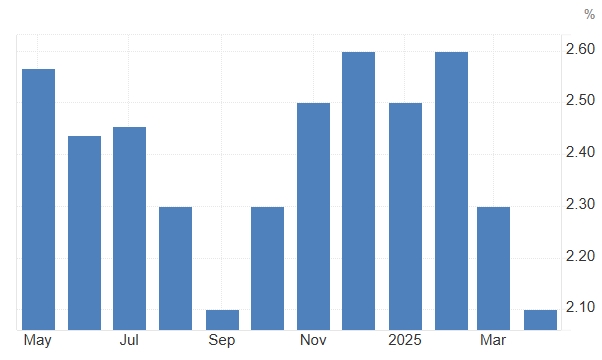

According to FactSet estimates, economists forecast the PCE price index to rise 0.1% month-over-month in May, matching the prior reading, and increase 2.3% year-over-year, up from 2.1% in April. The core PCE price index, which excludes food and energy, is also projected to rise 0.1% month-over-month, unchanged from the previous month, with annual growth rising to 2.6% from 2.5%.

U.S. PCE YoY, Source: Trading Economics

If realized, this would mark the third consecutive month that the core PCE has risen by just 0.1% — the weakest three-month stretch since the onset of the pandemic in 2020.

Inflation Signals Begin to Emerge – Q3 Will Be Critical

In the April PCE report, the core PCE price index recorded modest monthly gains for two straight months, hitting the lowest annual rate since February 2021.

Wall Street Journal reporter Nick Timiraos praised the report as an “A+,” but warned that the effects of tariffs could start showing in May and especially June, with faster increases in goods prices likely.

JPMorgan Chase analysts noted that inflation may pick up slightly in May, but this would only be the tip of the iceberg when it comes to tariff-driven inflation.

Goldman Sachs recently reported that May’s CPI and PPI figures suggested a mild impact from tariffs, but most of the inflationary pressure from those measures was expected to emerge between June and August.

Dovish Winds Seem to Prevail at the Fed

Following the Federal Reserve’s June policy meeting, there was an unusually wide divergence among officials regarding both the economic outlook and the path of interest rates. Deutsche Bank pointed out that the level of disagreement reflected in the June Summary of Economic Projections (SEP) was the highest in a decade.

Recent comments from Fed officials have underscored this divide. On one hand, Fed Governors Christopher Waller and Michelle Bowman argued that the inflationary effects of tariffs were less severe than anticipated, supporting a rate cut as early as July. On the other hand, Fed Chair Jerome Powell remained characteristically vague during his congressional testimony, while several officials emphasized the need for further clarity on the impact of tariffs.

Nonetheless, markets appear more focused on the dovish tone, especially amid speculation that President Trump is considering a list of potential future Fed chairs who are more open to aggressive rate cuts.

At the time of writing, the yield on the 10-year Treasury note had fallen from last Friday’s (June 20) high of 4.443% to 4.261%, while the U.S. Dollar Index (DXY) dropped to a three-year low.

Can U.S. Equities Breathe Easy?

The upcoming PCE report for May does not reflect the impact of the Israel-Hamas conflict in June, which briefly spiked oil prices. Economists worry that any disruption to oil supply could worsen U.S. inflation.

Carson Group noted that oil prices and their effect on inflation will influence how long the Fed maintains a "meaningfully restrictive" stance on interest rates.

However, with the U.S. military involvement and ceasefire agreements between Israel and Hamas, oil prices reversed course. The decline in risk aversion is expected to boost demand for risk assets like U.S. equities.

This week, amid heightened expectations for Fed rate cuts and improving corporate earnings outlooks, the Nasdaq 100 Index hit a new high, and NVIDIA shares set a fresh record on June 25.