Bitcoin Surges Toward All-Time High — Economists Warn of a New Tech Bubble

TradingKey – On Monday, August 11, Bitcoin (BTC) rallied past $122,000, gaining over 3% in 24 hours and coming within striking distance of its July 14 all-time high of $123,236. The move has reignited bullish sentiment across the market, with some analysts projecting a breakout toward $135,000 in the near term.

Bitcoin Price Chart – Source: TradingView

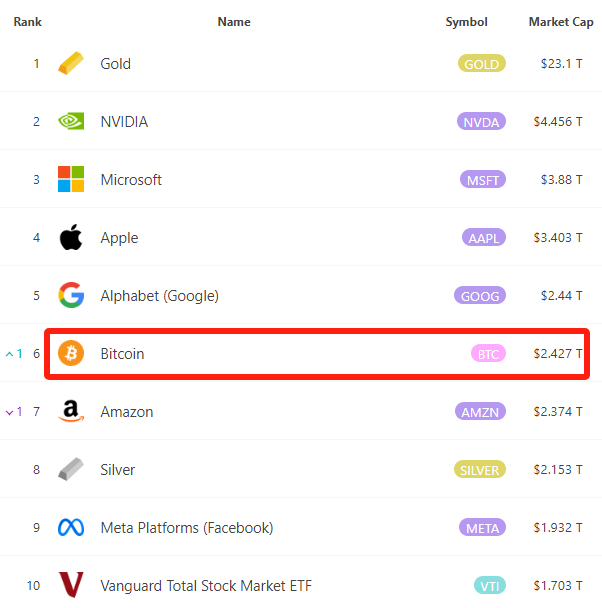

As Bitcoin’s price climbed, its market capitalization rose to $2.42 trillion, overtaking Amazon (AMZN) to become the 6th largest asset globally. This milestone underscores Bitcoin’s growing influence in traditional finance and its appeal as a macro hedge.

Global Asset Rankings – Source: 8marketcap

The rally was largely driven by President Trump’s August 7 executive order, which allows 401(k) retirement plans to invest in Bitcoin, Ethereum, and other digital assets. This policy shift triggered a wave of institutional buying:

- U.S. spot Bitcoin ETFs saw net inflows of $120.75M on August 7 and $403.67M on August 8

- A recent Fund Manager Survey revealed that 9% of respondents have now made structural allocations to crypto assets

Despite ongoing Bitcoin production and potential miner sell-offs, on-chain data shows that accumulation by large wallets far exceeds mining output. According to Curated Crypt, small and mid-sized wallets are now buying more BTC than miners are producing, reducing sell-side pressure.

The surge has prompted warnings from economists like Henrik Zeberi, who claims Bitcoin’s correlation with the Nasdaq suggests we’re entering “Tech Bubble 2.0.” He argues that speculative excess and macro distortions are inflating asset prices beyond fundamentals.

In contrast to warnings of a speculative bubble, Tony Pasquariello, Head of Hedge Fund Coverage at Goldman Sachs, sees Bitcoin and gold as strategic stores of value. He described going long on both assets as a core hedging strategy for the second half of 2025, especially amid macro uncertainty and rising geopolitical risk.

Meanwhile, Tom Lee, co-founder of Fundstrat and Chairman of BitMine, remains firmly bullish. He predicts Bitcoin will reach $250,000 by year-end, citing ETF inflows, declining exchange balances, and institutional accumulation as key drivers.

Taking it even further, Michael Saylor, founder of Strategy (MSTR) and one of Bitcoin’s most vocal advocates, stated: “When banks begin recommending Bitcoin, each coin will be worth $10 million.”