Northrop Grumman Corp Stock Closed Up by 3.26% on Feb 18: Facts Behind the Movement

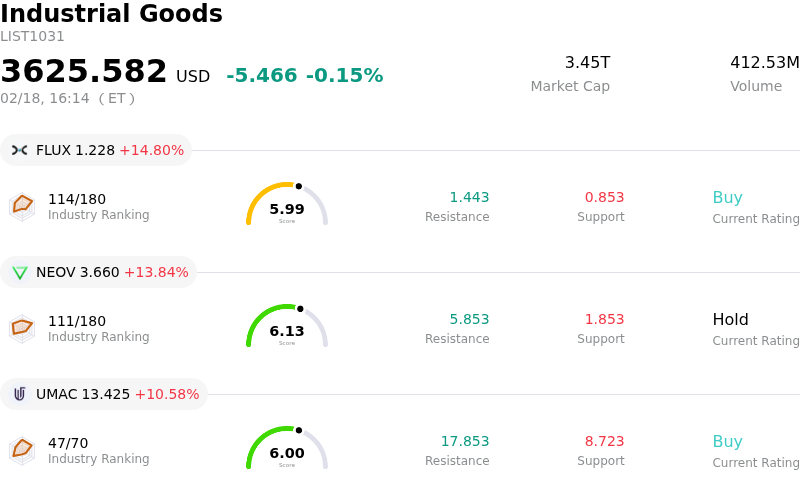

Northrop Grumman Corp (NOC) closed up by 3.26%. The Industrial Goods industry is down by 0.15%. The company outperformed the industry. Top 3 gainers of the industry: Flux Power Holdings Inc (FLUX) up 14.80%; NeoVolta Inc (NEOV) up 13.84%; Unusual Machines Inc (UMAC) up 10.58%.

Northrop Grumman's stock experienced an upward movement, likely driven by a combination of strong financial results, positive analyst sentiment, and favorable industry dynamics. The company recently reported fourth-quarter earnings that surpassed analyst expectations for both earnings per share and revenue. Its quarterly revenue demonstrated significant year-over-year growth. This robust financial performance provided a solid foundation for investor confidence.

Adding to the positive momentum, several analysts have recently raised their price targets and reiterated favorable ratings for Northrop Grumman. This includes a number of "Buy" and "Strong Buy" recommendations, reflecting optimism about the company's future prospects. This positive re-evaluation by the analytical community can significantly influence short-term stock movements.

Furthermore, the broader defense sector is experiencing a period of heightened demand, often referred to as a "super-cycle," driven by elevated geopolitical tensions and increased global defense spending. Northrop Grumman's CEO, Kathy Warden, addressed this trend at a recent conference, highlighting the unprecedented and sustaining demand for defense capabilities worldwide. This macroeconomic and industry-specific tailwind benefits major defense contractors like Northrop Grumman. The company also secured a notable contract for E-2D Advanced Hawkeye aircraft spares, further bolstering its order book. Additionally, a Memorandum of Understanding with Thales Belgium was signed to enhance European and NATO defense capabilities, signaling international growth opportunities.

Technically, Northrop Grumman Corp (NOC) shows a MACD (12,26,9) value of [22.45], indicating a neutral signal. The RSI at 62.08 suggests neutral condition and the Williams %R at -28.08 suggests oversold condition. Please monitor closely.

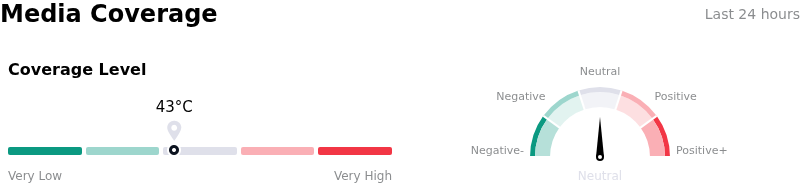

In terms of media coverage, Northrop Grumman Corp (NOC) shows a coverage score of 43.40, indicating a moderate level of media attention, with neutral sentiment.

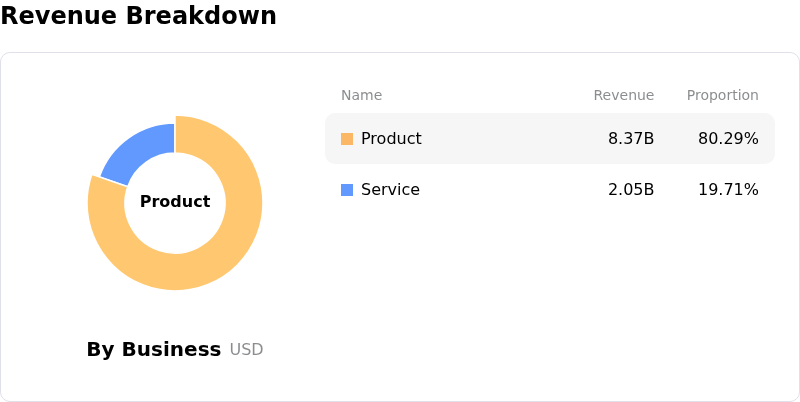

Northrop Grumman Corp (NOC) is in the Industrial Goods industry. Its latest annual revenue is 41.95B, ranking 6 in the industry. The net profit is 4.18B, ranking 5 in the industry. Company Profile

Over the past month, multiple analysts have rated the company as BUY, with an average price target of 729.99, a high of 815.00, and a low of 604.00.

Company Specific Risks:

- Northrop Grumman's 2026 guidance indicates modest sales and segment margins around 11%, coupled with a soft outlook for free cash flow growth, signaling potential operational and financial underperformance.

- The company faces increased capital intensity and the potential for profitless growth on key programs such as the B-21 and Sentinel, which could compress multiples if execution falters.

- The cessation of share repurchases beyond the completed 2024 program removes an important floor for the stock price, impacting shareholder returns and potentially increasing downside risk.

- Recent Form 4 SEC filings reveal insider selling activity, which can signal a lack of confidence from company executives or significant shareholders.