The Ultimate AI Technology Stock to Buy With $1,000 Right Now

Key Points

The past few weeks have been particularly punitive for most AI stocks.

The share price weakness in the sector has been indiscriminate.

The shortage of memory chips that is holding most technology companies back is only temporary, and likely already fully reflected in these companies' stock prices.

It has been a tough few weeks for plenty of artificial intelligence (AI) stocks. And to be fair, some of them deserved their share price setbacks.

Not all of them, though. In several cases, investors have thrown the proverbial baby out with the bathwater. Smart investors know that conditions like this ultimately spell opportunity.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

To this end, growth-minded investors with $1,000 they're ready to put to work for a while may want to consider jumping into Qualcomm (NASDAQ: QCOM) while it's trading at a 23% discount from its early January high.

Yes, Qualcomm

Anyone keeping tabs on Qualcomm of late might be a bit surprised at such a suggestion. The results it reported earlier this month for its fiscal 2026 first-quarter (which ended Dec. 28) weren't great. Although sales and earnings both topped analysts' estimates, the top line only improved 5% year over year. Meanwhile, management's guidance was downright alarming. The company is only looking for revenue between $10.2 billion and $11 billion for the quarter currently underway, versus analysts' consensus estimate of around $11.1 billion, and only up slightly from the year-ago comparison of $10.8 billion.

Qualcomm explained that its business is largely being stymied by the ongoing shortage of memory chips... which it is.

Image source: Getty Images.

As is so often the case, though, the market is so focused on the past and even the present that it's not thinking about the future, which is the one thing that should mean the most to investors at any given time.

And the future here actually looks quite bright.

Still gelling, with or without enough memory chips

Not the immediate future, mind you -- that's clearly going to be tepid. If you can look just a little further down the road, though, there's every reason to believe we'll be seeing glimmers of hope soon enough.

It has everything to do with the sliver of the chip market that Qualcomm serves. Initially designed for smartphones, Qualcomm's Snapdragon microprocessor chip is increasingly being found in AI-capable laptops and wearables, as well as serving as the centerpiece of more and more high-tech "connected" cars. It's eventually even going to handle some driver-assistance duties.

And 2026 could be the breakout year for this computing processing technology found somewhere between people's mobile devices and the cloud. As Qualcomm CEO Cristiano Amon recently said in an interview with The Wall Street Journal, "The biggest opportunity ... I think people finally see, in 2026, the opportunity that exists on the edge, especially if you have the ability to do a lot of processing on the edge."

Amon acknowledged his bias (Qualcomm's Snapdragon processors are now built for edge computing). He's not wrong, though. As artificial intelligence data centers bump into capacity constraints, the world is apt to begin understanding and accepting that a great deal of high-level processing work can be offloaded to platforms that are not currently at the forefront of the AI trend.

Then in 2027, Qualcomm expects its processing chips to start showing up in AI data centers. That makes sense. As the AI business adds more inference models, this company's purpose-built processors' power efficiency and better memory bandwidth (compared to GPUs) will make them a choice the artificial intelligence industry must at least consider.

And after that, we'll see a growing market in AI-powered robotics, including humanoid robots.

Always pricing in the future

But what of the worldwide memory shortage? It's still an issue, to be sure, and is expected to remain one for a while. This could weigh on investors' minds the whole time.

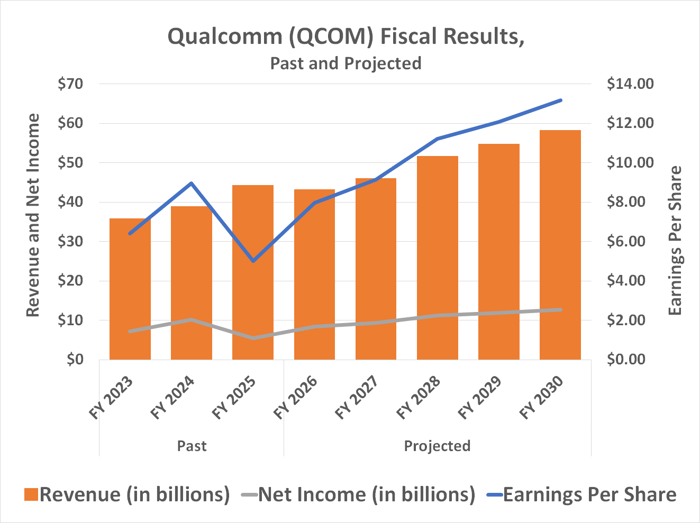

The fact is, however, most AI stocks -- including Qualcomm -- are likely to begin performing better before the supply shortfall is obviously easing, as investors will sense and anticipate this trend before there's clear and confirmed evidence of it. Analysts see it coming anyway.

Data source: Morningstar. Chart by author.

In the meantime, most (if not all) of the memory shortage's bad news may already be reflected in Qualcomm stock's current price, with none of the inevitable upside priced in. That's how the stock market often works.

Should you buy stock in Qualcomm right now?

Before you buy stock in Qualcomm, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Qualcomm wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 18, 2026.

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Qualcomm. The Motley Fool has a disclosure policy.