Is Micron a Trillion-Dollar Company in the Making?

Key Points

Micron has seen demand for its chips spike amid the buildout of new data centers for AI training and inference.

The entire industry is cautiously building out more production capacity, and supply will remain tight until 2027.

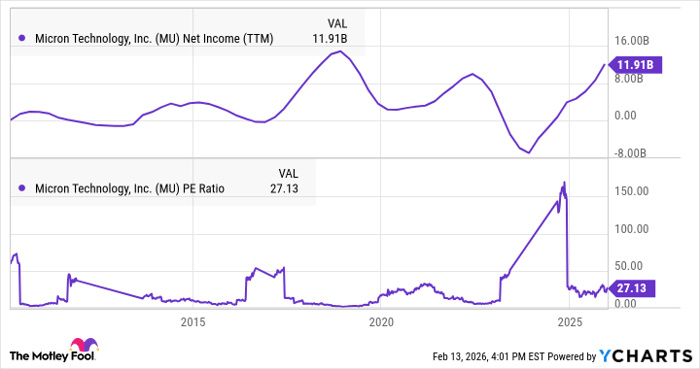

Micron's P/E ratio fluctuates widely based on where it is in the demand cycle.

Few artificial intelligence (AI) stocks have seen more capital pile into them in such a short period than Micron Technology (NASDAQ: MU). The memory-chip maker has seen its stock soar 250% since the start of September, and now sports a market cap of over $460 billion.

With the stock already 44% higher through the first few weeks of 2026, investors may be wondering whether it's set to surpass $1 trillion in the near future. Another doubling will just about do it.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Stock prices are forward-looking. To determine whether Micron can reach a $1 trillion valuation, it's important to understand what's driving its price higher and whether those factors will sustain its growth well into the future.

Image source: Getty Images.

What's behind Micron's soaring stock price?

Micron has been one of the biggest beneficiaries of the growing demand for high bandwidth memory (HBM). These memory chips are packaged with graphics processing units (GPUs) and AI accelerators for AI training and inference. With the growing demand for compute from AI developers, hyperscalers have increased their chip budgets, which, in turn, has increased demand for Micron's HBM.

The entire industry now faces a shortage of DRAM memory chips. These not only compose the building blocks of the high-bandwidth memory chips Micron makes but are also key components in other computing hardware, including PCs and smartphones.

As a result of the shortage, Micron has seen the prices it can charge for its chips rise considerably. The company's average selling price for DRAM chips increased 20% sequentially in the first quarter and gross margin expanded to 57% from 46%. With the pricing tailwind, Micron's earnings per share grew 167% to $4.78 last quarter and operating cash flow ballooned to $8.4 billion.

The company's outlook suggests 2026 could be even better. Management guided gross margin to expand to 68% this quarter, and earnings per share will reach $8.42. Management also said the supply of memory chips will remain tight beyond the 2026 calendar year.

That news kicked off another run in Micron's stock price, and analysts increased their expectations for fiscal 2026 and 2027 earnings. Wall Street now sees Micron generating $33.73 per share for 2026 and $43.54 in 2027.

Can Micron climb to $1 trillion?

Micron stock trades at about 12.2 times analysts' 2026 earnings expectations and 9.4 times 2027 earnings expectations. That might seem cheap, compared to other AI semiconductor stocks, but Micron's business isn't as differentiated as those of high-end chipmakers.

Memory chips are practically a commodity, and Micron faces competition from Korean companies SK Hynix and Samsung. Rest assured, neither of them is sitting on the opportunity to ramp up DRAM chip production.

While all three have remained cautious about how long demand will remain elevated, all three major DRAM chipmakers are investing in production capacity. Micron itself plans to spend $20 billion in capital expenditures for fiscal 2026.

This cycle has played out repeatedly in the industry, leading to peaks and valleys in Micron's earnings. The three chipmakers have to ramp up capacity to meet demand, but they're left with an oversupply when demand slows, leading to severe declines in earnings power. The cyclical nature of the industry is why Micron's earnings today aren't valued as highly as a company with more predictable and sustainable earnings power.

Nonetheless, Micron's current earnings multiple is much higher than it has been amid other peaks in its earnings cycles over the last 15 years or so. Micron's trailing price-to-earnings ratio (P/E) around the peak of prior earnings cycles has ranged from 3 to 6.

MU Net Income (TTM) data by YCharts.

As mentioned, Micron stock currently trades at 9.4 times 2027 earnings. That means investors are currently expecting the pricing tailwinds supporting Micron's current earnings boost to continue well past fiscal 2027. While AI demand is a strong driving force, past demand cycles suggest that Micron's earnings won't continue to climb much higher beyond 2027.

Even if this demand cycle extends to the end of the decade, the stock price is, at best, fairly valued. For it to reach a $1 trillion valuation, it would require overwhelming outperformance of management's guidance and analysts' expectations, fueled by an acceleration in demand from its hyperscaler end customers.

Should you buy stock in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 18, 2026.

Adam Levy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Micron Technology. The Motley Fool has a disclosure policy.