How Compound Interest Can Help You Retire a Millionaire -- Even on a Modest Income

Key Points

Contrary to a common assumption, almost anyone can become a millionaire.

Many people don’t do so, however, because they don’t do what they can when it matters the most.

Even the people who were disciplined enough to do it right likely felt like their start was agonizingly slow.

Think you need to start with a huge take-home salary to make a million bucks in the stock market? If so, think again. Plenty of people have amassed a seven-figure nest egg on surprisingly modest incomes. The trick isn't several mega-winning trades either. Rather, the key is simply taking consistent steps forward that you can for as long as you can with proven investments. Here's the math.

The snowball effect

It's called compounded interest, although for most investors, it will actually be compounded gains on any capital appreciation or dividends your investments produce rather than cash. The principle is the same either way -- by reinvesting any dividends and growth in the same investment producing them, your past earnings generate steadily increasing future gains, since you've got an ever-growing amount of capital at work.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

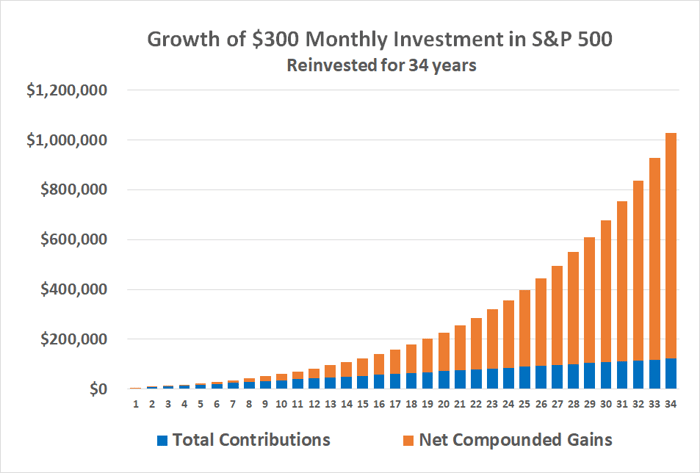

The graphic below illustrates the principle with a very realistic example. Assuming you're investing a very manageable $300 per month in an S&P 500 index fund that earns the index's average annual net gain of about 10% per year -- and then reinvesting these gains in more shares of the same index fund -- in 34 years, you'd be sitting on just a little more than $1 million.

Data source: Calculator.net. Chart by author.

That's the power of compounded interest! The more money you save and grow now, the more you've got progressively working for you all through the future. Think of it like a snowball rolling down a hill; the bigger it is when it starts rolling, the more snow it gathers on the way down.

Be patient enough to give it the time needed

There's a handful of important details to add to the discussion here.

First, although the S&P 500 truly does boast a historical average yearly return of 10%, that's certainly not its performance every year. In some years it does better. In other years, it loses ground. That's why you would ideally be thinking in timeframes of at least five years -- if not longer -- to smooth out this volatility that isn't evident in the graphic above.

Also notice you won't actually start producing more in yearly investment gains than your annual contribution until the eighth year in. Moreover, note that most of the net gain above materialized in just the last third of the 34 years in question. The key, however, is starting that last third of your savings timeframe with as much investable capital as possible.

Image source: Getty Images.

Finally, be sure to recognize the importance of getting started with investing as early as you possibly can when saving for retirement. Even shrinking the savings timeframe in the scenario above down to just 30 years would leave you with only about $678,000, and if it's only 25 years, you'd end up with a little less than $400,000. Those last few extra years make a huge difference down the road! So, even if you can't come up with an extra $300 per month right now, invest what you can as soon as you can.

Even if you're closer to retirement than not, however, it can never hurt to start somewhere, or start doing more. Maybe you will need a little luck to reach the million-dollar mark, but you at least want to give yourself a chance at experiencing that good fortune.

The $23,760 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Join Stock Advisor to learn more about these strategies.

James Brumley has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.