Does Riot Platforms' 5.3% Gain This Past Week Signal a Recovery Is Underway?

Key Points

Surging more than 5% this past week, Riot Platforms is a stock tech investors are starting to watch more closely.

A key purchase and lease agreement with AMD was the big news this past week, sending shares of RIOT stock higher.

Upcoming earnings on Feb. 24 could provide greater color into what this deal means for the company's fundamentals over time.

One of the top cryptocurrency miners turned compute providers, Riot Platforms (NASDAQ: RIOT), is among the tech stocks many investors are watching closely right now.

Much of that has to do with the volatility we've seen in Bitcoin (CRYPTO: BTC), which continues to provide plenty of juice to upside and downside rallies in RIOT stock. That's due to the more than 18,000 Bitcoin held on Riot Platforms' balance sheet (worth more than $1.2 billion at current levels), according to TheBlock.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

This key fundamental driver (the price action of Bitcoin) is but one of the notable drivers of Riot's price action from week to week. Let's dive into what happened this week, why RIOT stock surged 5.3% over the past five trading days, and whether this move indicates Riot represents a solid investment opportunity moving forward.

What's moving Riot Platforms higher?

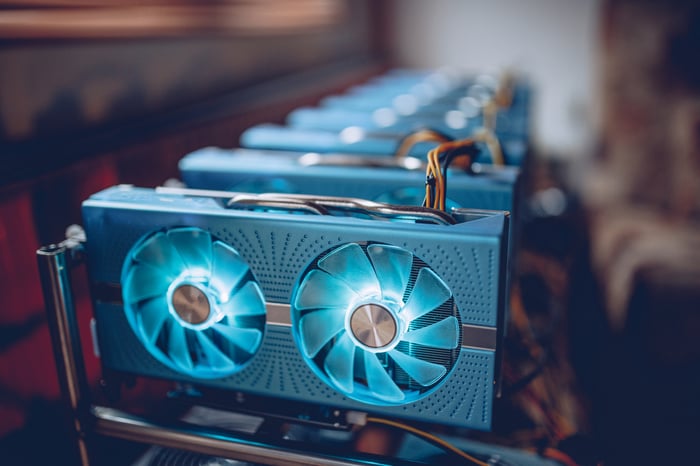

Source: Getty Images.

This past week, one of the most notable events for investors was the company's notice on Tuesday that it will release its Q4 earnings and full-year financial results on Feb. 24.

This release is expected to be notable, with investors continuing to assess whether the ongoing "re-rating" of the company's fundamental shift from a Bitcoin miner to an emerging data center/AI infrastructure play will be a positive or negative for the company. I'd argue that, given how Bitcoin has performed of late, the likelihood is that this transition should be perceived as a relative net positive. Still, the market may not see it that way (given the weakness we've seen in many AI-related stocks).

Additionally, the other big news this week was that Riot announced a land purchase and lease agreement for roughly 200 acres in Texas with Advanced Micro Devices (NASDAQ: AMD), under which the chipmaker will lease the land from Riot to support its high-performance computing needs. This deal could materially change how investors view Riot's long-term earnings power, particularly if forward earnings and EBITDA guidance improve in the upcoming commentary around the company's Q4 financials.

We'll have to see what ultimately comes of these announcements, but for now, I think investors are taking a relatively bullish view of Riot heading into this print.

Should you buy stock in Riot Platforms right now?

Before you buy stock in Riot Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Riot Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 15, 2026.

Chris MacDonald has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Bitcoin. The Motley Fool has a disclosure policy.