Nvidia Stock Just Did This for the First Time in Nearly a Year. History is Very Clear About What Happens Next.

Key Points

Nvidia has been one of the biggest winners of the AI boom so far.

The company’s stock has soared more than 1,000% over the past five years.

Investors looking for an artificial intelligence (AI) winner over the past few years knew they could turn to Nvidia (NASDAQ: NVDA). As the leading designer of AI chips, the company has delivered soaring revenue every quarter, high profitability on sales, and a very clear and consistent message: Demand from AI customers has been surging, at times ever surpassing supply.

All of this has helped Nvidia's stock price to skyrocket. Over the past five years, it's climbed 1,100%. But, in recent times, investors haven't been as quick to rush into AI stocks as they were in the past. In November, they worried about the high valuations of these players and the possibility of an AI bubble forming. And though comments from companies across the industry about strong AI demand have offered reason for optimism, any negative news has weighed heavily on Nvidia and other AI stocks.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

In fact, some of the negative sentiment recently pushed Nvidia stock to do something it hasn't done in a year. And history is very clear about what happens next.

Image source: Getty Images.

The news that hurt Nvidia

So, first, let's quickly note the news that's hurt Nvidia stock over the past few weeks. As mentioned, general worries about an AI bubble have remained in the background, spurring concern that the AI revenue opportunity may fall short of expectations. Investors have kept an eye on investment trends as sustained investment is a key part of the AI growth story.

And that brings me to the news that hurt Nvidia a few weeks ago. The Wall Street Journal reported that Nvidia's plan to invest as much as $100 billion in AI lab OpenAI had stalled. Though Nvidia chief Jensen Huang denied any troubles or change of plans, Nvidia stock still stumbled on the news. OpenAI, as a major innovator in the space, is an important client for Nvidia, so any possibility of a rift worried investors.

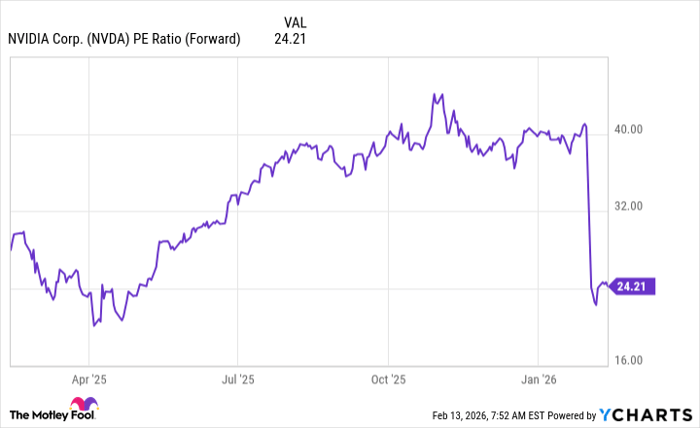

Now, let's consider the move that Nvidia's stock made in recent days. The shares reached their lowest valuation in relation to forward earnings estimates in almost a year.

NVDA PE Ratio (Forward) data by YCharts

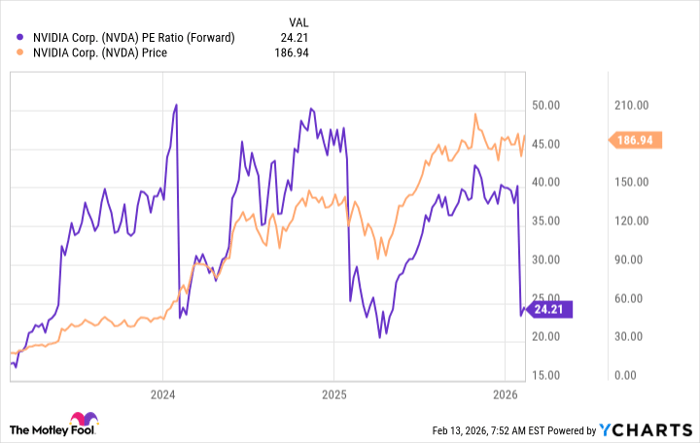

And history shows that every time over the past three years that Nvidia's valuation significantly dropped, the stock quickly went on to gain.

NVDA PE Ratio (Forward) data by YCharts

What may happen next

So, history is very clear about what generally happens next: Nvidia stock won't remain cheap for long as investors pile in, leading the stock to rebound and advance.

But before you start cheering, it's important to note a couple of things. First of all, history isn't always right. It offers us a picture of common patterns and trends, but this doesn't mean these will repeat themselves 100% of the time. Second, it's important to note that the general environment for AI stocks, as well as the economic environment today, is different than the one a year or two ago. Investors have become a bit more cautious, and that could slow the pace of gains moving forward.

Is Nvidia a buy?

Does this mean you should avoid Nvidia stock? I say just the opposite. Today's dip in valuation represents a fantastic buying opportunity. Nvidia's leadership in the chip market, along with its extensive portfolio of related products and services, makes it a central player in the AI story. Even if AI customers buy some chips from other providers or, in some cases, design their own, most major players rely on Nvidia chips as the backbone of their AI systems.

And Nvidia's commitment to innovation should keep this going as ambitious AI customers aim to work with the very best and latest products available. Nvidia has promised to update its chips annually, and as part of this, the company plans to release its Rubin platform later this year. This represents a big revenue driver ahead if the last big releases are any guide. Blackwell and Blackwell Ultra each met with soaring demand.

Meanwhile, the long-term AI story hasn't changed, with analysts predicting a trillion-dollar market a few years from now. And Nvidia is set to benefit from this.

All of this means that even if Nvidia stock doesn't follow the historical trend and quickly rebound, it's still well-positioned to soar over time -- and that makes it a bargain buy on the dip today.

Should you buy stock in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 15, 2026.

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.