The Clock Is Ticking: Nvidia Stock Is Set to Soar After Feb. 25

Key Points

Nvidia is getting great news from China and U.S. AI companies.

Nvidia's new technology is a gamechanger.

Feb. 25 is set to be an incredible day for Nvidia (NASDAQ: NVDA). That's when the company reports fourth-quarter fiscal year 2026 (ended January 2026) earnings, and I expect a blowout quarter.

However, what investors are really looking forward to is guidance. If recent indications from some of its largest clients have any bearing on that (hint: they do), then Nvidia's stock could be set to soar following its earnings.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

I think right now is the perfect time to scoop up Nvidia shares, as the move may be dramatic following its earnings report. I've got a handful of reasons why Nvidia is set to soar, although there are likely many others.

Image source: Getty Images.

1. China sales will likely return to guidance

After the Trump administration shut down Nvidia chip exports to China in April 2025, there was a sizable hole left in Nvidia's business. Now, it looks like Nvidia is in the clear to start exporting chips again.

We've already seen guidance from rival AMD, including chip sales to China, so I'd expect Nvidia to offer the same. Nvidia's revenue expectations for China for second-quarter FY 2026 was $8 billion, and if that amount returns to guidance for the first quarter, it could result in a massive growth step-up that the market isn't expecting.

However, even if chip sales to China aren't as large as I expect, there is still plenty of domestic demand.

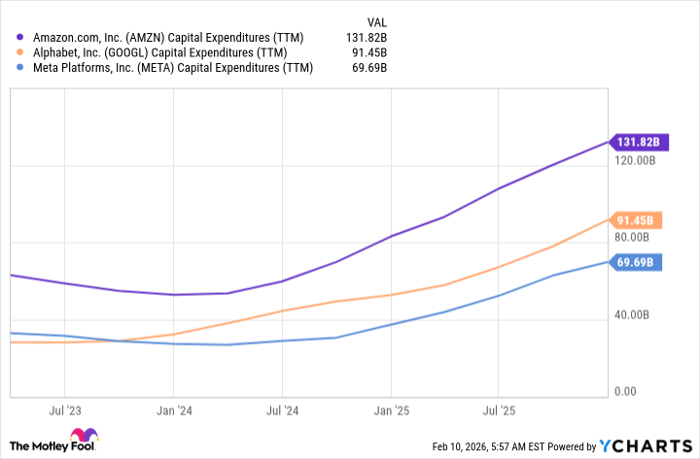

2. The AI hyperscalers are spending record amounts in 2026

Investors have also learned about AI hyperscalers' capital expenditure plans over the past few weeks. Some of Nvidia's biggest clients, including Alphabet, Amazon, and Meta Platforms, have informed investors of their 2026 capital expenditure plans. Alphabet is expected to spend between $175 billion and $185 billion, Amazon plans to spend $200 billion, and Meta gave guidance for $115 billion to $135 billion. Those are massive numbers and represent huge growth from the past 12 months.

AMZN Capital Expenditures (TTM) data by YCharts.

AI spending is going to reach record levels in 2026, and with Nvidia a primary chip provider, it's well positioned to take advantage.

3. Nvidia's new architecture will drive more growth

Nvidia is also launching its new Rubin chip architecture, which provides huge efficiency improvements over the previous Blackwell generation. If tasking a graphics processing unit (GPU) on training an AI model, it takes one Rubin GPU for every four Blackwell chips it used to take to deliver similar performance. On the inference side, it takes one Rubin GPU for every 10 Blackwell GPUs. That's an impressive gain, and may drive companies to upgrade their GPUs because of the cost-effectiveness of doing so.

This new technology should allow Nvidia to continue delivering stellar growth, but the market isn't respecting Nvidia's potential.

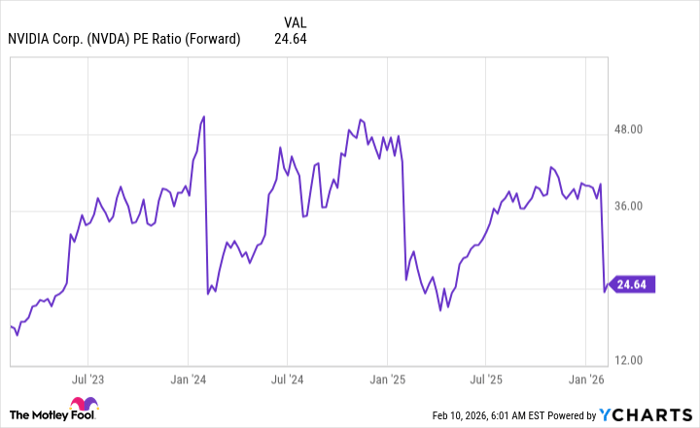

4. Nvidia's stock price is historically cheap

Many have argued that Nvidia's stock is incredibly expensive. If you're using a trailing earnings metric, then that might be true. However, trailing earnings metrics don't do a stock justice when it's expecting massive growth like Nvidia is. Using a more appropriate forward earnings measure, it's clear that Nvidia's stock really isn't all that expensive.

NVDA PE Ratio (Forward) data by YCharts. PE = price-to-earnings.

At less than 25 times forward earnings, it's near the lowest price it has been at over the past three years. Furthermore, it's barely more expensive than the S&P 500 (SNPINDEX: ^GSPC), which trades for 21.8 times forward earnings.

I think a 20% pop could be coming for the stock, as that would increase the price to around 30 times forward earnings, a more appropriate level for Nvidia to trade. That makes it a top-notch stock to buy now, and anyone waiting until after Feb. 25 to buy will have to pay a much higher price.

Should you buy stock in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 15, 2026.

Keithen Drury has positions in Alphabet, Amazon, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.