Crypto Daily | Cathie Wood’s ARK Sells Airbnb Stock, Buys Shopify and Robinhood; Coinbase Posts $667M Net Loss, Revenue Declines 20%

Crypto Daily is our column tracking crypto market trends, offering timely insights and valuable updates to keep you informed.

Crypto News

Bitcoin(BTC) Drops to $66,541 with a 1.37% Decrease in 24 Hours

Bitcoin has dropped to $66,541, with a narrowed 1.37% decrease in 24 hours.

Ethereum Falls to $1,953 Amid Daily Decline

Ethereum has dropped to $1,953. According to Foresight News, this represents a daily decrease of 0.66%.

Cathie Wood’s ARK Sells Airbnb Stock, Buys Shopify and Robinhood

Cathie Wood’s ARK ETF published their daily trades for Thursday, February 12, 2026, revealing a strategic reshuffling of their portfolio. The most significant move was the sale of 259,652 shares of Airbnb, Inc., amounting to $31,041,396. This sale was distributed across ARKK, ARKW, and ARKF ETFs, indicating a continued reduction in their position following a similar sell-off the previous day.

In contrast, ARK made substantial purchases in Shopify, acquiring 114,020 shares worth $13,535,314. This buy reflects a strong interest in the e-commerce platform, marking a notable addition to their portfolio. Similarly, ARK added 174,677 shares of Robinhood, investing $13,619,565. This purchase builds on a trend from the previous day, where ARK significantly increased its holdings in Robinhood.

Coinbase Posts $667 Million Net Loss, Revenue Declines 20%

Coinbase Global, Inc. showed how quickly a cooling crypto market can pressure even one of the industry’s most diversified exchanges.

Revenue in the fourth quarter tumbled a more-than-estimated 20% to $1.8 billion as falling token prices drained trading activity across digital assets. After registering an unrealized loss to mark down the value of its crypto holdings and investments, the company posted a net loss of $667 million, compared with a $1.3 billion profit from the same period last year.

The results arrive as Bitcoin has fallen nearly 50% from October’s high, a retreat that has left many retail traders sitting on the sidelines and revived comparisons to earlier crypto downturns. Those cycles have often forced exchanges to retrench quickly, and early signs suggest this one may follow a similar pattern.

Standard Chartered Cuts 2026 Bitcoin Forecast to $100,000, Sees near-Term Slide to $50,000

Standard Chartered has slashed its year-end bitcoin price forecast by a third, citing deteriorating macro conditions and the likelihood of further investor capitulation in the coming months.

The bank now expects bitcoin to finish 2026 at $100,000, down from its previous projection of $150,000. More concerning for crypto investors, Standard Chartered warned that bitcoin could drop to or just below $50,000 before recovering later in the year.

Trump-Tied World Liberty Financial Said to Launch Forex Remittance Platform

World Liberty Financial, the crypto venture linked to President Donald Trump and his family, is set to launch a new foreign exchange and remittance platform soon, according to co-founder Zak Folkman.

The new platform, World Swap, aims to settle foreign exchange remittances at a fraction of the fees charged by competitors, Reuters reported on Thursday.

"There's over $7 trillion of money moving around the world from currency to currency," Folkman reportedly told the audience of the Web 3 event Consensus in Hong Kong.

Marex Significantly Increases Stake in Bitmine

Marex, a global financial services firm, has significantly increased its investment in Bitmine, according to a recent 13F-HR filing. According to NS3.AI, the firm boosted its stake by 560.05%, holding over 10 million shares as of the fourth quarter of last year. This represents a substantial rise from the approximately 1.5 million shares reported in November. Bitmine's share price closed at $19.74 on February 12.

Whale Opens High-Stakes Bitcoin Long Position with 20x Leverage

Crypto KOL Ted posted on X about a significant move in the cryptocurrency market. A large investor, often referred to as a 'whale,' has opened a long position in Bitcoin valued at $53,464,000, utilizing 20x leverage. This high-risk strategy means that if Bitcoin's price decreases by 10%, the investor will face full liquidation of their position. The move highlights the ongoing volatility and speculative nature of the cryptocurrency market.

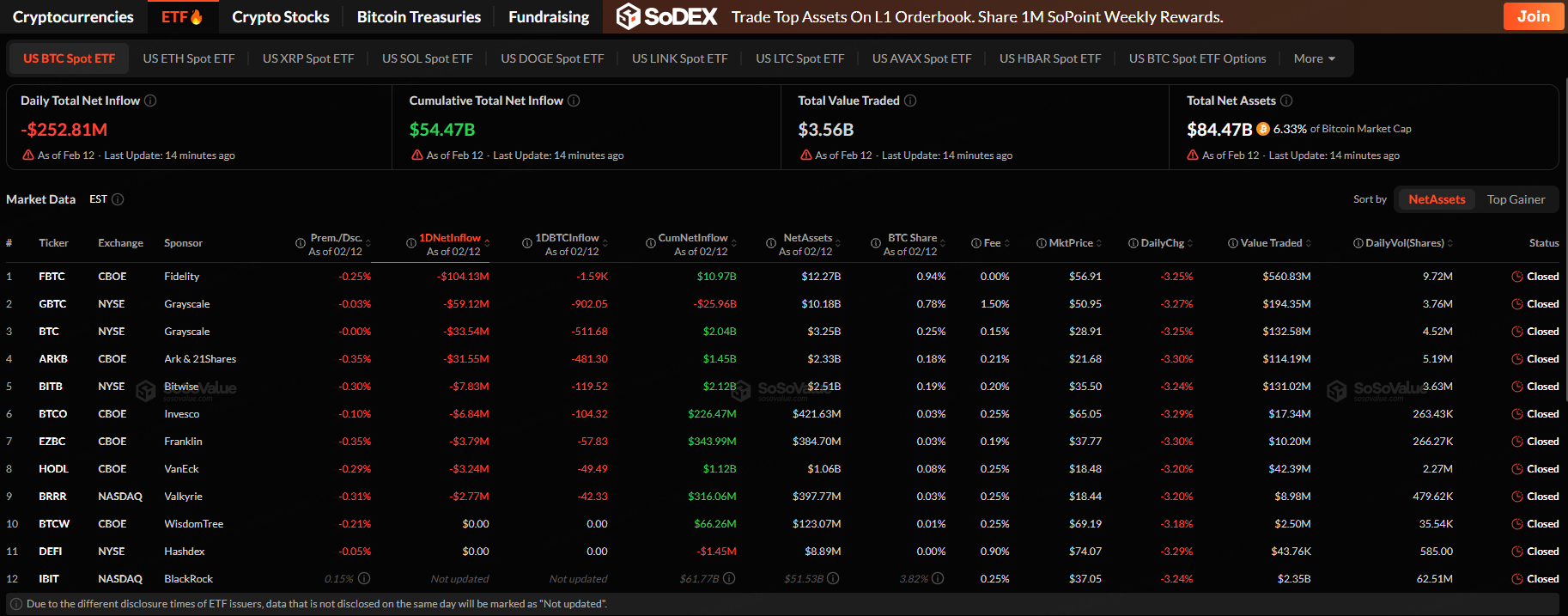

Bitcoin Spot ETF Flow

The overall net outflow of the US Bitcoin spot ETF on Thursday was $252.81 million. The total net asset value of Bitcoin spot ETFs is $84.47 billion, and the ETF net asset ratio (market value compared to total Bitcoin market value) is 6.33%.

The Bitcoin spot ETF with the highest net outflow on Feb. 12 was Fidelity Wise Origin Bitcoin Fund, with a net outflow of $104.13 million. Followed by Grayscale Bitcoin Trust, with a net outflow of 59.12 million, according to SoSoValue.

SoSoValue

SoSoValue