Is Micron Stock Your Ticket to Becoming a Millionaire?

Key Points

Micron delivered an excellent Q1 FY26 and offered tremendous guidance for the rest of the fiscal year.

A low forward P/E ratio presents a high margin of safety for a hypergrowth stock.

Tech giants have been ramping up their AI spending for several years and have $650 billion earmarked for this year.

Artificial intelligence (AI) stocks have been among the market's top performers over the past few years, and Micron (NASDAQ: MU) is no exception. This company supplies high-performance memory and storage solutions critical to AI semiconductor chips that process intense workloads.

While Nvidia, Broadcom, and Advanced Micro Devices have already enjoyed massive AI-fueled rallies, few realize that Micron has been the key to ensuring their chips perform optimally. As demand for advanced memory accelerates, Micron is uniquely positioned to capitalize on the next wave of AI growth -- with the potential to reach a $1 trillion valuation within the next two to three years.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

Micron is smashing records

Micron's first-quarter results for fiscal 2026 (FY2026) were a major catalyst that brought more attention to the stock. During that quarter, which ended Nov. 27, the memory storage company delivered 57% year-over-year revenue growth and nearly tripled its profits.

However, the fact that the AI stock followed up those incredible results by saying Q2 FY26 results would offer "substantial records" across revenue, margins, EPS, and free cash flow excited plenty of investors. Micron also said its business performance should "continue strengthening" through fiscal 2026, suggesting strong sequential growth.

Micron is an AI enabler that appears positioned to experience Nvidia-like growth over the next few years. That makes sense, since whenever chipmakers grow rapidly, Micron is bound to follow. They need Micron, and with only two other large competitors in the space, Micron has a comfortable position in its industry.

The rally is still early

Micron stock has more than quadrupled over the past year, and that type of return could suggest that investors are too late for the rally. However, looking at the fundamentals, there seems to be more room to run.

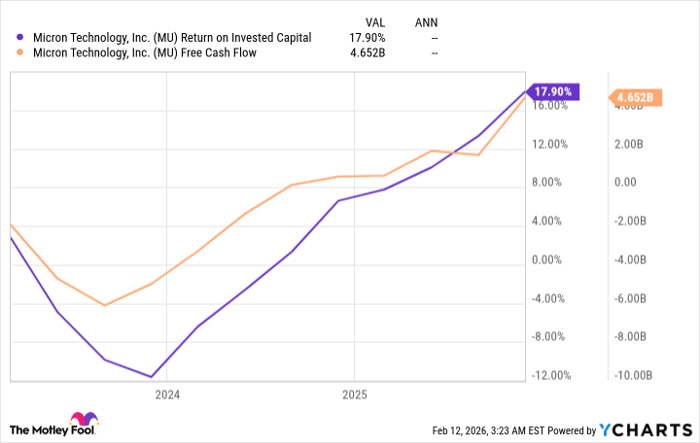

The current trend in Micron's return on invested capital and free cash flow suggests that this phase is still on an uptrend, as its customers continue to churn out highly profitable AI chips.

MU Return on Invested Capital data by YCharts.

Additionally, Micron's high revenue and net income growth also come along with a modest 12.5 forward P/E ratio. That's a much lower valuation than other AI stocks, suggesting Micron's stock has room to extend its rally.

Moreover, management’s upbeat fiscal 2026 outlook points to strong revenue and net income growth in the coming quarters. Tech leaders have committed to spending more than $650 billion on AI in 2026, and if these companies continue to allocate more expenditures to the AI buildout, Micron will continue to benefit.

Micron’s guidance, big tech’s AI spending, and its low forward P/E indicate the stock could create substantial wealth for investors.

Should you buy stock in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $429,385!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,045!*

Now, it’s worth noting Stock Advisor’s total average return is 913% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 12, 2026.

Marc Guberti has positions in Broadcom. The Motley Fool has positions in and recommends Advanced Micro Devices, Micron Technology, and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.