1 Reason to Buy Dell Technologies Stock Like There's No Tomorrow

Key Points

The hyperscalers intend to spend billions of dollars on servers in 2026.

Dell is a leader in AI servers, and investors may not be appreciating its full potential.

If excitement over artificial intelligence (AI) caused a stock market bubble in 2025, major technology players plan to inflate it more than ever in 2026.

AI stocks have soared because investors have high expectations for future financial results. Big tech is proving those hopes are well-founded. The four major hyperscalers, including Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), plan to spend roughly $650 billion in 2026 on capital expenditures (capex), much of which will be directed toward AI. In other words, investors should brace themselves for unprecedented AI infrastructure spending this year.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

Some investors fear there's an AI bubble that will soon pop. But I believe that this unprecedented wave of spending will likely prevent an implosion anytime soon. And this is why I believe that investors should consider Dell Technologies (NYSE: DELL) today -- hear me out.

Why investors should look at Dell stock

Dell stock is often overlooked among AI infrastructure investments, but the business is experiencing an incredible surge in demand for its AI server products. As of its fiscal third quarter of 2026 (which ended on Oct. 31), the company said orders for AI servers were at an all-time high, as was its backlog of $18.4 billion.

Here's where things get interesting: Alphabet intends to spend at least $175 billion in capex in 2026 -- a huge portion of the aforementioned $650 billion. Analysts wanted to know exactly where the money will be going. In response, management said it plans to spend about 60% on servers.

In short, Alphabet intends to spend over $100 billion on servers in 2026. And keep in mind that Alphabet is just one company, and the other three hyperscalers will need servers as well, to say nothing of other companies, presenting a massive tailwind for the server market.

Now, some might say that this doesn't necessarily portend anything for Dell. After all, the hyperscalers often use white box servers -- servers without branding, such as Dell's.

However, unprecedented server demand in 2026 will likely create an imbalance between supply and demand across the entire space, much like what's happening with computer memory right now. In other words, I believe this surging demand for AI servers will benefit Dell, even if the benefit is indirect.

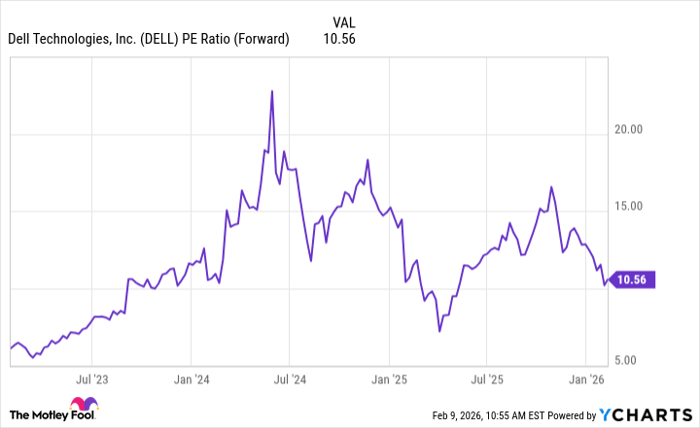

Bubbles occur when investors' expectations (and, consequently, valuations) get too far ahead of business fundamentals. However, I would say investors' expectations for Dell stock are modest right now. As of this writing, it trades at less than 11 times its forward earnings, which is quite reasonable.

DELL PE Ratio (Forward) data by YCharts

In conclusion, Dell stock is a low-risk investment because its business is stable, its products are in high demand, and the valuation is cheap. Demand for AI servers will be higher than ever in 2026, which makes this a stock to at least consider today.

Should you buy stock in Dell Technologies right now?

Before you buy stock in Dell Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dell Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $429,385!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,045!*

Now, it’s worth noting Stock Advisor’s total average return is 913% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 12, 2026.

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet. The Motley Fool has a disclosure policy.