Ready to Get Greedy in the "SaaSpocalypse"? Check Out This Software ETF.

Key Points

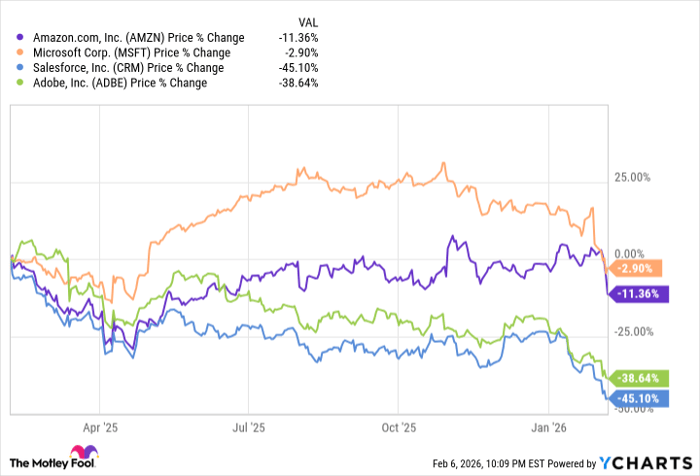

Major AI stocks and software stocks are down year to date amid investor concern about AI spending and disruption.

Buying the iShares Expanded Tech-Software ETF can let you invest in a possible rebound in software company share prices.

The stock market is going through turbulence driven by two conflicting ideas about the AI trade. On the one hand, investors seem worried that big AI companies like Amazon (NASDAQ: AMZN) and Microsoft (NASDAQ: MSFT) are spending too much money on AI data centers and other AI-related capital expenditures (capex).

Amazon's stock recently dropped after the company announced plans to spend $200 billion on AI-related capex in 2026. The stock is down about 9% year to date as I write this and 12% in the past year. Microsoft stock is also getting hit by AI doubts. On Jan. 28, the company reported strong quarterly earnings with a 17% year-over-year increase in revenue and a 21% year-over-year increase in operating income.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

But the stock went down the next day, driven by concerns about the company's plans to spend more than $100 billion on capex this year. Microsoft stock is down 17% year to date, and about 3.5% in the past year.

Meanwhile, software-as-a-service (SaaS) stocks like Salesforce (NYSE: CRM) and Adobe (NASDAQ: ADBE) are also getting hit hard. Software companies have seen big declines in share price year to date because investors are worried that new advances in AI will severely disrupt the enterprise software industry, and some investors are calling this sell-off the "SaaSpocalypse."

Image source: Getty Images.

What are investors thinking?

This "SaaSpocalypse" trade is based on the idea that agentic AI tools will become increasingly capable, to the point that companies won't need to buy as much software as they used to. This would make once-hot software stocks much less profitable.

It seems unlikely that both ideas will be proven correct. Is AI so all-powerful that it's going to wipe out software -- one of the world's most profitable industries? Or is AI overrated, to the point that AI stocks of the companies building its digital infrastructure are severely overvalued?

Industry insiders like Nvidia CEO Jensen Huang have recently spoken out against the SaaSpocalypse; Huang called the reasoning behind it"illogical." If you agree with this point of view, it seems unlikely that all software is going to be replaced by AI anytime soon. SaaS companies have built software to add value with specialized expertise for industry-specific needs. General-purpose AI agents might not be able to replicate this.

Instead, AI companies might be more likely to partner with software companies and use AI models to make software better. If you believe that the software stock sell-off is overblown, you can buy the dip by investing in the iShares Extended Tech-Software ETF (NYSEMKT: IGV).

How to buy the dip in software stocks

The iShares Extended Tech-Software ETF is an exchange-traded fund that gives you exposure to 114 North American software stocks. The fund's top five holdings are prominent technology stocks Microsoft (9.7% of the fund), Palantir (8.2%), Salesforce (7.7%), Oracle (7.2%), and Intuit (5.2%).

The fund has delivered average annual returns of 10.4% per year since its inception in 2001, and charges an expense ratio of 0.39%. It's trading at a price-to-earnings ratio of 35.2, which is slightly higher than the tech-heavy Nasdaq-100 index's P/E ratio of 32.4.

Although this fund's P/E ratio doesn't look cheap compared to the Nasdaq-100, it could be a good way to take a concentrated position specifically in software stocks -- and against the "SaaSpocalypse."

Should you buy stock in iShares Trust - iShares Expanded Tech-Software Sector ETF right now?

Before you buy stock in iShares Trust - iShares Expanded Tech-Software Sector ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and iShares Trust - iShares Expanded Tech-Software Sector ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $429,385!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,045!*

Now, it’s worth noting Stock Advisor’s total average return is 913% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 12, 2026.

Ben Gran has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Adobe, Amazon, Intuit, Microsoft, Nvidia, Oracle, Palantir Technologies, and Salesforce. The Motley Fool recommends the following options: long January 2028 $330 calls on Adobe and short January 2028 $340 calls on Adobe. The Motley Fool has a disclosure policy.