The AI Sell-Off Created a Rare Buying Opportunity in These 2 Stocks

Key Points

Microsoft is delivering strong cloud growth.

Nvidia is set to benefit from all of the massive artificial intelligence (AI) spending going on.

Very rarely do some artificial intelligence (AI) stocks go on sale. However, there are excellent buying opportunities right now that investors shouldn't miss. At the top of my shopping list are two solid AI stocks that will be OK, even if the market is a bit bearish on them right now.

These two stocks are Microsoft (NASDAQ: MSFT) and Nvidia (NASDAQ: NVDA). Each has been an incredible long-term investment, but they are trading significantly off of their all-time highs right now. With Microsoft down 23% and Nvidia down 9%, now is a perfect buying opportunity for both stocks.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

1. Microsoft

Microsoft is well-positioned to take advantage of generative AI developments. Its software is used by practically every business worldwide and will remain a dominant force in that realm even after all the generative AI innovations have wrapped up.

Another way Microsoft will benefit from the AI buildout is its cloud computing platform, Azure. Azure is one of the top options for building an AI product, as it provides access to several leading generative AI models. This has led to strong growth, with Azure's revenue rising 39% year over year in Q2 FY 2026 (ending Dec. 31).

This is the crown jewel of Microsoft's empire and helped power the company to 17% revenue growth and 23% net income growth on a non-GAAP (generally accepted accounting principles) basis; GAAP results are skewed from an OpenAI investment.

It's rare to see a company as large as Microsoft deliver such impressive results, but that's exactly what it does quarter after quarter. Yet, the market threw a temper tantrum and sold off the stock following its earnings.

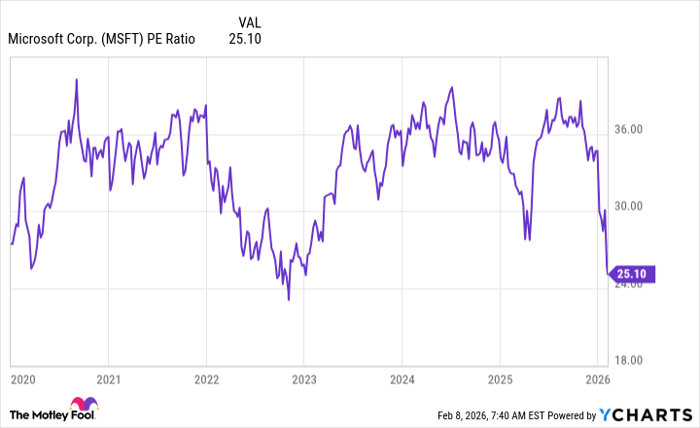

I think it's a rare buying opportunity for one of the best stocks on the market, and investors should use the weakness to load up on Microsoft, as the stock hasn't traded at a valuation this low since the 2023 market sell-off.

MSFT PE Ratio data by YCharts

2. Nvidia

If you thought Microsoft's results were impressive for its size, wait until you see Nvidia's. Nvidia is one of the primary beneficiaries of all of the AI spending, as its graphics processing units (GPUs) are the primary computing units deployed by most AI hyperscalers to rent out to clients. Nvidia's technology has become the industry standard, and it will be hard to dethrone it.

This is reflected in Nvidia's growth outlook, as Wall Street analysts expect 53% revenue growth this next year. For the world's largest company by market cap to be growing its revenue at a 50% or greater pace is nothing short of incredible. If AI demand lasts through 2030, as Nvidia and several others project it will, the party will just be getting started with Nvidia's stock.

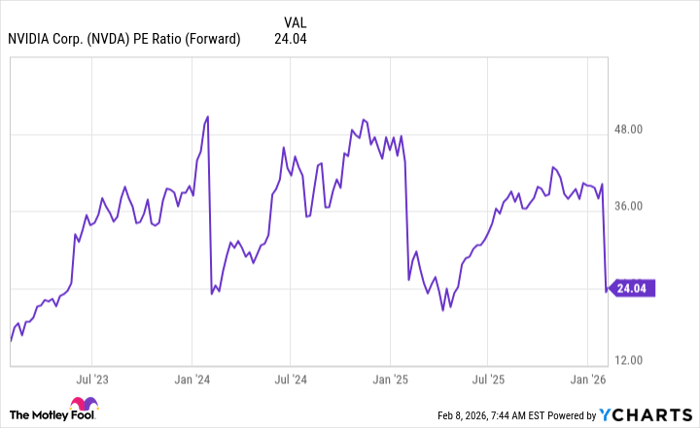

Despite a bullish five-year outlook, a leadership position in one of the biggest technological revolutions mankind has ever experienced, and incredible execution, the market still isn't giving Nvidia a premium valuation. It trades for 24 times forward earnings, which is hardly a premium on the S&P 500, which trades for 21.8 times forward earnings.

NVDA PE Ratio (Forward) data by YCharts

Nvidia is growing at a far faster rate than the market typically does, so this small premium seems like an absolute bargain. If AI spending continues to rise, as many expect, there will be few better stocks to own than Nvidia. I'm confident we haven't seen the last of unreal AI spending, and Nvidia will be well-positioned to thrive in the coming years and capitalize on it.

The market rarely gives investors the opportunity to buy Nvidia and Microsoft stock on sale. Investors shouldn't wait for a lower price, as these are among the best prices I've seen in years on them. The time to take action is now, as the market could snap back to reasonable levels in days.

Should you buy stock in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $429,385!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,045!*

Now, it’s worth noting Stock Advisor’s total average return is 913% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 12, 2026.

Keithen Drury has positions in Microsoft and Nvidia. The Motley Fool has positions in and recommends Microsoft and Nvidia. The Motley Fool has a disclosure policy.