Should You Buy the Invesco QQQ ETF With the Nasdaq Near a Record High? Here's What History Says.

Key Points

The Nasdaq-100 index holds 100 of the largest nonfinancial companies listed on the Nasdaq stock exchange.

The technology sector makes up over 60% of the index by market capitalization, so it has a very high exposure to hypergrowth themes like AI.

The Invesco QQQ ETF tracks the performance of the Nasdaq-100, and history suggests it might be a great buy right now.

The Nasdaq-100 is a stock market index featuring 100 of the largest nonfinancial companies listed on the Nasdaq stock exchange. The index is known for its extremely high concentration of technology stocks, and in fact, the tech sector accounts for over 60% of its overall portfolio (by market capitalization).

The Nasdaq-100 delivered a return of 20.2% last year, comfortably beating the more diversified S&P 500 (SNPINDEX: ^GSPC) index, which climbed by 16.4%, thanks mainly to blistering returns in stocks like Nvidia, Alphabet, and Palantir Technologies. Although the index is off to a more volatile start to 2026, it remains just 3.7% below its all-time high.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

The Invesco QQQ Trust (NASDAQ: QQQ) is an exchange-traded fund (ETF) that tracks the performance of the Nasdaq-100 by holding the same stocks and maintaining similar weightings. Is now a good time to buy it? History offers a very clear answer.

Image source: Getty Images.

The right ingredients for solid long-term returns

Emerging industries like artificial intelligence (AI), cloud computing, robotics, quantum computing, and autonomous driving have been key drivers of stock market returns over the last few years, so any index or ETF with a high degree of exposure to them has typically outperformed.

AI is the main focus for investors right now, because it has already created trillions of dollars in value for dozens of American companies. Below are five recognized AI leaders, along with their portfolio weightings in the Invesco QQQ ETF and the S&P 500 index:

|

Stock |

Invesco ETF Weighting |

S&P 500 Weighting |

|---|---|---|

|

Nvidia |

8.32% |

7.18% |

|

Alphabet (Google) |

7.41% |

6.22% |

|

Meta Platforms |

3.92% |

2.67% |

|

Broadcom |

2.92% |

2.51% |

|

5Palantir Technologies |

1.63% |

0.52% |

Data source: Invesco, Slickcharts. Portfolio weightings are accurate as of Feb. 5, 2026, and are subject to change.

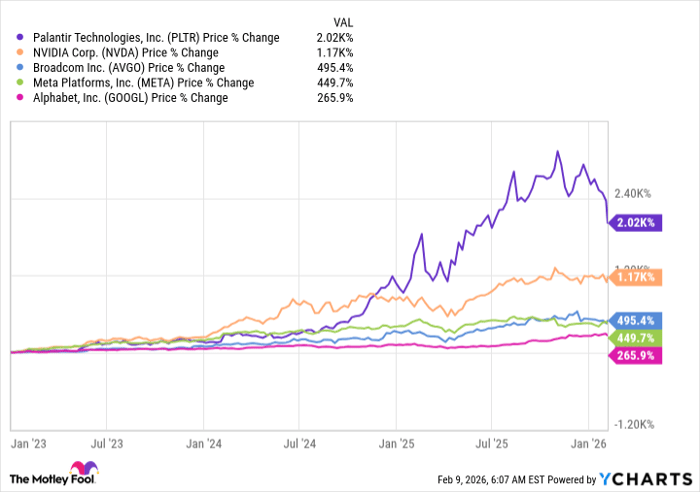

Those five stocks have delivered an incredible average return of 880% since the beginning of 2023, which is when the AI boom started gathering momentum. This is an example of why the Nasdaq-100 (and by extension, the Invesco ETF) has delivered much better returns than the S&P 500. Even though both indexes hold each of these stocks, position sizing has made an enormous difference.

The above five stocks are likely to continue delivering solid returns, but I want to highlight a few other Nasdaq-100 names that could contribute meaningfully to the index's upside from here:

- Tesla (NASDAQ: TSLA): Make no mistake, this stock is extremely expensive right now. However, if the company successfully transitions from making electric vehicles (EVs) to dominating the humanoid robotics market, it could be a major source of long-term upside for investors.

- Micron Technology (NASDAQ: MU): This company supplies critical high-bandwidth memory solutions for data centers, which Nvidia uses in its latest AI chips. It will be one of the biggest beneficiaries of the ongoing AI infrastructure boom, and it's currently cheaper than many of its peers.

- CrowdStrike (NASDAQ: CRWD): Data is the nectar of AI software, so safeguarding it will be increasingly important for every company going forward. CrowdStrike protects the entire enterprise from top to bottom, using a single, all-in-one platform called Falcon, which I think will attract growing demand as AI usage expands.

It's always a good time to invest in the Nasdaq-100 for the long term

Timing the market is practically impossible because nobody can accurately predict the future. But what we do know is that the Invesco QQQ ETF has delivered a compound annual return of 10.4% since it was established in 1999 and an even faster annual return of 20.5% over the last decade, specifically.

Those gains account for every sell-off, correction, and bear market in the Nasdaq-100 along the way. In fact, the index has suffered peak-to-trough declines of over 20% five times since the Invesco ETF was established 26 years ago. They were triggered by events like the dot-com crash in 2000, the global financial crisis in 2008, and the COVID-19 pandemic in 2020, to name some of the more prominent examples.

Therefore, while it might feel counterintuitive to invest in stocks when the market is crashing, history suggests it might actually be the best time to buy. Similarly, investors who bought the Invesco QQQ ETF with the Nasdaq-100 at all-time highs at any time since 1999 would have made money if they held for the long term -- even if the index crashed immediately after making the purchase.

Therefore, as long as investors maintain a long-term view of at least five years, now probably isn't a bad time to buy the Invesco QQQ ETF even with the Nasdaq-100 nearing a fresh record high.

Should you buy stock in Invesco QQQ Trust right now?

Before you buy stock in Invesco QQQ Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco QQQ Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $429,385!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,045!*

Now, it’s worth noting Stock Advisor’s total average return is 913% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 12, 2026.

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, CrowdStrike, Meta Platforms, Micron Technology, Nvidia, Palantir Technologies, and Tesla. The Motley Fool recommends Broadcom and Nasdaq. The Motley Fool has a disclosure policy.