Is Joby Aviation Stock Yesterday's News?

Key Points

Joby Aviation is attempting to build a business around what amounts to air taxis.

The stock price is down nearly 50% from its 52-week high.

Joby Aviation (NYSE: JOBY) is one of several companies seeking approval for an electric vertical takeoff and landing (eVTOL) aircraft. Essentially, it is competing to build and operate air taxis. It could be an exciting development in the transportation space, but there's a long way to go before the company is sustainably profitable.

How is Joby Aviation doing?

Joby Aviation is making steady progress toward its big goal of regulatory approval for its eVTOL aircraft. It conducted hundreds of test flights in 2025 and is gearing up to start using simulators to train pilots. This is important progress.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

That said, Joby Aviation lost $1.01 per share through the first nine months of 2025. The loss was up from $0.53 per share of red ink in the same period of 2024. Given the early stage of the company's development, it seems likely that material losses will continue for the foreseeable future.

An exciting idea, but it comes with a catch

The problem here isn't the eVTOL concept. That remains an important opportunity in the transportation world. Flying over traffic instead of being stuck in it could be a game changer, especially if the integration of artificial intelligence allows eVTOL's to operate autonomously. So in that regard, Joby is not yesterday's news.

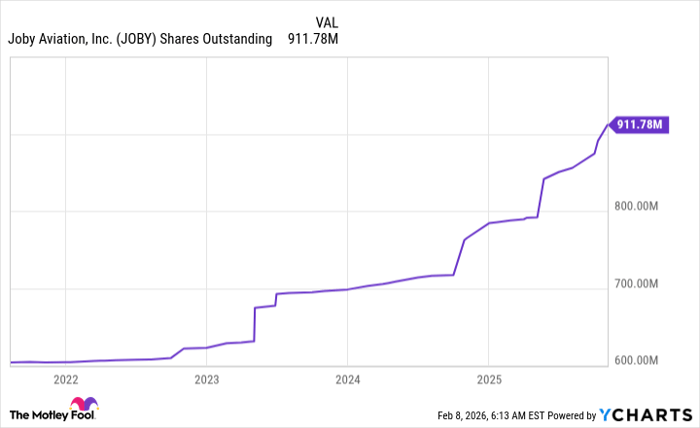

However, getting the company from where it is today to sustainable profitability won't be easy or cheap. And investors seem worried, given that the stock price has fallen nearly 50% from its 52-week high. One of the big risks here is dilution, noting that Joby just recently announced that it is selling $600 million worth of convertible notes and 52,863,437 shares of common stock.

Data by YCharts.

It is hardly uncommon for a start-up to fund its growth through equity and debt. In fact, the whole reason Joby went public was to tap the capital markets for cash. However, each new share that gets issued dilutes existing shareholders.

Probably best for most investors to wait

Given the still-uncertain future here, it appears Wall Street has adopted a "show me" attitude. In other words, Joby needs to hit more development milestones before investors get excited about the stock again.

However, for most investors, waiting until Joby turns sustainably profitable will probably be a better choice than trying to get in early. If the company's air taxis take off, the opportunity is likely to be long-term and not a one-time event.

Should you buy stock in Joby Aviation right now?

Before you buy stock in Joby Aviation, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Joby Aviation wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,155,789!*

Now, it’s worth noting Stock Advisor’s total average return is 920% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 12, 2026.

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.