This Top Warren Buffett Stock Faces a Big Competitive Risk: Here's Why Investors Shouldn't Worry.

Key Points

Buy now, pay later platforms and stablecoins have been two of the biggest developments in payments systems in recent years.

Although these innovations could pose a threat to a dominant card and payments platform, its financial performance should ease concerns.

It's encouraging that this Buffett holding is seeing greater adoption from younger consumers.

Companies that make it into Berkshire Hathaway's equities portfolio usually pass the Oracle of Omaha's test in terms of quality. However, that doesn't mean the investments are guaranteed to work out well. Thorough analysis requires understanding downside variables.

One of Warren Buffett's top stocks, which makes up more than 16% of the conglomerate's portfolio, faces a big competitive risk. But there are reasons investors shouldn't worry just yet.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

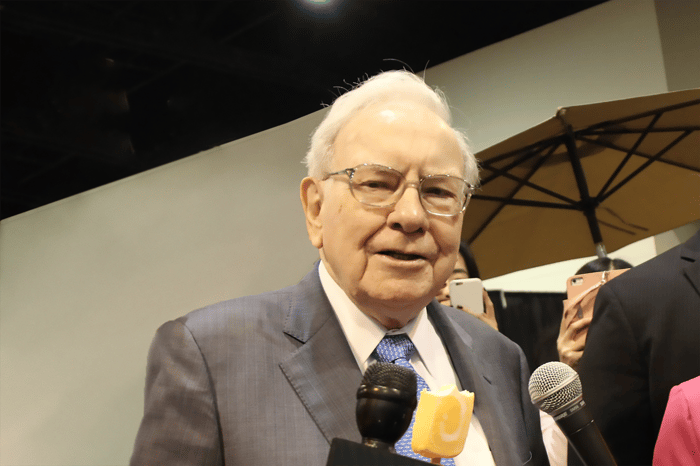

Image source: The Motley Fool.

Looking at the rise of innovative payment mechanisms

In the past few years, two of the most prominent developments in the payments industry have been fintech services, such as buy now, pay later (BNPL), and stablecoins. The former can appeal to younger consumers struggling with high costs who don't want to take on credit card debt. The latter provides fast and cheap transfers, which might draw the attention of merchants looking to avoid transaction fees.

Well-known payment processing companies, like PayPal, Fiserv, and Stripe, have issued their own stablecoins or accept them as payments. And with the Genius Act, favorable legislation was passed in 2025 that provides a regulatory framework for stablecoins. This can instill confidence in the industry.

American Express is thriving

BNPL and stablecoins are two innovations that can pose a potential threat to American Express (NYSE: AXP), a leading Buffett stock, which generated $9.9 billion in revenue from merchants and $2.6 billion in card membership fees in the fourth quarter of 2025. But it's worth mentioning that Amex just reported double-digit percentage revenue and earnings-per-share growth last year, with the same pace forecast for 2026 and over the long term.

It's clearly providing value to its user base. Cardholders have an affinity for the American Express brand. And they love the excellent perks and rewards that they receive. Given that these are high-income consumers, merchants will pay Amex higher processing fees so that they don't have to turn down these sales opportunities.

Investors also shouldn't worry, mainly as it relates to BNPL, because American Express is succeeding at bringing in a younger customer cohort. "As of Q4, millennial and Gen Z customers now make up the largest share of U.S. consumer spending, and they remain the fastest-growing cohorts," Chief Financial Officer Christophe Le Caillec said on the latest earnings call.

Even American Express isn't sitting on its hands. It's exploring stablecoin-related opportunities to potentially pursue. Chief Executive Officer Steve Squeri agrees that they could be used in certain payment situations.

Investors will want to pay attention to developments as they relate to BNPL and stablecoin adoption. Right now, however, there's probably nothing for Amex shareholders to worry about on this front.

Should you buy stock in American Express right now?

Before you buy stock in American Express, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and American Express wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 9, 2026.

American Express is an advertising partner of Motley Fool Money. Neil Patel has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and PayPal. The Motley Fool recommends the following options: long January 2027 $42.50 calls on PayPal and short March 2026 $65 calls on PayPal. The Motley Fool has a disclosure policy.