AI Superstar Palantir Has Plunged 37% From Its All-Time High -- and a Minimum Decline of 60% Should Be Expected, Based on What History Says

Key Points

Artificial intelligence (AI) is, arguably, the most consequential technological leap forward since the advent of the internet -- and Palantir is taking full advantage.

Palantir's two core operating platforms -- Gotham and Foundry -- lack large-scale competition.

Despite well-defined competitive advantages, Palantir faces two historical headwinds that point to significant downside to come.

Over the last three years, no trend has garnered investors' attention and capital quite like artificial intelligence (AI). Empowering software and systems with the tools to make split-second decisions without the need for human oversight is a multitrillion-dollar global opportunity that can benefit humanity and corporate America.

Although AI hardware providers tend to hog all the glory -- here's looking at you, Nvidia -- a strong argument can be made that artificial intelligence application companies like Palantir Technologies (NASDAQ: PLTR) have climbed to the top of the pedestal. Since the beginning of 2023, Palantir stock has rallied more than 1,900% and tacked on north of $300 billion in market value.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

But not even Wall Street's most influential stocks in the market's hottest trend can escape headwinds.

Since hitting its all-time closing high in early November, shares of Palantir have cratered 37%, as of the closing bell on Feb. 5. While some growth-seeking investors will view this as a can't-miss buying opportunity, history offers a different perspective.

Palantir's sustainable moat has catapulted its valuation into the stratosphere

Make no mistake: Palantir is a rock-solid company that's soared thanks to its sustainable competitive edge.

Palantir has two core AI- and machine-learning-driven software-as-a-service (SaaS) platforms, Gotham and Foundry. What makes these platforms special, aside from the fact that they helped Palantir reach profitability well ahead of Wall Street's consensus forecast, is that they're free of large-scale competition. Since no other company can offer the array of services Palantir provides, it doesn't have to worry about its customers or operating cash flow being siphoned away.

For the moment, Gotham is Palantir's crown jewel and chief profit-maker. This is the SaaS platform used by the U.S. federal government and its immediate allies to plan and oversee military operations, as well as gather intelligence for missions and criminal investigations. In other words, Gotham is a key cog for America's defense network.

Meanwhile, Foundry is a comparatively newer SaaS platform aimed at businesses. It's a subscription-based service that helps companies organize big data flows to become more efficient. This might involve integrating existing data or improving a company's supply chain. Palantir closed out 2025 with 780 commercial customers, representing 37% year-over-year growth. However, 780 is just a drop in the bucket, underscoring the extent of Foundry's long-term growth runway.

Investors have also become accustomed to Palantir blowing analysts' revenue and profit forecasts out of the water. With Gotham securing multi-year contracts with the U.S. government and Foundry's subscription service doing a phenomenal job of retaining existing clients, Palantir's growth rate has accelerated.

But in spite of these competitive advantages, history offers two compelling reasons to expect Palantir to shed at least 60% of its value from its record-closing high of $207.

Image source: Getty Images.

History weighs in on Palantir

Although artificial intelligence is the most defining technological trend since the advent and proliferation of the internet in the mid-1990s, there's a historically high probability it'll share the same fate as every next-big-thing trend over the last three decades.

Beginning with the internet, every hyped trend with a highly touted addressable market has navigated an early stage bubble-bursting event. The reason these bubbles form and subsequently burst is that investors persistently overestimate how quickly a new technology or trend will be adopted and/or optimized by businesses.

For example, the internet was adopted exceptionally fast by consumers and businesses. While the internet offered a brand-new way for companies to market and sell their products and services, it took well over half a decade before they figured out how to maximize their return on investment and bolster their sales and profits with this technology.

It takes time for every new technology to mature and for businesses to understand how to maximize their return on investment. Though we're witnessing a breakneck pace of AI infrastructure/data center adoption, most companies aren't close to optimizing AI solutions or generating a positive return on their investments. This suggests the AI bubble is going to burst -- presumably at some point in the not-too-distant future -- and take Palantir and its peers down with it.

It is worth noting that Palantir's multi-year government contracts and subscription revenue should partially shield the company if history repeats and the AI bubble bursts. Nevertheless, investor sentiment would be expected to further weigh on Palantir stock.

History also tells us that companies at the forefront of next-big-thing trends with nosebleed valuations are destined to fall.

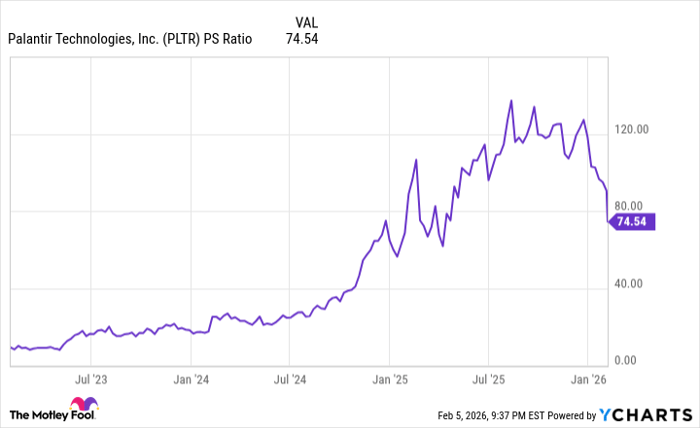

PLTR PS Ratio data by YCharts. PS Ratio = price-to-sales ratio.

During the irrational exuberance phase of the dot-com era, leading internet stocks commonly topped out at price-to-sales (P/S) ratios of 30 to 45, give or take a bit. While drawing a line in the sand at a trailing 12-month (TTM) P/S ratio of 30 is arbitrary, this line has consistently indicated the presence of a bubble in next-big-thing investment trends when looking back decades.

In the week leading up to Palantir's fourth-quarter operating results, its TTM P/S ratio was hovering around 100! No company at the forefront of a next-big-thing trend has sustained a P/S ratio above 30 over an extended period.

The good news is that as Palantir's revenue soars, its TTM P/S ratio should decline (assuming a static share price). Taking into account the sizable pullback in its shares and the company's fourth-quarter sales, Palantir's new TTM P/S ratio is down to "just" 69.3, as of Feb. 5.

While this represents an improvement, it's still more than double the historically sustainable P/S ratio, based on what history tells us. Taking into consideration Palantir's lightning-fast sales growth rate, its shares would have to decline by at least 60% from its all-time high to potentially escape what history deems bubble territory.

In other words, Palantir's steep descent may be just getting started.

Should you buy stock in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 9, 2026.

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.