Is Applied Digital Your Ticket to Becoming a Millionaire?

Key Points

Applied Digital is building huge computing capacity in North Dakota and South Dakota.

The stock carries a premium as investors are excited about the future.

The AI space is full of booming companies that have the potential to turn meager investments into massive dollar figures. Some are even viewing it as a space that could mint new millionaires. One stock that has excited investors in particular is Applied Digital (NASDAQ: APLD). Applied Digital has been on an absolute tear during 2026, rising 50% through Feb. 3. Since the start of 2025, it's up nearly 400% as I write this.

Clearly, something is going on here, but is it enough to turn investors into millionaires?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Applied Digital is building data centers

Applied Digital builds and operates data centers for several large clients. Most AI hyperscalers are building data centers for themselves. Still, they like the flexibility of staying somewhat asset-light and having other companies take on the risk of owning and operating a data center as well. This opens up the opportunity for companies like Applied Digital to build and operate data centers.

One of the biggest factors in building a data center is ensuring that there is energy availability. AI consumes a ton of electricity, and it's placing a strain on the grid. However, Applied Digital has located an area in North Dakota and South Dakota where there is excess energy capacity, and is building data centers there. Those areas are in a more northern part of the U.S., so cooling these systems becomes easier because it isn't as hot year-round.

Applied Digital has some capabilities up and running already, but it has far more in development. There are 700 megawatts already under construction, and it's actively developing another 4.3 gigawatts.

That's huge growth expected over the next few years, and it should lead to a booming stock price as a result. But is too much success already priced in?

Applied Digital stock is pricey

With a ton of growth on the horizon, you'd think that the stock would trade for an unreal premium, and that's exactly right. Applied Digital doesn't have any profits to speak of, nor has it set projections for when there might be some. This shouldn't surprise investors, as Applied Digital is building as fast as it can to capture market share, which is the right thing to do. However, the question is what Applied Digital's business model will be once its buildout is complete, which adds uncertainty to this projection.

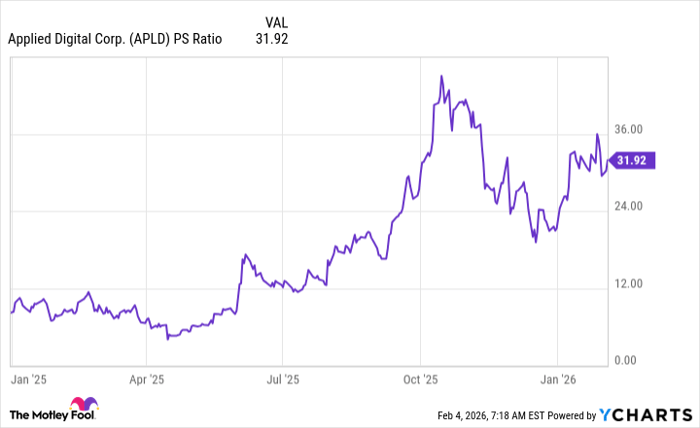

Right now, Applied Digital trades for an expensive 32 times sales.

APLD PS Ratio data by YCharts. PS = price-to-sales.

That's pricey even for a software company, and Applied Digital's margins will likely be far slimmer. However, that's the price the market is willing to pay for strong potential growth. Wall Street analysts expct 61% growth in fiscal year 2026 and 55% in FY 2027. There's clear demand for AI computing power, and as more computing capacity comes online, Applied Digital's revenue will boom. So, this valuation is more like a projection of what the company would be worth years down the road.

However, with so much growth priced in, I'm not a huge fan of the investment. I doubt that Applied Digital will be a millionaire-maker stock from a meager investment. Still, it could beat the market over the long term, which would accelerate an investor's path to becoming a millionaire.

There are several ways to invest in the AI buildout, but I'd rather own a hardware company like Nvidia that's making massive money right now. Nvidia will continue thriving alongside Applied Digital, as Nvidia's computing units will fill the data centers Applied Digital builds. However, Nvidia has far less risk and nearly the same growth, making it a no-brainer pick over Applied Digital.

Should you buy stock in Applied Digital right now?

Before you buy stock in Applied Digital, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Applied Digital wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 9, 2026.

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.