Quantum Computing Stocks IonQ, Rigetti Computing, and D-Wave Quantum Can Plunge Up to 58%, According to Select Wall Street Analysts

Key Points

Shares of quantum computing pure-play stocks IonQ, Rigetti Computing, and D-Wave Quantum have catapulted higher by as much as 3,060% over the trailing year.

On paper, quantum computers offer intriguing real-world utility, with one forecast expecting this technology to add $1 trillion in global economic value by 2035.

However, low-water price targets by select Wall Street analysts point to clear deficiencies for quantum computing's hottest stocks.

If you think artificial intelligence (AI) stocks have been hot in 2025, you haven't been paying close enough attention to the investor hype surrounding the rise of quantum computing.

Over the trailing year, ended Oct. 30, shares of quantum computing pure-play stocks IonQ (NYSE: IONQ), Rigetti Computing (NASDAQ: RGTI), D-Wave Quantum (NYSE: QBTS), and Quantum Computing Inc. (NASDAQ: QUBT) have respectively gained 262%, 2,810%, 3,060%, and 1,130%. Rallies of this magnitude tend to inspire the fear of missing out (FOMO) in retail investors.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

But while the quantum computing revolution offers plenty of intrigue on paper, select Wall Street analysts have taken a different approach with these pure-play stocks. If their price target prognostications prove accurate, these clear-as-day winners could lose up to 58% of their respective value over the coming year.

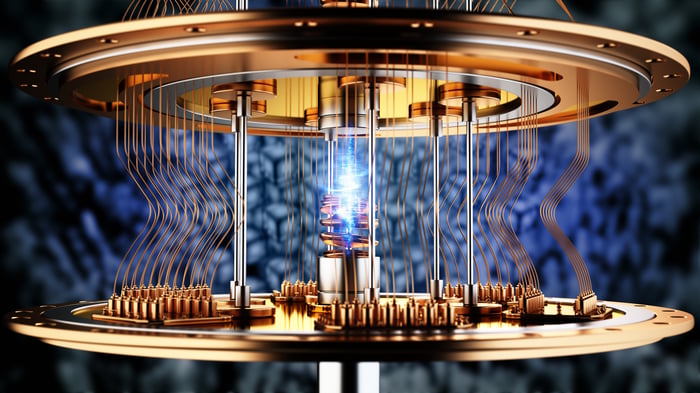

Image source: Getty Images.

Quantum computing is rivaling AI as Wall Street's hottest trend

Quantum computing involves the use of specialized computers reliant on the theories of quantum mechanics to solve highly complex problems that classical computers either can't do, or wouldn't be able to complete for eons. The ability for quantum computers to conduct numerous simultaneous calculations, as well as perform calculations faster than the world's top supercomputers, opens the door to a host of possibilities.

One of the more exciting use cases for these computers would be to run molecular interaction simulations to help drug developers devise a best course of action when tackling treatments for deadly diseases.

Quantum computers can also, theoretically, be used to rapidly speed up the learning process of AI algorithms, which can expedite the utility and proficiency of large language models.

Another reason IonQ, Rigetti Computing, D-Wave Quantum, and Quantum Computing Inc. shares have soared is because we're witnessing some early stage usage by brand-name businesses.

For instance, Amazon and Microsoft collectively account for more than half of global cloud infrastructure service spend with their respective platforms, Amazon Web Services (AWS) and Microsoft Azure. Both companies offer subscription quantum cloud computing services hosted on their respective platforms, AWS and Azure, which provide access to IonQ's and Rigetti's quantum computers.

Investors are likely enticed by pie-in-the-sky growth expectations for quantum computing, as well. Boston Consulting Group believes this technology will create $450 billion to $850 billion in worldwide economic value by 2040, with online publication The Quantum Insider looking for $1 trillion in global economic value creation come 2035.

But in spite of these catalysts, not all Wall Street analysts are on board with the parabolic rally quantum computing stocks have enjoyed.

Image source: Getty Images.

IonQ, Rigetti Computing, and D-Wave Quantum stocks can plummet

Keeping in mind that Wall Street analyst price targets tend to be reactive rather than proactive, select analysts are forecasting significant downside:

- IonQ: Morgan Stanley analyst Joseph Moore reiterated his price target of $32 for IonQ in September, which takes into account the company's pole position in qubit technology, but also factors in various regulatory hurdles and expansion potholes that it'll have to contend with. This price target implies 47% downside, based on where IonQ stock ended the trading session on Oct. 30.

- Rigetti Computing: Cantor Fitzgerald's Troy Jensen pointed to Rigetti's promise following the release of its second-quarter operating results. However, he also opined in his research note, where he raised the company's price target to $18 per share, that Rigetti is still "four years" from the point where quantum computers can solve practical problems faster than classical computers. Jensen's price target would represent 58% downside from the Oct. 30 close.

- D-Wave Quantum: Cantor Fitzgerald's Jensen also provides the low-water mark for D-Wave Quantum, with a $20 per share price target. Similar to Rigetti, he recognized the long-term implications of this technology, but pointed to current steep valuations, as well as full-scale quantum capabilities being "years away" in his research note to investors. Jensen's $20 price target, if accurate, would lead to 45% downside in D-Wave Quantum stock.

The primary hurdle that these Wall Street analysts touched on is the need for quantum computing to mature as a technology.

Since the advent and proliferation of the internet more than three decades ago, no game-changing technology or hyped trend has been able to avoid an eventual bubble-bursting event. These events occur because investors consistently overestimate the early innings utility and adoption rates of new innovations, without realizing they need time to mature.

Aside from the prior example of IonQ and Rigetti having their specialized computers accessible via Amazon's Braket service and Microsoft's Azure Quantum service, there are very few real-world examples these solutions being commercialized. It's also not apparent if the investments being made by businesses in quantum computers and quantum solutions are generating a positive return on investment. This all points to a bubble being formed and, eventually, bursting.

The other undeniable issue is the aforementioned steep valuations associated with quantum computing stocks.

In the months and years leading up to the bursting of the dot-com bubble, companies on the leading edge of the internet revolution peaked at price-to-sales (P/S) ratios in the range of (roughly) 30 to 40. As of the closing bell on Oct. 30, the trailing-12-month P/S ratios of Wall Street's quantum computing darlings were as follows:

- IonQ: 263

- Rigetti Computing: 1,361

- D-Wave Quantum: 414

Even basing the P/S ratio on sales forecasts two to four years into the future doesn't bring any quantum computing stock below the P/S ratio range of 30 to 40, which has consistently proven to be unsustainable over an extended period.

Though these low-water price targets are currently outliers, they would appear to have a good chance of becoming reality at some point in the future.

Should you invest $1,000 in IonQ right now?

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $603,392!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,241,236!*

Now, it’s worth noting Stock Advisor’s total average return is 1,072% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of October 27, 2025

Sean Williams has positions in Amazon. The Motley Fool has positions in and recommends Amazon and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.